Buy Astra Microwave Products Ltd for the Target Rs. 1,150 by Motilal Oswal Financial Services Ltd

Better than expected performance

Astra Microwave (ASTRA)’s 3QFY26 results were ahead of our estimates on better-thanexpected margins. Order inflow was strong at INR4.7b (standalone basis) in 3QFY26, with another INR5-6b expected in 4QFY26. The company is rightly positioned to benefit from a strong addressable market of INR250b over the next 4-5 years. We expect ASTRA to get orders from DPSUs and DRDO for various platforms such as QRSAM, Tejas, Su-30 upgrade, etc. We maintain our estimates and expect revenue/EBITDA/PAT CAGR of 18/19/23% over FY25-28. We believe ASTRA’s revenue growth is likely to accelerate over FY27-30, as larger platform orders are finalized by DPSUs and MoD. We consider ASTRA as a long-term investment opportunity and maintain our BUY rating with a revised TP of INR1,150 (earlier INR1,100), rolling forward to 38x Mar’28E EPS

Strong beat on profitability

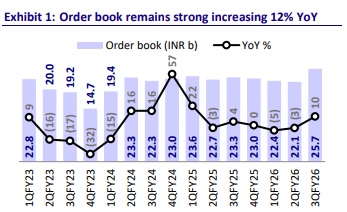

ASTRA’s revenue was in line, while EBITDA and PAT beat our estimates. Revenue was broadly flat YoY at INR2.6b, in line with our estimate. Gross margin expanded 730bp YoY to 55.3%, above our estimate of 47.0%. This led to an EBITDA beat of 34% at INR825m (+8% YoY), while margin expanded 220bp YoY to 31.7% vs. our estimate of 23.5%. However, a higher tax rate compared to last year led to a 1% YoY dip in PAT to INR468m. This was still much better than our expectation of INR305m (54% beat). For 9MFY26, revenue/EBITDA/ PAT increased 5%/15%/9% YoY, while EBITDA margin expanded 220bp YoY to 25.4%. The company received orders worth INR6.6b during the quarter, taking the consolidated order book to INR25.7b

Defense segment continues to be key contributor

Defense segment’s revenue declined 3% YoY to INR2.1b, while order inflows stood at INR2.9b, taking the total order book to INR14.8b. The company has secured key subsystem wins such as DCPP for EW suites for platforms like Sukhoi. Several EW systems, where ASTRA has been qualified, such as Nayan, Samudrika, and Dharashakti, are entering production stages, which can enhance revenue stability. This transition from development to production is likely to support margin sustainability over time. We expect the segment to grow at a CAGR of 29% over FY25-28.

Meteorology segment to drive diversification

Meteorology segment’s revenue increased 27% YoY to INR88m, while inflows stood at INR1.5b, taking the total order book to INR3.7b. The company is actively involved in Mission Mausam under the Indian Meteorological Department, with multiple contracts already under execution. The overall opportunity is expected to be rolled out through 4-5 tenders over the next few years. Order finalization is likely to take two years, while execution may be spread out over three to four years. Continued participation in national weather infrastructure projects strengthens the company’s execution beyond defense. We expect the segment’s revenue to clock a CAGR of 51% over FY25-28.

Space segment growth to be prolonged

Space segment revenue declined 21% YoY to INR68m, with order inflows of INR174m taking the order book to INR2.5b. Most orders in the current order book are related to satellite payload electronics, with only ~5% linked to launch vehicle systems. The company expects repeat orders over the next 2-3 years in similar configurations. It is also working toward developing its own satellite, with a potential launch timeline of around two years. Partnerships with startups are being pursued to strengthen capabilities in propulsion and satellite technologies. We expect the segment’s current revenue levels to sustain over the medium term and grow meaningfully beyond FY28 once the company launches its own satellite.

Export segment execution to remain moderated on selective approach

Export revenue increased 38% YoY to INR299m, while order inflows stood at INR204m, taking the segment order book to INR1.3b. The company has consciously shifted away from low-margin high-value export contracts (BTP) to design-led highmargin business (BTS). As a result, export revenue has moderated in recent years but margins have improved. New opportunities are emerging following trade agreements with Europe and the US, with renewed discussions currently underway. However, these opportunities may take time to convert into firm orders due to long qualification and negotiation cycles. Consequently, the company’s selective approach is expected to keep execution moderated in the export segment.

MoU with Bharat Electronics

The company has signed a memorandum of understanding with BHE to jointly design, develop, and manufacture advanced defense systems. This partnership focuses on strengthening indigenous capabilities in radar, electronic warfare, and related technologies. Through this arrangement, the company aims to integrate more deeply into major DPSU-led programs, particularly in areas requiring complex RF, microwave, and mission critical electronics. Overall, this partnership supports long-term order visibility while reinforcing the company’s competitive positioning.

Guidance

FY26 revenue is guided to grow 10% YoY with healthy margins. The company expects order inflows worth INR5.5b-6b in 4QFY26, taking the FY26 inflows to ~INR13b. Of this INR5.5b-6b, ~INR4.5b is expected to come from defense and ~INR1.2b from metrology. For FY27, the company has guided revenue growth of 15% YoY, with order inflows for the year reaching ~INR15b-16b. Majority of this will be from DPSUs like BHE which are expecting some large-size inflows in 1QFY27 for QRSAM, as well as from DRDO where ASTRA is participating in few R&D programs. Export order inflows are expected to be ~INR1b-1.3b in FY27

JV performance

The Astra-Rafael joint venture reported an order book of ~USD80m and executed orders worth ~USD18.2m in 3QFY26. For FY26, the JV is expected to generate revenue of ~INR3.5b, rising to ~INR4b+ in FY27. PBT margin is estimated at 10%- 12%. The JV has secured two major orders worth over INR3b during the quarter. Its strong execution track record supports sustainable growth over the next five to six years

Financial outlook

We maintain our estimates and expect the company’s revenue/EBITDA/PAT to clock a CAGR of 18%/19%/23% over FY25-28. With margins to sustain at current strong levels, we expect its RoE and RoCE to remain at comfortable levels of 15-18% by FY28.

Valuation and view

ASTRA is currently trading at 38.2x/30x P/E on FY27E/FY28E EPS. We reiterate our BUY rating on the stock with a revised TP of INR1,150 (earlier INR1,100) on roll forward to 38x Mar’28E EPS.

Key risks and concerns

Key risks include delays in awarding of larger platforms, lower-than-expected spending from the government on the defense sector, slower export momentum, and supply-chain related constraints.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412