Buy Prince Pipes and Fittings Ltd for the Target Rs. 430 by Motilal Oswal Financial Services Ltd

Improving performance despite PVC price volatility

Earnings beat our estimate

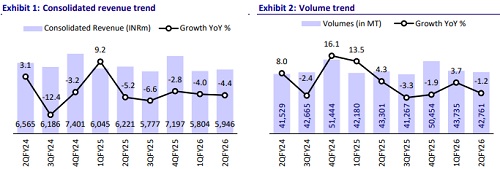

* Prince Pipes and Fittings (PRINCPIP) reported a steady quarter amid the ongoing challenges of volatile pricing and the extended monsoon, affecting demand. The company reported a marginal decline in revenue (~4% YoY), with volumes declining only 1% YoY to 42.8k MT. However, its EBITDA/kg grew 22% YoY/42% QoQ to INR12.9, mainly led by a better product mix (higher sales of CPVC pipes)

* Management anticipates a healthy recovery in demand in 2HFY26, driving high single-digit volume growth for FY26 (Oct’25 was subdued due to festivals and ADD-related uncertainties, while Nov’25 is seeing a healthy pickup). Consequently, margins are expected to recover sequentially to low double digits by 4QFY26 (normalized levels), fueled by operating leverage and an improved product mix. The implementation of ADD by mid-Nov’25 is expected to be a key trigger for the PVC industry and for PRINCPIP.

* We largely maintain our FY26E/FY27E/FY28E earnings and value the stock at 25x Sep’27E EPS to arrive at our TP of INR430. Reiterate BUY.

Flattish volume growth; higher VAP mix supports margins expansion

* Consolidated revenue declined 4% YoY to INR5.9b (est. INR6.3b), while volumes marginally declined 1% YoY to 42.8k MT. Realization continued to decline (down 3% YoY, to INR139/Kg) amid volatile PVC pricing.

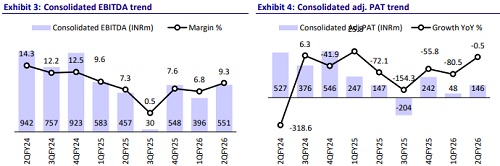

* Consolidated EBITDA grew 21% YoY/39% QoQ to INR551m (est. INR501m). EBITDA margin stood at 9.3% (est. 7.9%), which expanded 190bp YoY/250bp QoQ. EBITDA/kg stood at INR13/kg (up 22%/42% YoY/QoQ). Adj. PAT remained flat YoY and grew 3x QoQ to INR146m (est. INR128m).

* The bathware segment (Aquel brand) generated revenue of ~INR120m/INR220m, with a net loss of ~INR50m/INR100m in 2QFY26/1HFY26.

* Net working capital days further improved to 85 as of Sep’25 vs. 98 as of Mar’25. This was largely led by lower inventory (down eight days) and receivables (down nine days), offset by lower payable days (down four days).

* Gross debt stood at INR2.3b in Sep'25 vs INR2.6b in Mar'25. CFO stood at INR2b in Sep'25 compared to INR990m in Sep'24.

Highlights from the management commentary

* CPVC: With the CPVC segment witnessing faster growth, PRINCPIP plans to diversify its raw material sourcing beyond Lubrizol. The company also plans to launch its own brand soon. Management expects both company and industry growth to be driven by the CPVC segment going forward.

* Capex: PRINCPIP commissioned its Phase 2 capacity at Bihar in Sep’25. The company incurred capex of ~INR1.2b (INR700m for Bihar plant) in 1HFY26, with expected capex of INR1-1.1b in 2HFY26 (INR500-600m for operational plant and INR450-500 for the Bathware business)

* Bathware business (Aquel): At present, the company’s revenue is primarily generated from the Northern and Eastern regions, while it has begun expanding its distribution network in the Southern and Western markets. The Bathware business is expected to break even within the next four quarters, with a quarterly revenue run rate projected at INR220-250m.

Valuation and view

* With the stabilization of PVC prices, an improving demand outlook, the ramp-up of the new Begusarai plant, and geographical expansion of the bathware segment into the Southern and Eastern markets, the company is well-positioned for renewed growth in the coming quarters.

* We expect PRINCPIP to clock a 13%/37%/72% CAGR in revenue/EBITDA/PAT over FY25-28. We value the stock at 25x Sep’27 EPS to arrive at our TP of INR430. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)