Add United Spirits Ltd For Target Rs. 1,475 By JM Financial Services Ltd

Strong on premiumisation; policy bumps to drag near term growth

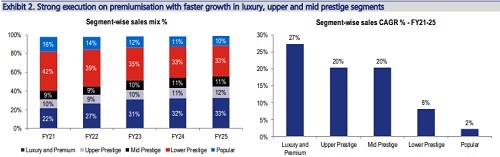

Post-acquisition by Diageo, UNSP has undergone a transformation with clear focus on driving premiumisation, improving profitability and strengthening balance sheet. Success is visible from uptick in P&A salience, sharp improvement in EBITDA margin (+1,000bps over FY15- 25), zero debt and healthy FCF generation. The headwind in Maharashtra will weigh on nearterm growth but favourable policies in UP, AP, MP and Karnataka should provide some cushion. We are factoring in the same through lower sales growth in P&A/Popular segment and assigning a lower target multiple (vs. historical average). Having said that, our analysis of the P&A segment suggests UNSP has outperformed Pernod Ricard and seen share gains in Mid & Upper prestige segments, where it was relatively weaker. Its leadership in Premium and Luxury portfolio makes it one of the key beneficiaries of the India-UK FTA and likely urban recovery in coming quarters. This provides comfort on UNSP’s ability to achieve double-digit sales growth in P&A over the medium to long term. Margin execution has been strong over FY23-25; premiumisation, stable RM and the cost efficiency programme will help sustain high-teen margins. Sharp corrections due to near-term headwinds are an opportunity to add the stock. We initiate coverage with ADD; TP of INR 1,475 (valuing standalone business at 51x Sep 27E + INR 130/share for Royal Challengers Sports Pvt Ltd).

* Maharashtra tax hike a near-term headwind..: Maharashtra (c.16-18% of sales/EBITDA) may see disruption due to a) steep hike in excise duty for IMFL (c.30-40% increase in MRP) and b) introduction of MML segment between IMFL and Country liquor with huge price gap. Our checks/industry interactions point to possible downtrading and industry decline of c.20%, which could weigh on near term sales growth. Favourable policies in certain states and likely recovery in urban discretionary could provide some cushion. We bake in lower sales growth of c.6% in P&A (vs. management guidance of double-digit growth) for FY26E. Possible opening up of Delhi/Bihar market can be an upside risk.

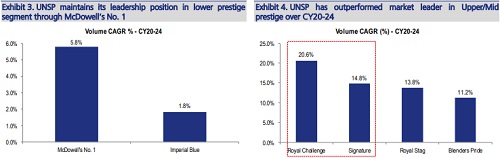

* …but stepped-up interventions in P&A showing encouraging results; provides comfort on medium-term trajectory: Over last 3-6 years, UNSP’s P&A sales has grown much faster than Pernod Ricard. The notable trends are – a) Faster growth in luxury segment (33% of sales), b) share gains in lower prestige from Imperial blue and c) share gains in Mid/upper prestige (c.23% of sales and high margin segment) led by RC and Signature, where it had a relatively weaker position vs. Pernod Ricard. Better execution here provides comfort on double-digit growth over the medium term (we bake in c.10% growth in FY27 and 28E).

* Healthy execution on margins so far, expect high-teen margin to sustain: Over FY15-25, while gross margin has improved by c.400bps, EBITDA margin has expanded by c.1,000bps (without curtailing A&P spends), led by divestments of regular portfolio, rationalisation of manufacturing footprint and the supply chain agility programme. While margin expansion over the last 2 years was ahead of expectations, faster growth in Mid/upper prestige, productivity initiatives and UK FTA benefit (in FY27E) should help sustain high-teen margins and drive higher EBITDA growth (CAGR:11%) over FY25-28E

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)