Buy Triveni Turbine Ltd for the Target Rs. 650 By Prabhudas Liladhar Capital Ltd

Long-term strength despite short-term pressure

Quick Pointers:

* TRIV commands 50-55%/20-25% share in domestic/global steam turbine market of up to 100 MW.

* Despite tariff-related short-term headwinds, the management expects moderate growth in FY26 and aims to double its revenue in the next 5 years.

TRIV is well-positioned in the niche <100 MW steam turbine market with 50– 55% domestic share and 20–25% global share, supported by limited competition and strong OEM capabilities. Despite near-term headwinds from tariff-related uncertainties and slower-than-expected US traction, recovery is expected from H2FY26 with long-term macro tailwinds intact. The high-growth Aftermarket segment remains a key earnings driver, supported by refurbishment and service opportunities across the turbine lifecycle. In parallel, API turbines business is expected to benefit from TRIV’s expanding footprint in the Indian and Middle Eastern markets. Additionally, new CO?-based product initiatives reinforce the company’s long-term growth pipeline. With a dominant position in core markets, expanding global footprint, and steady diversification into new technologies, TRIV targets to double its revenue over the next 5 years, offering strong growth visibility.

We remain watchful of TRIV’s short-term challenges due to order finalization delays and weaker execution. However, its long-term prospects continue to remain strong due to 1) a healthy enquiry pipeline across markets, 2) growing share of higher margin exports & Aftermarket sales, 3) strong traction in both industrial & API drive turbines, and 4) a robust order book with strong inflows across businesses. The stock is trading at a P/E of 40.0x/32.6x on FY26/27E EPS. We maintain ‘BUY’ rating with a TP of Rs650 (same as earlier), valuing the stock at a P/E of 40x Mar’27E (same as earlier).

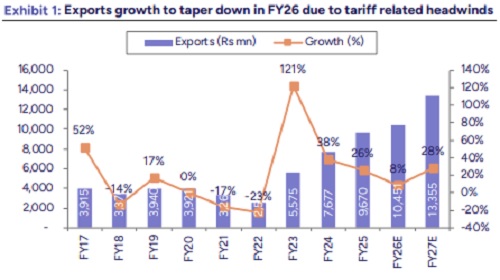

Near-term headwinds, long-term growth drivers: TRIV faced tariff-related uncertainties in Q1FY26, leading to elongated order conversion cycles, weaker order bookings, and delays in inspections and dispatches. These headwinds are expected to persist in Q2FY26, with recovery anticipated in H2FY26. In the US, growth has been slower than expected due to tariff-driven delays, resulting in annual losses of Rs200–250mn. The Aftermarket segment remains the key longterm growth driver, with refurbishment growing faster than the parts and spares sub-segment, supporting the company’s target of doubling its revenue over the next 5 years.

Expanding presence across niche markets and new growth levers: TRIV holds a dominant 50–55% share in the domestic 0–30 MW steam turbine segment, which represents the bulk of India’s sub-100 MW market; the 30–100 MW range remains largely tender-driven and is led by BHEL. With India accounting for ~20% of the global sub-100 MW market, TRIV has leveraged its end-to-end value chain strategy to capture 20–25% global share. Beyond turbines, the company is also building future growth levers through CO?-based products and high-temperature heat pumps. While near-term revenue contribution from these new products is limited, they will drive TRIV’s long-term growth prospects.

Above views are of the author and not of the website kindly read disclaimer

.jpg)