Buy Marico Ltd For Target Rs. 825 By JM Financial Services

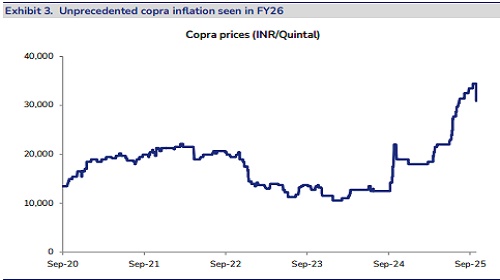

Continuing with the recent trend, Marico’s pre-quarter update points to yet another strong quarter. Despite GST-led disruption, revenue growth in the 30s is better than our estimate of c.28% largely due to better-than-envisaged growth in VAHO and lower volume decline in Parachute. EBITDA/PAT growth is expected to be moderate given the steep inflation in copra and higher brand investments. While Marico has demonstrated strong pricing power in core portfolio, unprecedented copra inflation will weigh on FY26 profitability (especially in 1H). Going ahead we see margin pressures bottoming out with a) likely moderation in 2H (copra prices down c.10% from peak), b) recovery in better margin VAHO portfolio and c) improving execution on portfolio diversification (Foods & Premium personal care which is now c.22% of India sales with EBITDA margin at breakeven level) both in terms of sales/profitability. Successful execution should result in better EBITDA growth going ahead thereby driving overall earnings growth (est. c.13% CAGR over FY25-28E) and can also lead to upsides to our current margin estimates. We like Marico’s strength in core, relatively better execution on portfolio diversification and International business vs. peers. We maintain BUY with a revised TP of INR 825 (48x Sep’27 EPS).

* Revenue momentum remains strong led by strong pricing growth and high-single-digit UVG: Marico’s consolidated revenue is expected to grow in the 30s led by strong pricing-led growth in Parachute and Saffola edible oils, better-than-envisaged recovery in VAHO and sustained momentum in Foods and Premium personal care portfolio. On the domestic front, c.30% of its domestic business has benefitted from GST rate rationalisation. Despite disruption in trade channels and CSD, India business volume grew in high single digit but was a tad lower vs. 1QFY26 (we estimate UVG of c.7-8% vs. c.9% in 1Q). We estimate sales growth of c.30% YoY for 2QFY26E. International business momentum also remained healthy with constant currency growth in the 20s led by Bangladesh and MENA.

* Parachute/Saffola to see strong pricing led sales growth, VAHO surprises positively with acceleration in growth: Within the core portfolio, Parachute volume declined in low single digits (in line with our estimates), despite a strong price hike (c.60%). Adjusting for ml-age reductions in lieu of price increases, the brand saw flattish volume in the quarter. Saffola volume was flat (lower vs. estimates) impacted by GST-led disruption in the CSD channel. However, pricing resulted in high-teens sales growth for the brand. VAHO surprised positively yet again with high-teens growth (improvement vs. c.10% growth seen in 1Q) and momentum is likely to continue led by strategic focus on mid & premium portfolio, distribution expansion and recent GST rate rationalisation.

* High input cost inflation, brand spends and trade discounts to result in modest EBITDA growth: Consol. EBITDA growth is likely to be modest due to a) steep inflation in copra (+137%/40% YoY/QoQ), b) high A&P spends and c) discounts implemented in the trade channel to liquidate old inventory during the GST transition period. We expect EBITDA growth of c.4% YoY with margin compression of c.400bps YoY. Going forward we expect margin pressures to ease with copra prices likely to moderate in 2H, along with sustained recovery in VAHO (has better margins) and improving profitability in Foods and Premium personal care.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

Ltd ( 1 ).jpg)