Buy Time Technoplast Ltd for the Target Rs. 280 by Motilal Oswal Financial Services Ltd

Robust outlook and attractive valuation warrant a re-rating Healthy in-line 3QFY26 - revenue/EBITDA/PAT grow 13%/16%/25% YoY

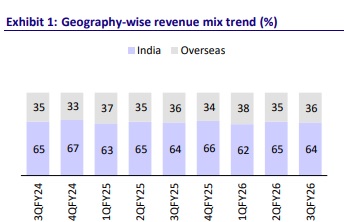

* Time Technoplast (TIME) reported a healthy and in-line set of results in 3QFY26. Volume/revenue/EBITDA/PAT grew 16%/13%/16%/25% YoY. EBITDA margin expanded 46bp YoY to 14.9%. Volume growth was led by both the Overseas (up 17%) and Indian businesses (up 15%).

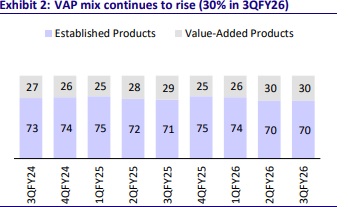

* Value-added products (VAP) revenue grew 18% YoY, with an 18.8% EBITDAM. Established product revenue up 10% YoY with a 13.4% EBITDAM.

* For 9M, revenue/EBITDA/PAT grew 11%/14%/21% YoY.

Key highlights from the management commentary

* VAP sales grew 18% YoY; focus remains on driving higher margin VAP sales.

* Despite INR1.8b capex in 9M, debt reduced INR3.8b, aided by QIP money and healthy CFO (INR3.3b). Gross debt now stands at INR2.6b.

* TIME aims to be debt-free in the next six months. ? Revenue growth guidance: Overall 15%+, Packaging Products 11-13%, Composite 25-30%, PE Pipes 20-25%.

* Margin levers are efficiency improvement, manufacturing consolidation, manpower cost reduction, automation, and adoption of solar solutions.

* RoCE expansion of 20% in FY26E is on track; it stood at 18.6% in 9M.

* 4Q generates roughly 30% of annual revenue.

* Working capital targeted to reduce to 90 days from 100+ days currently.

* It targets completion of due diligence for the FIBC acquisition by Mar’26.

* The company sees a large market opportunity for hydrogen and fire extinguisher composite cylinders.

* The use of solar power at select plants is likely to save INR100m in FY27.

* Plant consolidation of CNG composite cylinder and capex (from 480 to 1080 cascades) is on track for commissioning in 4QFY26.

* The first recycling plant is expected to be operational by Apr’26.

* Phase 1 of plant automation is expected to be completed by FY27.

* Expanding PE pipe capacities at various locations to meet strong demand.

* It has received 3 acres of land from the Gujarat government for the future expansion of packaging product capacities.

Valuation and view: Reiterate BUY

* We maintain our earnings estimates after an in-line result in 3QFY26.

* After clocking a 16%/19%/39% CAGR in revenue/EBITDA/PAT over FY21-25, we estimate a 14%/15%/22% CAGR over FY25-28, to be fueled by its strong performance in the VAP segment (20% revenue CAGR, 18%+ EBITDAM).

* Pre-tax RoCE and RoIC are expected to expand from ~18.2% each in FY25 (FY24: 16-17%) to ~23% and ~25% in FY28, respectively, led by healthy operating results, improved efficiency, and working capital management.

* Robust outlook and attractive valuation (~14x FY28E P/E) warrant a rerating, in our view. Reiterate BUY and a TP of INR280 (20x FY28E P/E).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412