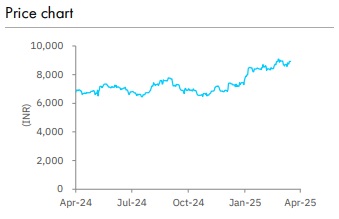

Buy Bajaj Finance Ltd for Target Rs. 11,161 by Elara Capitals

Resilience amid headwinds

Although in-line with expectations, BAJAJ FINANCE (BAF IN) earnings witnessed elevated provisions for Q4 but were offset by lower opex and one-off tax reversals. Recalibration of unsecured book weighed on margin, down 13bp QoQ. Q4 saw asset quality blips with increased ECL provisions of INR 3.6bn after factoring in higher forward flows of 9MFY25, spike in Stage 2, up INR 7.8bn, and higher write-offs of INR 21bn. While rural B2C is still not out of the woods and urban B2C is on a cautionary mode, BAF has observed improvement in early vintages across the portfolios. Its resilience amid headwinds is evident in unchanged guidance with credit cost at 1.85-1.95% and 24-25% AUM growth for FY26E. We reiterate Buy with a TP of INR 11,161 (please refer to our note Consumer finance: Tale of two giants released on 15 April 2025)

Low opex, tax reversals offset provisions spike: Q4 PAT of INR 39.4bn was up 6% QoQ/16%YoY as increased provisions of 15% QoQ and 80%YoY were offset by one-off tax reversals and flat opex, up by a mere 1.6% QoQ, with a cost-income ratio down 33bp QoQ to 33.9%. Standalone credit cost spiked 23bp QoQ to 3.1%, led by changes in expected credit loss (ECL) model. Optimization of opex and AI-led productivity gains would continue to bring operational efficiency coupled with deceleration in credit cost to support ROA of 4.6-4.8% over FY26-28E.

Strategic levers in place to drive a 25% AUM CAGR during FY24-27E: BAF recorded healthy business momentum in Q4 at 5.3% QoQ and 26.1% YoY underpinned by 10.7mn new loans, 4.8% QoQ growth in customer franchise and new businesses launched in the past 2-3 years. AUM growth was led by 8.7% QoQ rise in rural B2C + Gold (7.1% AUM) and SME, up 7.1% QoQ. While vehicle and rural business segments were curbed due to stress, 9MFY25 saw BAF focusing on rural geographic expansion. With management confident of 14-16mn customer accretion run-rate, it can climb to 16-17mn during FY26-28E. With targeted AUM growth is 24-25% for FY26E, we retain a 25% AUM CAGR during FY24-27E.

Asset quality concerns peaking: Q4 saw major asset quality blips: 1) ECL rejig after factoring in 9MFY25 headwinds necessitating additional provisions of INR 3.6bn, 2) spike in Stage 2 assets by INR 7.8bn, and 3) credit cost climbing to ~2.3%. That said, Stage 3 was down INR ~4.9bn attributable to higher write-offs of INR 21bn. Considerable reduction in 3+ personal loan exposures, winding down of 2W & 3W business and adequate action in used car business are enabling confidence to maintain credit cost guidance of 1.85-1.95%. We expect 2.2% credit costs for consolidated and 2.8-2.6% for standalone business during FY26-28E.

Reiterate Buy with a TP of INR 11,161: We retain our EPS estimates as we conservatively factor in credit cost of 2.3% during FY26-27E to err on the side of caution but expect heathy business offset slight fees to aid in a robust EPS CAGR of 25% during FY24-27E. BAF is poised to post a 24% NII CAGR, and a 25% EPS CAGR with a 4.7% RoA & 20% RoE during FY24-27E, underscored by robust customer acquisition engine and proactive risk management initiatives. We reiterate Buy valuing its standalone book at 4.9x (unchanged) FY27E P/ABV and BHFL at 3.8x FY27E P/ABV to arrive at a SOTP-TP of INR 11,161. We introduce FY28 estimates. The stock and bonus split to be factored Q1FY26 onwards.

Please refer disclaimer at Report

SEBI Registration number is INH000000933