Buy LG Electronics India Ltd for the Target Rs. 1,800 by Motilal Oswal Financial Services Ltd

Beyond gadgets – building lifestyles!

Focus on premiumization, localization, and higher export/B2B revenue

* High industry growth potential; holds leadership position: India’s home appliances and consumer electronics market (excluding mobile phones) is estimated to post a CAGR of ~14% over CY24-29. LG Electronics India (LGEIL), with its leadership across key product categories, is well-positioned to capitalize on this growth opportunity. The company plans to balance between premium and mass products as part of LG’s global strategy and aims for premiumization of mass products, which should help to improve affordability and, in turn, increase its customer base.

* Focus on export; higher B2B and AMC segment revenue: The company plans to raise its export share to ~10% by FY28E from 6% in FY25. It also aims to generate 14-15% of its revenue from the B2B segment over the next few years (vs. ~10% in FY25), noting that B2B margins are higher than those in the B2C segment. Further, LGEIL targets an over 25% YoY growth in AMC revenue for the next few years.

* Premiumization and localization drive profitability: LGEIL’s strategic focus on premiumization has resulted in innovative launches across OLED TVs, inverter ACs, and advanced smart appliances. The company holds strong market positions in premium segments, such as OLED TVs (~63%), front-load washing machines (~37%), and side-by-side refrigerators (~43%). The share of raw materials sourced domestically stood at ~54% in FY25, with plans to increase this to ~63% over the next four years. This will also lead to an improvement in gross margin.

* Extensive distribution network; focus on brand building and localization: Distribution remains a key competitive strength for LGEIL, with 35,640 B2C touchpoints, 777 exclusive brand shops, and 463 B2B trade partners in 1QFY26. The company also operates one of India’s largest after-sales networks, comprising 1,006 service centers. It allocates ~4.5% of its revenue to advertising and promotion (A&P) expenses, which we expect to continue until FY28.

* Strong fundamentals; initiate coverage with a BUY rating: We expect LGEIL to trade at higher multiples, given: 1) strong return ratios (RoE/RoIC of ~30%/66% in FY28E); 2) higher OCF conversion, averaging ~74% during FY26-28E; 3) a strategic focus on localization, which is expected to further expand gross margin; 4) targeted growth in high-margin B2B and AMC business; and 5) a leadership position across key product categories. We initiate coverage on LGEIL with a BUY rating and a TP of INR1,800, premised on 40x FY28E EPS.

* Key downside risks: 1) any increase in royalty by the parent company, LG Electronics Korea, 2) volatile raw material prices, and 3) intensifying competition.

Strong industry tailwinds, leadership position, and export potential

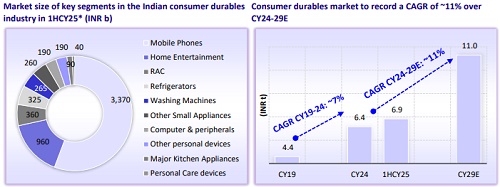

* India’s home appliances and consumer electronics market is projected to post a CAGR of ~11% over CY24-29, reaching ~INR11t by CY29. Excluding mobile phones (LGEIL exited this segment in FY23), the market is estimated to clock a 14% CAGR during CY24-29. As a market leader in major categories, LGEIL is well-placed to benefit from this strong industry growth momentum.

* LGEIL holds strong offline market shares in key consumer durables categories, such as TVs, washing machines, refrigerators, ACs, ovens, and water purifiers. The company holds a market share (in terms of value in the offline channel during 1HCY25) of ~28% in panel televisions, ~34% in washing machines, ~30% in refrigerators, ~21% in inverter AC (~18% in RAC), ~51% in microwave ovens, and ~41% in water purifiers.

* LGEIL also operates in the B2B segment, which contributed ~10% to its revenue in FY25. The company aims to increase the B2B revenue share to 14-15% over the next few years. We believe that the B2B segment has higher margins than the B2C segment.

* Exports accounted for ~6% of revenue in FY25, largely from Asia and Africa. The company plans to increase its export revenue share to ~10% by FY28E.

* AMC and services revenue posted a CAGR of 17% over FY23-25. The company targets an over 25% YoY increase in AMC revenue for the next few years.

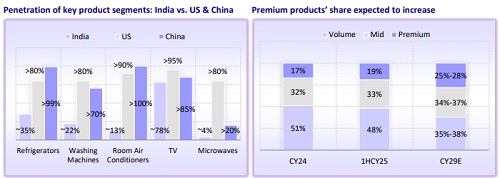

Leveraging premiumization for sustained leadership

* India’s young, urban, and affluent consumers are increasingly seeking advanced, connected, and stylish appliances. The premium segment in the appliances and electronics market is projected to rise to 25-28% by CY29 from ~19% in 1HCY25.

* LGEIL aims to capture this shift by introducing innovative, design-led products, such as OLED TVs, inverter ACs, and AI-enabled appliances, strengthening its appeal among aspirational consumers and reinforcing brand leadership.

* Premium products account for ~25% of LGEIL’s revenue, well above the ~15% industry average. This drives higher margins and supports sustained leadership through continuous innovation and value-led offerings.

* LGEIL’s market share in the premium category of RAC was ~27% in 1HCY25. The company also holds strong positions in premium segments of other categories, such as OLED TVs (~63%), front-load washing machines (~37%), and side-by-side refrigerators (~43%).

Investment in brand building and focus on localization

* LGEIL invests in a diversified mix of traditional and digital channels, including television, print, in-store activations, regional campaigns, and online platforms, to strengthen the LG brand and engage consumers across India.

* A&P expenses clocked a CAGR of 5% over FY19-25, averaging ~4.5% of revenue. We expect A&P spending to remain steady at ~4.5% of revenue over FY26-28.

* LGEIL is following a phased localization strategy—steadily increasing the share of locally sourced components. The share of raw materials sourced domestically increased to ~54% in FY25/1QFY26 (each) from 49% in FY24. The company plans to increase domestic sourcing to ~63% over the next four years. Increased localization will also help improve the gross margin.

Expect 10% EBITDA CAGR and 12% PAT CAGR over FY25-28

* We expect LGEIL to report ~9% revenue CAGR over FY25-28 (~11% CAGR over FY26-28, as FY26 revenue was impacted by a weak summer season and GST transition issues).

* We estimate an EBITDA/PAT CAGR of 10%/12% for LGEIL over FY25-28, with the EBITDA margin reaching 12.6%/13.1% in FY27/FY28 vs. 12.1% in FY26 (and 12.8% in FY25). However, we expect an EBITDA and profit CAGR of ~15% and 17%, respectively, over FY26-28.

Valuation and view: Strong fundamentals; initiate coverage with a BUY

* LGEIL has consistently generated operating cash flows (cumulative OCF of INR154b over the past 10 years; ~69% of the same was used for dividend payout) and has a high EBITDA-to-OCF conversion ratio (average of ~70% over FY19-25; expected to reach ~74% over FY26-28). The company’s planned capex of INR50b for the new plant in Sri City (spread over FY26-29E) is expected to result in lower FCF (cumulative FCF of ~INR41b) over FY26-28.

* Significant investments in the new plant at Sri City are expected to initially reduce the asset turnover ratio. Along with lower dividend payouts (assumed at 35% vs. the average payout of ~69% over FY16-25), this will likely moderate return ratios. RoE is estimated to be ~30% in FY28E vs. 45% in FY25 and an average of ~36% over FY16-25.

* We also believe that the company could target the mass category segment (~19% of the industry in 1HCY25) through premiumization of mass products as part of its global strategy. This strategy may also help improve the asset turnover of the Sri City plant, which in turn could enhance return ratios.

* We initiate coverage on LGEIL with a BUY rating and a TP of INR1,800, premised on 40x FY28E EPS. We expect LGEIL to trade at higher multiples, given the strong return ratios, higher OCF conversion, a strategic focus on localization, targeted growth in high-margin B2B and AMC revenues, and a leadership position across key product categories.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412