Daily Derivatives Report By Axis Securities Ltd

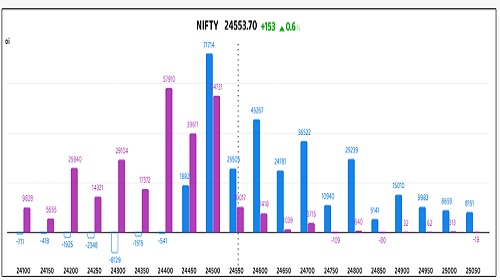

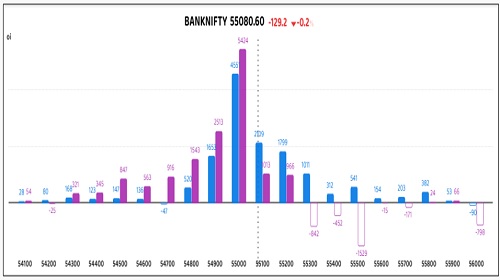

Nifty Futures: 24,553.7 (0.6%), Bank Nifty Futures: 55,080.6 (-0.2%).

Nifty futures concluded Monday's trading session up by 153 points, propelled by falling global crude oil prices following OPEC+'s announcement of a production hike, which positively impacted energy stocks. In contrast, Bank Nifty lagged behind broader indices, finishing down 129 points. Optimism about a potential trade agreement between India and the U.S. and continued foreign institutional investor inflows further supported the market, marking eight weeks of positive performance. Sectors like Auto, Oil and Gas, and FMCG rose, while private and public banking shares saw slight declines. Adani group stocks surged, adding optimism in the market following reports of U.S. administration discussions regarding criminal charges. The India VIX increased by 0.43% to 18.34, and the Indian rupee appreciated by 28 paise to close at 84.26 against the U.S. dollar, influenced by lower crude oil prices and strong foreign fund inflows. The premium for Nifty futures rose to 93 points, up from 54, while the Bank Nifty premium surged from 94 to 161 points.

Global Movers:

US stocks dropped, ending the longest daily winning run in two decades, as mixed messages on the economy confused investors. The S&P 500 fell 0.6%, while the Nasdaq 100 dropped 0.7%. Meanwhile, the Fed is expected to keep rates constant when it meets on Wednesday, with President Trump insisting that he does not plan to fire Chair Powell. Elsewhere, data showed that US services sector activity expanded more than expected in April. Talking markets, the VIX rose 4.2%, the dollar fell slightly, the 10-year treasury yield rose for a third day, bitcoin fell, Gold gained nearly 3% in what was its best day in two weeks, while nymex oil fell to $57/barrel on OPEC's decision to increase production even though analysts said oil demand would fall if trade wars slow down global growth.

Stock Futures:

During yesterday's session, Adani Total Gas, Indraprastha Gas, Kotak Mahindra Bank, and State Bank of India experienced a notable increase in trading volume along with heightened price volatility. This suggests a surge in market activity and a growing interest from investors in these stocks.

Adani Total Gas (ATGL) experienced a strong surge of 11% in its stock price, achieving a four-month high in single-session gains, along with the highest daily trading volume since December 2024. This positive trend was driven by a substantial 14.9% year-over-year growth in Net Sales for March 2025. However, the company reported a slight 8% decline in Quarterly Net Profit to ?154.6 crore, and a 9.4% decrease in EBITDA to ?274.5 crore during the same timeframe. Significantly, ATGL observed a Long Addition, marked by price appreciation in conjunction with an 11.6% increase in open interest. The current futures open interest is at 4,341 contracts, with a significant addition of 453 contracts, equating to 350,000 shares – the highest build-up over the past ten trading sessions. This combination of positive price movement, elevated trading volume, and considerable long build-up in the derivatives market indicates a prevailing strong bullish sentiment, potentially spurred by the revenue growth despite the decline in profitability.

Indraprastha Gas (IGL) saw a remarkable 7.6% rise in its stock price, reaching a near-three-month high on strong volume, largely driven by a ?1 per kg increase in CNG prices effective May 3, 2025, across Delhi and neighbouring regions. However, the counter experienced significant short covering, demonstrated by the price increase alongside a 4.5% decline in open interest. The current futures open interest stands at 9,969 contracts, reflecting a reduction of 465 contracts, which corresponds to 1.28 million shares. In terms of options, total open interest in call options amounted to 6,292 contracts, while put options totalled 5,532 contracts, with call open interest growing by 1,038 contracts and put open interest increasing by 1,377 contracts, resulting in a rise of the put-call ratio to 0.88 from 0.79. This price climb, despite short covering and a slight increase in call open interest compared to puts, points toward an underlying bullish sentiment driven by pricing dynamics, though the overall decline in futures open interest should be monitored for sustainable momentum.

Kotak Mahindra Bank faced a steep 4.2% decline in its stock value, marking its most considerable single-day decrease amidst peak trading volume over the last fifteen sessions. This downturn was triggered by a reported 5.4% year-on-year growth in net interest income, contrasted with a 14% year-on-year slowdown in net profit. While asset quality remained stable, higher provisions on both a sequential and annual basis led to rating downgrades from several brokerages. The counter recorded long unwinding, characterised by price reduction coupled with a slight 0.9% decrease in open interest. Presently, futures open interest stands at 66,977 contracts, representing an unwinding of 574 contracts, equivalent to 230,000 shares. Option positioning indicates a total call open interest of 29,573 contracts and a put open interest of 16,696 contracts, with additions of 13,465 call contracts and 1,043 put contracts. The increase in call open interest has tightened the put-call ratio, indicating active call writing and a bearish sentiment, as market participants anticipate continued market fluctuations and potential further downside.

State Bank of India (SBIN) reported a notable 2% decrease in its stock price amid substantial trading volume, prompted by its earnings announcement. The bank disclosed a 10% year-on-year drop in standalone net profit, amounting to ?18,643 crore for the fourth quarter. Despite loan growth surpassing 12%, core net interest income experienced a modest 2.69% rise, primarily affected by a compression of the net interest margin by 32 basis points year-on-year, decreasing to 3.15%. The counter underwent short addition, measured by a price contraction alongside a significant 8.3% increase in open interest. Current futures open interest is at 104,818 contracts, reflecting a sizable addition of 8,028 contracts, equivalent to 6 million shares. Options data reveals a total call open interest of 85,104 contracts and a put open interest of 49,480 contracts, with increases of 21,317 call contracts and 3,596 put contracts. The marked build-up in call open interest has led to a drop in the put-call ratio from 0.72 to 0.58, indicating a heightened demand for call options, possibly for hedging against anticipated price volatility or expressing bearish sentiment through call writing.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR)rose to 0.97 from 0.91 points, while the Bank Nifty PCR fell from 0.94 to 0.93 points.

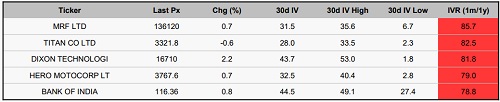

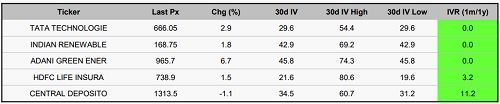

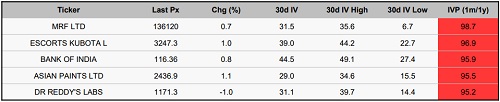

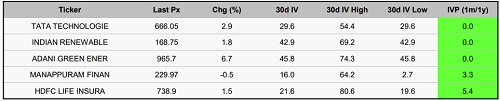

Implied Volatility:

Titan Company and Dixon Technologies (India) have shown notable fluctuations in their stock prices, reflected in their implied volatility rankings of 83 and 82, respectively. Titan Company's implied volatility has surged to 28%, while Dixon Technologies (India) has reached 44%. This rise indicates that options are becoming pricier, leading traders to implement risk management strategies to address these changes. In contrast, Adani Green Energy holds the lowest implied volatility rankings, followed closely by Tata Technologies, with implied volatilities of 46% and 30%. These levels suggest that their options may offer more favourable prospects for investors looking to take long positions.

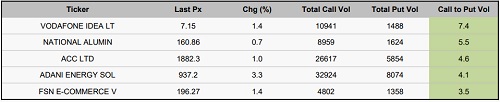

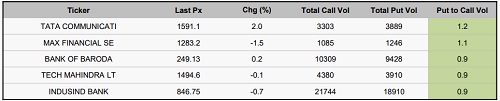

Options volume and Open Interest highlights:

ACC and Adani Energy Solutions show a positive market outlook, highlighted by their strong call-put volume ratios of 4:1. This ratio reflects a solid demand for call options, suggesting that the market anticipates rising prices. Nonetheless, the significant call skew might indicate possible overvaluation in the options market. In contrast, Bank Baroda and Indusind Bank present a notable put-call volume ratio, with rising put volumes reflecting a risk-averse sentiment fuelled by worries about potential price drops. Nevertheless, high put volumes might also signal an oversold condition, offering contrarian trading opportunities. In terms of market positioning, Syngene International and Tata Technologies exhibit considerable open interest in call options, while Voltas Ltd and CDSL display substantial open interest in put options. This activity points to potential price volatility, which could act as a resistance level or create upward price momentum. (This data considers only those stock options that saw a minimum of 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In index futures, client activity indicated a marginal net addition of 73 contracts, contrasting sharply with a substantial accumulation of 3,619 contracts by Foreign Institutional Investors (FIIs), suggesting a bullish bias from this cohort. Conversely, proprietary traders exhibited a notable reduction of 2,499 contracts, potentially reflecting a cautious or profit-booking stance. Shifting focus to stock futures, the data unveils a pronounced divergence: clients registered a decrease of 1,576 contracts, while FIIs aggressively augmented their holdings by a significant 46,245 contracts, reinforcing their optimistic outlook on individual equities. Proprietary traders, mirroring their index futures activity, demonstrated a considerable decrease of 8,867 contracts, underscoring a potentially bearish or risk-reducing sentiment.

Securities in Ban for Trade Date 06-May-2025:

1) MANAPPURAM

2) RBLBANK

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

Stocks With High Call Volume To Put Volume

Stocks With High Put Volume To Call Volume

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633