Buy Star Cement Ltd for the Target Rs.325 by Axis Securities Ltd

Capacity Expansion, Plant Incentives & Resilient Demand to Propel Growth

Summary

* Capacity Expansion: In FY25, Star Cement commissioned a 3.3 mtpa Clinker grinding unit in the State of Meghalaya along with 12 MW WHRS (West Heat Recovery System). Its 2 mtpa grinding unit at Silchar is expected to be commissioned in Q4FY26 and Jorhat (2 mtpa) in FY27, bringing the total capacity to 11.7 mtpa. At the new grinding unit, the company achieved ~90% capacity utilisation — a demonstration of operational excellence. The company also forayed into the Rajasthan Market, a tactical shift to reduce geographical concentration by securing Limestone mines in the state.

* Increase in Sales of Premium Cement: During the year under review, the company's sales of premium cement grew by 85% YoY, reaching 11% of total trade sales driven by aggressive marketing and promotional efforts. Additionally, Star Cement launched a new cement brand, Dhalai Master, in the premium category, further strengthening its product portfolio.

* North-East Market to See Higher Growth: The proactive investment by the Central government in developing the region's overall infrastructure has contributed to higher cement demand. The North-East region is expected to grow at a faster rate in terms of cement demand compared to pan-India, driven by larger infrastructure investments planned in roads, airports, hydropower, bridges, and flyovers over the next 5-10 years. The company achieved 8.2% revenue growth in the Northeast region, outperforming the industry growth of 4%.

Key Highlights

* Robust Sales & Volume Growth: During the year, the company delivered a robust 9% YoY growth in sales to Rs 3,163 Cr, supported by an 8% increase in volumes. The strong performance was largely driven by the commissioning of a 2 MTPA grinding unit in Guwahati, which ramped up quickly to achieve 90% capacity utilisation during the year.

* Softness in EBITDA Margins: EBITDA margins declined to 18.3% from 19.1% in the previous year, primarily due to subdued cement prices and additional clinker purchases, as the new clinker line took time to stabilise.

* Increase in Use of Green Energy: The company expanded the share of green energy in its power mix. This transition was amplified by a strategic agreement with JSW Energy to supply green energy. Star Cement aims to take the share of green energy to 55% by FY26

* Key Competitive Strengths: a) Largest cement producer in the NER region with 27% market share; b) Strong entry barriers created by the regional demography, which support the company in maintaining a healthy market share; c) Robust financial position; and d) Strong dealers and distribution network in its operating regions.

* Strategies Implemented: a) Capacity expansion; b) Focus on increasing non-trade sales; c) Focused on cost optimisation and value creation; and d) Continued digitisation processes.

* Growth Drivers: a) Increasing overall cement demand in its key operating regions; b) High consumption in the Eastern and North-Eastern regions; c) Augmenting railway infrastructure; and d) Supportive initiatives by the proactive government.

* Key Focus Areas Moving Forward: a) Capacity expansion to sustain market share; b) Strengthening the dealer and distribution network; c) Focusing on volume growth; d) Ensuring profitability; e) Brand building; and f) Sustainable operation.

Outlook & Recommendation

With its upcoming capacity expansion, the company is well-positioned to capitalise on the rising demand in its operating region, primarily the North-East. We project SCL will achieve a CAGR of 12%/16% in volume and revenue and a 31% /52% CAGR in EBITDA and PAT over FY25- FY27E. The stock is currently trading at 12x and 11x FY26E/FY27E EV/EBITDA. We maintain our BUY rating on the stock with a TP of Rs 325/share, implying an upside potential of 27% from the CMP.

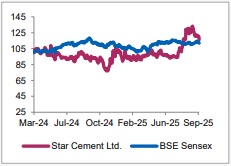

Relative Performance

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633