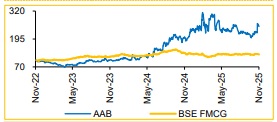

Buy Associated Alcohols Breweries Ltd For Target Rs. 1,300 By Choice Broking Ltd

Malt Plant Online, IMFL Volumes Jump

Commissioning of Malt Unit Marks Next Growth Phase: AAB commissioned its 6,000 LPD malt plant in October 2025, marking a key milestone in its premiumisation and integration strategy. The facility strengthens AAB’s valuecreation framework in premium aged spirits and positions it for the launch of its Single Malt Whisky. Located within the 150-acre Barwaha complex, the malt plant is expected to enhance quality control, cost-efficiency and backward integration, supporting AAB’s focus on premium and export-led growth.

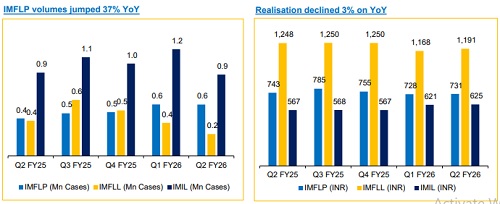

Premium Momentum amid Realignment: AAB’s IMFL Proprietary volumes rose 37% YoY, while Licensed IMFL declined 38% due to business realignment with Inbrew as focus shifts to higher-margin proprietary brands. Despite margin pressure from input mix and lower byproduct realisation, upcoming RTD, Tequila and Brandy launches strengthen growth visibility.

View and Valuation: Q2FY26 was a non typical quarter, marred by input cost pressure and changing product mix. However, AAB showed strong resilience in the P&A segment. We, therefore, maintain our estimate for FY26E/FY27E. Hence, we maintain our TP of INR 1,300 using the DCF methodology. Our TP implies an FY27E/FY28E PE of ~26x/23x.

Soft Quarter affected by Cost Mix and Realignment

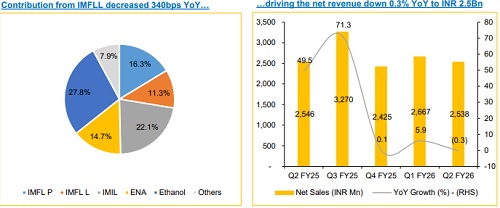

* Net revenue for Q2FY26 was at INR 2.5Bn, down 0.3 YoY and 4.8% QoQ (vs CIE est. at INR 2.7Bn).

* The decline can be attributed to realignment of the lower-margin IMFL Licensed (IMFLL) business volumes (down 37.7% YoY), which offset 37% volume growth achieved in the higher-margin IMFLP business.

* EBITDA stood at INR 240Mn, down 3.7% YoY and 35.3% QoQ (vs CIE est. at INR 337Mn), with margin contracting 34 bps YoY and 445 bps QoQ to 9.5% (vs. CIE est. of 12.2%), affected by an adverse raw material mix and lower byproduct realisation amid market oversupply.

* PAT for Q2FY26 was at INR 140Mn, down 8.6% YoY and 40.8% QoQ, respectively (vs CIE est. at INR 205Mn).

Robust Growth in IMFLP Portfolio: AAB’s IMFL Proprietary (IMFL P) segment recorded robust performance, with revenue up 35% and volumes rising 37% YoY. The company’s well-integrated portfolio, anchored by IMFLP, supported by ENA and Country Liquor, continues to enhance earnings visibility and margin resilience.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131