Nifty Open Interest Put Call ratio fell to 0.89 levels from 0.92 levels - HDFC Securities Ltd

Nifty : Absence of sharp momentum during declines. Higher possibility of bounce back from near the supports of 26100-26000

Nifty IT : Comeback of bulls after a reasonable downward correction. Formation of higher bottom at the cluster supports.

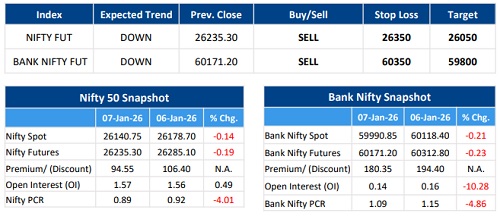

F&O Highlights

SHORT BUILD UP WAS SEEN IN THE NIFTY FUTURES

Create shorts with the SL of 26350 levels.

* Nifty extended its losing streak to a third straight session, slipping 37 points to settle at 26,140, but managing to close off the day’s low. The index went through a choppy session, underscoring indecision and a clear tug-of-war between bulls and bears. A smart 86-point recovery in the last hour helped the index defend the crucial 26,100 support zone.

* Short Build-Up was seen in the Nifty Futures where Open Interest rose by 0.49% with Nifty falling by 0.14%.

* Long Unwinding was seen in the Bank Nifty Futures where Open Interest fell by 10.28% with Bank Nifty falling by 0.21%.

* Nifty Open Interest Put Call ratio fell to 0.89 levels from 0.92 levels.

* Amongst the Nifty options (13-Jan Expiry), Call writing is seen at 26300-26400 levels, indicating Nifty is likely to find strong resistance in the vicinity of 26300-26400 levels. On the lower side, an immediate support is placed in the vicinity of 26000-26100 levels where we have seen Put writing.

* Long unwinding was seen by FII's in the Index Futures segment where they net sold worth 1,450 cr with their Open Interest going down by 702 contracts

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133