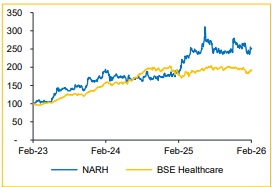

Buy Narayana Hrudayalaya Ltd for the Target Rs.2,500 by Choice Institutional Equity Limited

Core markets strong, global performance improving: NARH remains focussed on sustaining double-digit growth in India through mix optimisation and flagship expansion, driving steady margin across Bangalore, East and North clusters. Cayman continues stable growth with insurance optimization ahead, while the UK integration targets efficiencies and gradual margin improvement, supporting EPS-neutral performance, long-term value.

View and valuation: We project Revenue/EBITDA/PAT to expand at a CAGR of 17.9%/18.6%/22.2% over FY26–FY28E. Maintaining our valuation multiple to 26x EV/EBITDA on the average of FY27–FY28E, we maintain our target price at INR 2,500 and a BUY rating on the stock. We expect India growth strong on mix upgrade; Cayman stable with insurance upside; UK margin improving via efficiencies, driving steady earnings and long-term value.

Strong revenue growth overshadowed by sharp profit decline due to one-off

* Revenue grew significantly by 57.4% YoY and 30.9% QoQ to INR 21.5 Bn (vs CIE estimate of INR 16.5 Bn), driven by the highest ARPP in the quarter

* EBITDA stood at INR 3.7 Bn, up 19.6% YoY but down 8.8% QoQ, with margin at 17.1%, contracted by 539 bps YoY and 741 bps QoQ (vs CIE estimate of 24.2%), impacted due to one-off labour codes

* PAT de-grew by 32.7% YoY and 49.9% QoQ to INR 1.3 Bn (vs CIE estimate of INR 2.5 Bn), with a PAT margin of 6% as compared to 14.1% in Q3FY25

India capex pipeline: Structural margin expansion driven by change in casemix: India has entered a structural profitability upcycle, with EBITDA margin reaching 22.7% in the quarter, driven by sustained case-mix optimisation and higher realisation procedures (robotic cardiac surgery and bone marrow transplants). The company has outlined an aggressive INR 3,000 Cr capex pipeline, funded through internal accruals and debt. We believe like-to-like hospital growth can sustain without relying on new hospitals, supported by improvement in realisation rather than volume expansion. With technology integration, robotic procedures and better payer mix driving consistent realisation gains, India margin is likely to see further gradual expansion in the next 3–5 years, providing strong operating leverage.

Cayman Expansion: Scaling up towards full market potential: The Cayman hospital has already achieved ~USD 45 Mn quarterly revenue, yet the management believes there remains significant untapped market share both, locally and internationally. Despite strong growth, the government hospital remains larger, indicating substantial headroom for market share capture. Insurance expansion has progressed faster than expected, with the management achieving targeted book size ahead of schedule and now shifting focus to improving underwriting margin and profitability.

UK turnaround opportunity: The recently-acquired UK business offers significant margin expansion potential through operational efficiency and revenue mix optimisation. Plan is to implement proven operational models from India and Cayman, including technology integration, process automation and clinical efficiency, which have historically driven substantial profitability gains.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131