Buy Kirloskar Oil Engines Ltd for the Target Rs. 1,150 by Motilal Oswal Financial Services Ltd

Moving in the right direction!

Kirloskar Oil Engines (KOEL)’s 4QFY25 result was above our expectations, driven by higher growth in the powergen segment, higher sales in the B2C segment, and improved margin. The issues that adversely impacted the company’s performance in 3QFY25 are gradually being addressed, with genset demand recovering in key segments and the B2C segment being stabilized. The genset market demand and pricing will normalize in 1-2 quarters, and KOEL remains focused on improving its margins despite the competitive environment in gensets. KOEL has maintained its focus on increasing its share of the higher-margin segments such as HHP, distribution, and exports. We also expect the company to benefit from the recent large order in the industrial segment, too. We bake in its FY25 performance and trim our estimates by 1%/2% for FY26/27. We reiterate our BUY rating with an unchanged TP of INR1,150. The stock is trading at attractive valuations of 26.7x/22x FY26E/27E earnings.

Better than expected results

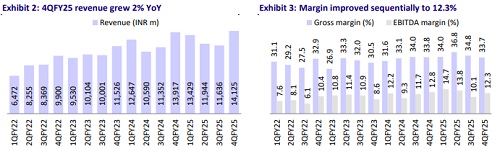

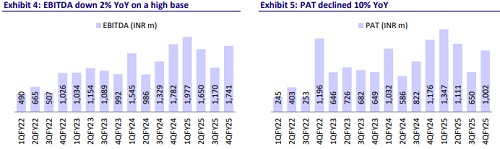

KOEL reported a good set of numbers, beating all parameters. Revenue stood at INR14.1b, which was the highest ever in a quarter. It grew 2% YoY even on a high base of INR13.9b in 4QFY24. The B2B segment was broadly flat YoY, while B2C revenue rose 15% YoY. EBITDA at INR1.7b was above our estimates of INR1.6b (11% beat), albeit down 2% YoY. Accordingly, its EBITDA margin came in at 12.3% (~-50bp YoY). The B2B segment’s revenue contribution to total rose 1%/ 6% YoY for 4Q/FY25, while the B2C segment grew 10% YoY due to strong growth in WMS. However, FMS is still to see an improvement. PAT declined 10% YoY to INR1.1b, with an adjustment for an exceptional gain on the sale of aircraft amounting to INR209m, and a lower-than-expected tax rate (25.6% actual vs. 26.7% expected). For FY25, despite demand correction after the pre-buy and the CPCB4+ transition, KOEL’s revenue/EBITDA/PAT grew 5%/16%/15% YoY, and its EBITDA margin/PAT margin expanded 120bp/60bp YoY. OCF/FCF rose 13%/ 71% YoY, reaching INR4.9b/INR2.7b in 4QFY25 vs. INR4.3b/INR1.6b in 4QFY24.

Powergen segment to improve, aided by volume recovery

The powergen segment reported a 5%/3% YoY growth for 4QFY25/FY25. This was better than our estimates, as the volume decline for KOEL was offset by improved pricing for the CPCB 4+ products. The company appears to have now stabilized its market share, which was hit during 3QFY25. Within the powergen segment, HHP sales contributed nearly INR1b for the year. With a strong product portfolio across nodes in the powergen segment, we expect KOEL to focus more on mid-to-high kVA nodes and increase the share of HHP sales in the overall revenue mix. For FY26, we bake in volume recovery for the company, while we expect pricing to remain stable YoY.

Industrial segment to continue its growth trajectory in key accounts

KOEL was recently awarded a project worth INR2.7b from the Indian Navy to design and develop a 6MW medium-speed marine diesel engine. This project falls under the "Make-I" category. The developed engine, with over 50% indigenous content, will be used for main propulsion and power generation on ships of the Indian Navy and the Indian Coast Guard. For this project, KOEL will be developing and designing engines and will also have IP rights for the same. The company will be making the prototype for this engine, and project execution is spread over 36 months. Once the prototype is approved by the client, KOEL will have the opportunity to be included on the preferred vendor list. We believe this can notably expand the addressable market for the company after three years. We also expect the industrial segment to benefit from the delivery of NPCIL orders from FY26 onwards. Going forward, KOEL is also optimistic about the continued growth from its key accounts in construction, defense, and railways, backed by a fortified engine portfolio and a deeper account engagement. Hence, we tweak our estimates for the industrial segment in FY26/27.

Distribution, B2C, export performance, and future outlook

In 4QFY25, revenue for distribution/B2C segments grew 12%/10% YoY. Growth in the distribution segment was driven by a deliberate restructuring of KOEL’s service and sales channel network, while the B2C segment growth was led by the successful consolidation of five smaller plants into one mega facility at Sanand, which led to improved product availability and manufacturing efficiency. B2C segment profitability has started improving, which can be seen as margins for the segment have more than doubled YoY in 4QFY25 to 11.0% vs. 5.2% last year in the same quarter. Exports dipped 14%/6% QoQ/YoY. The export figure was notably below the target of reaching 30% of total revenue in FY25, given the complexities of entering and scaling in foreign markets. The company is currently focused on three priority regions, namely, the Middle East, Africa, and the US. The company is evaluating each international region carefully to determine the right operating model - whether through local partnerships, direct presence, or acquisitions - with a focus on sustainability rather than opportunistic growth.

Arka Fincap enters its next phase of growth

Arka Fincap’s revenue grew 26% YoY to INR2.0b in 4QFY25. PAT, however, dipped 51% YoY to INR110m. Under the newly appointed management, Arka has moved from Arka 1.0 (focused on building a stable loan book with low delinquencies) to Arka 2.0, which centers on creating a granular, secured, retail-focused portfolio. The new ‘3-3-3’ strategy targets 3x AUM growth, a 3% ROA, and <3% GNPA. Key growth drivers include small-ticket loans against property (STLAP), pre-owned vehicle financing, and genset financing – all high-yield segments. Arka plans to build out its distribution network across seven states in FY26, leveraging KOEL’s existing ecosystem, particularly in Tier 2 and beyond

The 2B2B strategy: Aiming for INR2b revenue by FY30

Reflecting on the completed 2X3Y strategy (“To be 2x in 3 Years”), management reported a 1.6x revenue growth, slightly below the 2x target. However, it highlighted that EBITDA and cash generation surpassed expectations, surging 2.4x and 2.6x, respectively. All segments, except FMS, grew over 1.5x, and even the FMS business, which was restructured, turned EBITDA positive in Mar’25. Looking ahead, KOEL’s management unveiled the 2B2B strategy (“To be USD2b”) with a clear goal to reach USD2b in revenue by FY30. Management acknowledged that this target is far more ambitious than the previous 2X3Y strategy. The future growth pillars include a focus on high-value segments like data centers and defense, expansion into global markets, and diversification into non-internal combustion technologies such as batteries, hydrogen, methanol, ethanol, and microgrids. The company is open to achieving this through a combination of in-house R&D, strategic partnerships, or acquisitions, depending on the opportunity and geography.

Financial outlook

We trim our estimates slightly by 1%/2% for FY26/27 to bake in FY25 performance. We expect a revenue CAGR of 15% over FY25-27, driven by 10%/11%/10%/10%/11% CAGR in powergen/industrial/distribution/exports/B2C. Over FY25-27E, we bake in a 70bp improvement in margins to build in better product mix and operating leverage benefits. We expect EBITDA/PAT CAGR of 18%/19% over the same period.

Valuation and recommendation

The stock is currently trading at 26.7x/21.9x FY26/27E earnings. Adjusted for the subsidiary valuation, KOEL is trading at 22.9x/18.8x on FY26/27E EPS, which is still at a significant discount to the market leader. We reiterate our BUY rating on KOEL as we expect it to benefit from improved sales in the higher HP segments and exports, as well as improving the trajectory of the B2C segment.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412