Buy JSW Energy Ltd for the Target Rs. 592 by Motilal Oswal Financial Services Ltd

Soft quarter amid weaker thermal performance

* JSWE’s 4QFY25 revenue was 16% below our estimate. at INR31.8b (+16% YoY) as EBITDA came in at INR12b (+3% YoY), 8% below our estimate. The weakness in 4QFY25 earnings performance was primarily driven by softer performance at the Ratnagiri and Barmer thermal power plants, where net generation declined by 7% and 11% YoY, respectively. Additionally, standalone EBITDA margins remained under pressure despite the benefit of lower fuel costs, as higher employee expenses and elevated other operating costs offset these gains.

* JSWE has completed the acquisition of both KSK Mahanadi and O2 Power, which should drive EBITDA growth in FY26. Further, Vijaynagar plant capacity is now fully tied up under a PPA, thus bringing down merchant exposure to below 1GW, with imported coal dependence now limited to only 9-10%. This too should contribute to lowering earnings volatility. In 1QFY26, JSWE signed a PPA with UPPCL for another 12 GWh pumped storage project, targeted for delivery over the next six years. Overall, JSWE has set a roadmap to reach 30GW of total generation capacity and 40GWh of energy storage by 2030. By FY30, JSWE expects EBITDA to grow by 2.7x to 3x compared to pro forma FY25 levels. This growth will be supported by planned capex of INR1,300b between FY26 and FY30.

* While power demand growth has weakened to 2% in Apr’25 and the stock could remain under pressure in the near term, we maintain BUY with a revised TP of INR592/share.

EBITDA below expectations amid weaker thermal performance

* Consolidated:

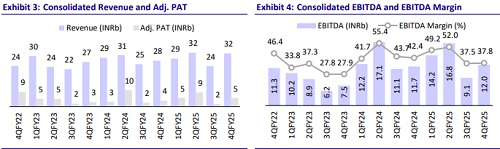

* JSWE reported 4QFY25 consol. revenue of INR31.8b (+16% YoY), which was 16% below our estimate. EBITDA came in at INR12b (+3% YoY), 8% below our estimate. The weakness in 4Q earnings performance was attributable mainly to 1) weaker performance at Ratnagiri/ Barmer entities, where net generation declined 7%/11% YoY respectively; and 2) standalone EBITDA margin was weak amid higher employee costs and other expenses, which offset the benefit of lower fuel costs.

* Adj. 4Q PAT was 34% above our estimate at INR2.9b, driven by 1) higher other income (mainly treasury related income) and 2) lower tax expenses due to deferred tax adjustments. Other income came in significantly above our estimates due to extraordinary income of ~INR1b on account of a writeback of deferred consideration for the Mytrah acquisition.

* FY25 revenue was flat YoY at INR117b. EBITDA also remained flat at INR52b.

* The board has approved a fundraising plan of up to INR100b.

* The board has recommended a dividend of INR2/share.

*Standalone:

* JSWE reported standalone 4Q PAT of INR4.6b (+36% YoY). Revenue dipped 23% YoY to INR9.5b. EBITDA stood at INR2.7b (-41% YoY).

* FY25 revenue came in at INR39b, down 23% YoY. EBITDA also declined 30% to INR12b. PAT rose 28% YoY to INR12b.

* Operational highlights:

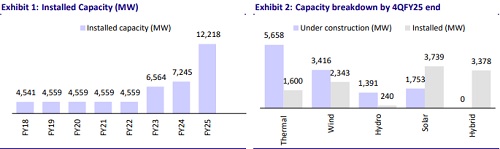

* Capacity: The company's operational capacity stood at 12.2GW. The project pipeline stood at 6.7GW (1.8GW thermal; 4.9GW RE).

* PLF and generation: Thermal PLF stood at 84% in 4Q. Net generation increased by 24% YoY to 7.9BUs, supported by new wind capacity and output from KSK Mahanadi (1,800MW) and Utkal plants. Net generation increased 16% YoY from 27BUs in FY24 to 32BUs in FY25. IND Barath Unit 2 has ramped up now and stabilized with Utkal PLF at 64%, while KSK Mahanadi PLF has been raised to 79% from 67% in the previous year. RE generation was at 1.7BUs, up 32% YoY, primarily due to a 67% increase in wind generation.

* Capacity increase: 2.8GW total increase in installed capacity in 4QFY25, including 478MW wind (1.3GW FY25) and 2,150MW thermal (350MW JSW Unit 2- Utkal and 1,800 KSK Mahanadi).

* Acquisition:

* Finished acquisition of Hetero Group's 125MW RE assets and KSK Mahanadi's 3,600MW thermal plant.

* In Apr’25, the company further acquired O2 Power's 4.7 GW RE platform.

* Other details:

* Receivable days stood at 76. C&CE stood at INR56b.

4QFY25 highlights:

* By FY30, JSWE expects EBITDA to grow by 2.7x to 3x compared to pro forma FY25 levels. This growth will be supported by planned capex of INR1,300b during FY26-FY30.

* For FY26, JSWE is targeting capex in the range of INR150-180b.

* Net generation during the quarter increased 24% YoY to 7.9 billion units, driven by a 32% rise in renewable generation due to new capacity additions.

* The second unit of the 350 MW Ind Bharat JSW Utkal plant was commissioned during the quarter and is now operating smoothly.

* The KSK Mahanadi plant reported EBITDA of INR28.95b for FY25, with a plant load factor (PLF) of 67.4%. Underlying EBITDA stood at INR23.82b. After the completion of the transaction in Mar’25, PLF improved to 79% within just 25 days of operations, with a deemed PLF of 99% during that period.

* JSWE has set a roadmap to reach 30GW of total generation capacity and 40GWhours of energy storage by 2030.

* O2 Power, a JSWE subsidiary, currently operates 1.3GW and is expected to scale up to 4.7GW by Jun’27, with a planned capital investment of INR130-140b.

Valuation and view

* The valuation of JSWE is based on SoTP:

* Thermal is valued at 9x FY27E EBITDA and renewable energy at 15x FY27E EBITDA (FY28E EBITDA discounted by one year).

* Hydro at 2x FY27E book value and green hydrogen equity at a 2x multiple.

* Additionally, the company's stake in JSW Steel is valued at a 25% discount to the current market price, acknowledging the strategic significance of this holding while incorporating a conservative valuation approach.

* By aggregating the values from these different components, the total equity value of JSWE was determined, leading to a TP of INR592/share.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412