Buy Federal Bank Ltd For Target Rs. 228 By IIFL Capital

.jpg)

Risk-reward favourable; upgrade to BUY

We attended Federal Bank’s (FB) analyst day, where K.V.S Manian, the recently appointed CEO, presented new medium-term strategy. In its pursuit to become a universal bank, FB intends to launch new businesses, open 400-450 new branches (> additions since FY14), and laid out aggressive FY28 targets – ROA/ROE improvement by 75/120bps. We tweak our est. (still conservative), and raise SOTP based TP to Rs218 (21% upside). Post 17% correction in stock price, risk-reward is favourable, and we upgrade our rating to BUY.

Aspires to become a PAN India and truly universal bank: In its pursuit to become a universal bank, FB intends to organically and/or inorganically build MFI, asset and wealth management, affordable housing, capital/ securities market businesses. FB intends to mainly focus on the four pillars: a) Expand NR deposit franchise (where it is already dominant) outside of Kerala and GCC, b) Expand mass affluent banking, c) Become SME bank of choice, and d) Focus on profitable mid-corporate banking. The CEO shared 12 themes (Fig. 6) that FB will be focusing on, and various business initiatives identified (Fig. 9) to help accomplish the strategy.

Focus on profitability over growth; aggressive targets laid out … FB aspires for 70-80bps RoA improvement by FY28 led by higher NII (better CASA, lower COF, higher loan yield) and fee income growth (higher cross sell, more transaction banking fees), stable cost ratios (productivity gains), but partly offset by a rise in credit costs. With FB’s Top 3 priorities being CASA, NIM and fee income, there is a clear focus on improving profitability over growth. Our est. are fairly conservative vis-à-vis the management guidance (Fig. 1), and we expect ROA improvement to be only gradual.

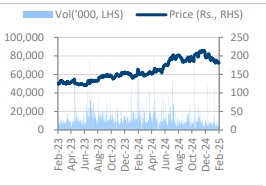

… but even a partial delivery should suffice for stock re-rating: We like the FB’s strategy but believe the ROA improvement target of 70-80bps by FY28E is ambitious. Having said that, even if FB is able to deliver only 20-30bps ROA improvement and reach 1.4-1.5% ROA and 14-14.5% ROE, the stock can potentially re-rate by 20-30% to 1.4-1.5x P/B vs. current 1YF core P/B of 1.14x. We tweak FY26/27 est. by -1%/+4%, and raise our SOTP based TP to Rs218 based on target P/B of 1.25x and subs value of Rs9/share. Post 17% correction in stock price from the peak, risk-reward is favourable, and we upgrade our rating to BUY.

Above views are of the author and not of the website kindly read disclaimer