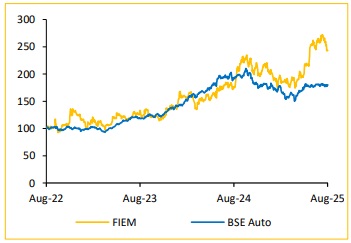

Add Fiem Industries Ltd for the Target Rs.2,530 by Choice Broking Ltd

Growing share of high-value LED lighting:

The percentage of total automotive lighting revenue derived from LED lighting increased significantly to 63.9% in Q1FY26, up from 55.2% in Q1FY25. This share is expected to gradually increase to 75%-80% over the next couple of years. The company's pipeline for new models is 100% LED, indicating a continued shift towards LED technology. We believe this shift towards LED will contribute to a higher revenue scale potential as realizations for LED lighting are at least 2x higher compared to conventional lighting.

Deep-Rooted OEM Partnerships and Resilient Customer Demand:

The performance in Q1FY26 was significantly driven by robust demand from TVS, Royal Enfield, and Yamaha. The company confirmed no loss of wallet share with HMSI, with new product developments underway for launch next year. With Hero MotoCorp, new orders are on track, and is set to expand the 125cc segment with a new all-LED lighting model. FIEM's sales to Yamaha increased by almost 20% in Q1FY26. We believe this consistent strong performance with key clients, coupled with a robust expected demand due to the festive season and good monsoon, positions FIEM for strong growth ahead.

View and Valuation: We revise our FY26/27 EPS estimates up by 2.3%/4.8% and arrive our target price of INR 2,100. We value the company at 18x (maintained) on the average FY27/28E EPS, while we introduce FY28 estimates. Consequently, we maintain our ‘ADD’ rating on the stock.

Q1FY26 results were in line with expectations on all fronts

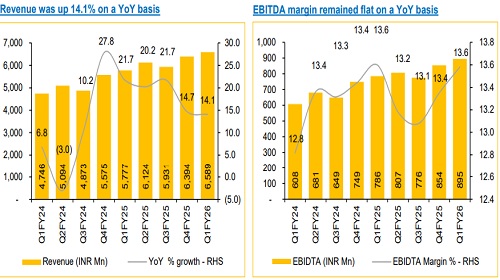

* Revenue was up 14.1% YoY and up 3.0% QoQ to INR 6,589Mn (vs CIE est. at INR 6,649Mn).

* EBITDA was up 13.9% YoY and up 4.8% QoQ to INR 895Mn (vs CIE est. at INR 878Mn). EBITDA margin was flat YoY and up 23bps QoQ to 13.6% (vs CIE est. at 13.2%).

* APAT was up 17.6% YoY and up 2.7% QoQ to INR 575Mn (vs CIE est. at INR 565Mn).

Strategic Investments in Technology and Diversification Efforts:

FIEM has made significant investments in a new innovation and R&D center in Gurugram, consolidating mechanical, optical, and electronics capabilities. FIEM is also setting up a state-of-the-art EMC EMI electronic validation laboratory, for integrated electronic development. FIEM has also diversified into the 4W segment and recently secured development orders for three products from Force Motors, marking a crucial new customer engagement. Commercial production for Mahindra has already commenced in Q1FY26 with an LED license plate lamp, with further products for the Bolero model to follow.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131