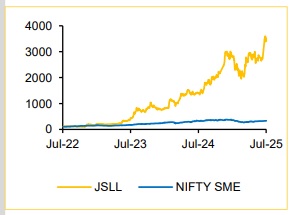

Buy Jeena Sikho Lifecare Ltd For Target Rs. 900 By Choice Broking Ltd

A Monopoly Business Model - Ayurveda as IPD (In-Patient Department)

JSLL has institutionalised at scale Ayurvedic in-patient treatment; a feat not many players have achieved. In the aftermath of rise in demand for tackling lifestyle diseases, such as diabetes, heart diseases, etc., JSLL is positioned to dominate this blue ocean market, with robust govt. backing through integration of AYUSH.

In the past year, JSLL has witnessed remarkable growth, expanding its hospital network from 32 to 50 facilities. Bed capacity surged by ~70%, rising from 1,277 to 2,173 beds in FY25. Operational beds also grew by around 25%, reaching 1,600. Additionally, the ARPOB increased from INR 7,900 to INR 8,200, while occupancy rates improved significantly from 38.4% to 53.1%.

Rapid Expansion Expected via a Zero-Capex Plan

JSLL plans to diversify its business model by partnering with Ayurveda colleges, which will bypass heavy capex and rapidly expand its network. This enables faster breakeven, better capital efficiency and higher ROIC. India’s 600+ Ayurveda colleges, each with a ~100-bed capacity, will help expand rapidly. We project that JSLL will scale its bed capacity to 5,000+ by FY28, with 4,000+ beds operational beds, achieving an occupancy rate of ~61% and an ARPOB exceeding INR 8,500.

OTC Business Segment to Scale Up Substantially for ~20% Overall Revenue

JSLL addresses the gap between short-term treatment and long-term wellness by offering personalised treatment through its IPD/OPD network and OTC products. At present, there are ~15 new products in the pipeline; we expect 12 of them to get launched by FY28, with the first just launched (Pet Shuddhi Kit) priced at INR 960 (vs. competitors at INR 115--200), charging more than 5x compared to the competitors and making ~90% gross margin.

JSLL commands a premium pricing by offering kits that bundle 5 complementary products, all made with 100% organic ingredients. We anticipate the revenue contribution to rise significantly from 4% in FY26 to ~20% by FY28, driven by the built-in benefits of the products.

Investment View: Without additional investment, JSLL is expanding rapidly via Ayurveda colleges and plans to enter into the high-margin OTC business. With no debt on its books, we expect JSLL to deliver significant Revenue/EBITDA/PAT CAGR of 44.2%/57.9%/60.3% over FY25--28E.

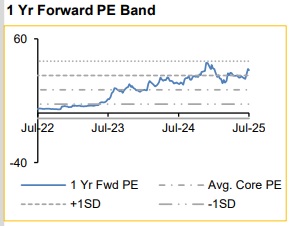

Thus, we initiate coverage on JSLL with a BUY recommendation and target price of INR 900, with an upside of 64.4%, by valuing the company on DCF, implying a PE multiple of 25.6/18.2 at FY27E EPS/FY28E EPS.

BULL/BEAR Case

Mitigating the Key-Man risk: Investors are concerned that the company is dependent on the promoter, as so far, Mr. Manish Grover, alongside the CFO, has successfully led JSLL’s transformation. But as the company enters its next phase of rapid expansion, it is now strengthening its leadership bench by bringing on board a CEO, COO, and trained doctors, which will mitigate the Key-Man risk over time.

Optionality: Mainboard transition to boost investor interest amid higher liquidity

Risks to our BUY rating: Change in the government policy, which may not favor Ayurvedic treatment/products and failure of the OTC business segment.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)