Add Eicher Motors Ltd For Target Rs. 5,885 By Choice Broking Ltd

Aggressive International Expansion and Diverse Product Portfolio:

Royal Enfield's international volumes surged by 41.2% to 22,547 units, despite uncertain macroeconomic conditions. The company is actively strengthening its global footprint by setting up a second CKD (Completely Knocked Down) facility in Brazil and focusing on finance schemes to boost customer acquisition. Markets like Nepal and Bangladesh are performing exceptionally well. We believe the company will continue the strong growth momentum in the export market led by continued demand and expansion plans.

Successful Penetration into New Demographics and Rural Markets:

Royal Enfield is effectively broadening its customer base by attracting a younger demographic, particularly with the new Hunter 350, which is appealing to riders aged 24-26, bringing in a wave of new and young riders and the Classic 650 showing good acceptance. The Continental GT is also seeing its average customer age decrease to 26-27. Furthermore, Royal Enfield has significantly expanded its reach into the rural market, where sales in rural states now account for almost 50% of total sales, a substantial increase from about 30% previously.

View and Valuation We revise our FY26/FY27 EPS estimates downwards by 5.0%/6.3%, and maintain our target price of INR 5,885, valuing the company at 25x (unchanged) on the average FY27/28E EPS while introducing FY28E estimates. Accordingly, we maintain our rating to ‘ADD’.

Strong Quarter: Overall in line results compared to expectations

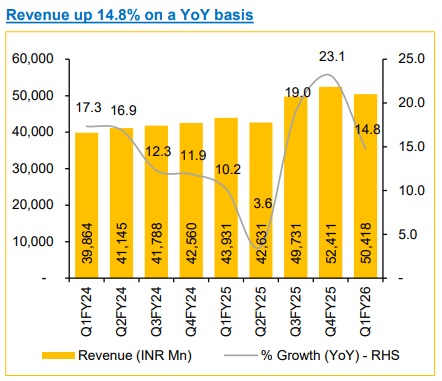

* Revenue for Q1FY26 was at INR 50,418Mn up 14.8 YoY and down 3.8% QoQ (vs consensus est. at INR 49,606Mn) led by 14.7% YoY growth in volume and flat ASP YoY.

* EBITDA for Q1FY26 was at INR 12,028Mn, up 3.2% YoY and down 4.4% QoQ (vs consensus est. at INR 11,996Mn). EBITDA margin was down 267 bps YoY and down 14 bps QoQ to 23.9% (vs consensus est. at 24.2%).

* PAT for Q1FY26 was at INR 12,052Mn, up 9.4% YoY and down 11.5% QoQ (vs consensus est. at INR 11,472Mn).

Robust Performance and Future-Ready Portfolio in Commercial Vehicles (VECV):

EIM‘s commercial vehicle arm, VECV, has shown exceptional performance, recording its best-ever Q1 sales of 21,610 units, surpassing previous records. VECV holds a leading market share in LMD trucks at 34.5% and a strong 21.5% in the bus division. We believe VECV is strategically positioned for future demand with a full product range across ICE, electric, CNG, and LNG platforms providing a diversified and sustainable growth avenue for EIM.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

Ltd.jpg )