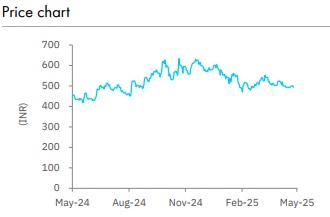

Buy Eureka Forbes Ltd for Target Rs. 720 by Elara Capitals

Volume jumps with sharp rise in margin

Eureka Forbes (EUREKAFO IN) witnessed healthy performance across segments, led by growth in the products segment despite muted consumer demand in Q4. Volume for the overall products segment grew in high-teens, led by higher ad spend and new launches. EBITDA margin reached new highs, both annually and quarterly, led by growing premium contribution and operating leverage. We raise our TP to INR 720 on 41x March FY27E P/E and retain Buy. EUREKAFO is a compelling choice in the consumer durables industry, given low penetration of water purifiers, market leadership and strong margin improvement (led by premiumization).

Products segment – Robust growth props topline: Q4 revenue grew 11% YoY to INR 6.1bn, led by strong performance in the products segment (YoY growth in high teens). This was the sixth consecutive quarter of double-digit growth, with continuing business up 10.9% YoY. FY25 sales grew 11% YoY to INR 24.4bn. Growth was broad-based across categories, with ecommerce and direct sales channel contributing to the topline. Premium electric water purifiers and robotic vacuum cleaners contributed significantly to growth. For the services segment, performance was subdued – Average selling price (ASP) declined due to tiered AMC offering, but unit volume grew in this category

Ad spends at 11% of sales in FY25: EUREKAFO seeks to increase its sales led by rising penetration of water purifiers and vacuum cleaners via ad spend, new product launches, innovations, schemes and offers. Ad spend was up 25% YoY in FY25 to ~11% of sales. Going forward, the company expects to sustain this level of ad spends, especially for its new premium products, so as to increase awareness and to create demand.

Margin at historical high in Q4: EBITDA margin surged 300bps YoY to 12.6% in Q4, the highest ever in EUREKAFO’s history, led by operating leverage kicking in on higher sales, and robust growth in the premium portfolio. This helped offset the rise in cost of advertisement and other expenses, such as in innovation and digitization (to increase penetration). Per the management, there is still room to grow profitability. Hence, margin may continue to expand. FY25 EBITDA margin expanded 180bps YoY to 10.9%, reaching double-digits for the first time annually in EUREKAFO’s history.

Reiterate Buy with a higher TP of INR 720: We lower our EPS estimate by 8% for FY26E given continued higher ad spend and rising discount (these may drag down margin), but raise it by 2% for FY27E on better product mix. We introduce FY28E. We raise our TP to INR 720 from INR 660 on 41x (from 40x) March FY27E P/E, given low penetration of water purifiers and efforts to grow it, EUREKAFO’s market leadership, and premiumization-led strong margin improvement – Retain Buy. We expect an earnings CAGR of 34% in FY25-28E, with an average ROE and ROCE of 12% and 9% in FY26E-28E.

Please refer disclaimer at Report

SEBI Registration number is INH000000933