Nifty Open Interest Put Call ratio rose to 1.27 levels from 0.90 levels - HDFC Sescurities Ltd

Nifty : “Morning Doji Star” Candlestick On Daily Chart Indicates Probable Bullish Reversal

Nifty Oil & Gas Index : Fresh Breakout On The Daily Charts; Expect Further Gains

F&O Highlights

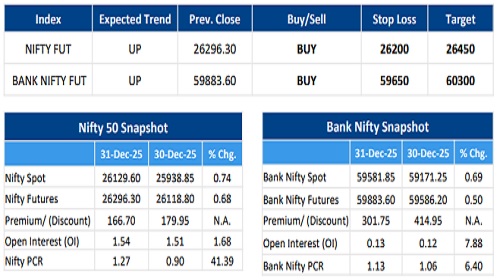

LONG BUILD UP WAS SEEN IN THE NIFTY & BANK NIFTY FUTURES

Create longs with the SL of 26200 levels.

* Nifty staged a strong comeback on the first day of the January series, snapping a four-day losing streak with a sharp 190 point rebound to close at 26,129.

* Long Build-Up was seen in the Nifty Futures where Open Interest rose by 1.68% with Nifty rising by 0.74%.

* Long Build-Up was seen in the Bank Nifty Futures where Open Interest rose by 7.88% with Bank Nifty rising by 0.69%.

* Nifty Open Interest Put Call ratio rose to 1.27 levels from 0.90 levels.

* Amongst the Nifty options (06-Jan Expiry), Call writing is seen at 26400-26500 levels, indicating Nifty is likely to find strong resistance in the vicinity of 26400-26500 levels. On the lower side, an immediate support is placed in the vicinity of 26200-26300 levels where we have seen Put writing.

* Short build-up was seen by FII's in the Index Futures segment where they net sold worth 288 cr with their Open Interest going up by 2302 contracts.

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133

Tag News

Indian Markets Look Set To Surge To Record Levels In The New Year's First Full Trading Week ...

.jpg)