Gap-up open saw follow-through buying, closing above 20-day EMA - ICICI Direct

Nifty : 26129

Technical Outlook

Day that was…

Equity benchmark ended the final session of the calendar year on a strong note snapping a four-day losing streak to close firmly higher at 26,129, up 0.75%, supported by broad-based buying. Market breadth remained strong, with an advance-decline ratio of 2:1, while broader markets outperformed as Nifty Midcap and Smallcap indices gained 1% each. Sectorally, barring IT, all indices ended in positive territory, with Oil & Gas, Metals, and Auto stocks leading the advance.

Technical Outlook:

* The index opened with a positive gap-up and witnessed sustained follow-through buying above the previous session’s high, culminating in a decisive close above the 20-day EMA. The daily price action formed a strong bullish candle carrying higher high-low structure, underscoring that intraday declines were swiftly bought into.

* Notably, the index retraced nearly 80% of its preceding four-day decline in a single session, coupled with a sharp rebound from the rising trendline, highlighting an accelerated pace of recovery. Going ahead, we expect the index to gradually challenge the 26,300 mark and open the door for 26800 in the coming week, being measured target of the current consolidation range (25700-26300).

* In the process, volatility would prevail tracking global development and onset of Q3 earning season. Hence, dips should be capitalized as incremental buying opportunity in quality stocks as we expect index to hold its strong support base placed at 25,700, which coincides with the 50-day EMA and the previous swing-low.

Our constructive bias is outlined on the basis of following observations:

1. The US Dollar Index (DXY) has decisively slipped below 98 after failing to sustain above 100, easing currency-led headwinds. This has fuelled a sharp up-move in base metals, with Copper scaling fresh (all-time highs on MCX), while Aluminum breaks out from a three-year base, signalling the start of a structural uptrend.

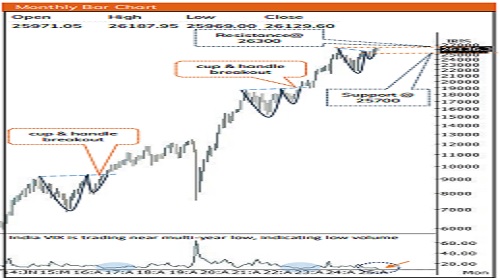

2. Historically, since 2017 there have been two such instances when VIX slipped below the 9 mark, and on both occasion the Nifty has formed cup & handle formation and witnessed a positive breakout. In the current scenario too India VIX has fell around 9, with a formation of cup & handle pattern in Nifty, mirroring a similar past rhythm.(as shown in graph)

3. On expected line, USD/INR has retreated from the upper band of rising wedge. Historically, there have been five instances where a retreat in USD/INR from the upper band of this wedge averaging a ~4% decline (with a maximum drawdown of ~7%) over a two-month period was followed by the Nifty delivering average gains of >10% over the subsequent two months.

Key Monitorable for the next week:

* Auto sales figure

* Quarterly earnings

* US and India trade deal

Intraday Rational:

* Trend- index retraced nearly 80% of its preceding four-day decline in a single session indicating faster pace of recovery

* Levels: Buy near 50% retracement level of its preceding up-move (26130- 26325)

Nifty Bank : 59582

Technical Outlook

Day that was:

Bank Nifty ended the session on a positive note on back of mixed global cues settling at 59616, higher by 0.7%. Nifty PSU Bank index & Private Bank Index ended higher by 1.2 and 1% respectively.

Technical Outlook:

* From a technical standpoint, the daily price action on is strong Bull candle with upper shadow, indicating positive momentum in short term.

* Key point to note is that, Index has finally managed to breakout from the recent consolidation range (58,500- 59,500), indicating resumption of uptrend. Going ahead we expect index to resolve higher and head towards all-time high near 60,100 in coming sessions.

* Structurally, index has undergone slower pace of retracement wherein past four weeks rally was merely retraced by 38% in last four weeks, highlighting inherent strength that bodes well for extension of prevailing uptrend

* Meanwhile, the Nifty PSU Bank index witnessed breakout above last weeks high and follow through buying above previous session candle and sustaining above its 20-day EMA suggesting inherent strength in the index and buying demand at elevated support base. We expect Index to challenge its All time high at 8650 in the coming weeks.

* Nifty Private Bank Index also relatively outperformed the benchmark gaining 1% and rebounded after taking support at 50-day EMA. Going ahead follow through strength above todays high would gradually lead index higher to challenge at 28900 levels

Intraday Rational:

Trend- short term range breakout(58500-59500)

Levels: Buy near 50% retracement level of its previous day up-move (59,587-60,043

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631