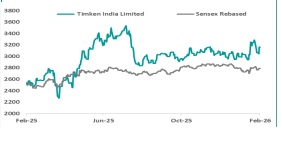

Accumulate Timken India Ltd for Target Rs. 3,665 by Geojit Investments Ltd

Demand Revival Across Segments Drives Topline

Timken India Ltd. (TMKN) manufactures and distributes anti-friction bearings, components, and mechanical power transmission products. It also offers maintenance, refurbishment, and industrial services across various sectors.

* Timken's Q3FY26 revenue from operations grew 14% YoY to Rs.764.3cr. All business segments grew during the quarter, with the Process segment showing the strongest momentum, jumping 24%YoY to Rs.167cr.

* Gross profit stood at Rs.273.6cr, with gross margins at 35.8%, which is 342 bps lower than last year due to an unfavourable mix and higher material costs and the purchase of traded goods.

* Other expenses rose 25% YoY, and employee expenses increased 12% YoY, pressuring EBITDA margins to contract 333bps to stand at 13%, with EBITDA for the quarter at Rs.95.8cr.

* Profit Before Tax (PBT) fell 26% YoY due to higher depreciation expense on account of capitalisation of new manufacturing lines at Bharuch, partially offset by lower finance cost. Other income was lower because of a reduction in investable surplus, following dividend payouts and the GGB acquisition.

* PAT declined 33% YoY to Rs.49.8cr, and PAT margins softened to 6%. The company noted that these pressures are temporary, and margins should gradually improve as the new Bharuch plant scales up.

Outlook & Valuation

Though impacted by temporary cost pressures and the initial ramp-up phase of the Bharuch plant, Timken continues to demonstrate underlying demand strength across key industrial segments. We expect revenues to grow at 15% CAGR, driven by demand improvement from CV and rail segments and improving utilisation at the new SRB/CRB capacity and potential upside from favourable global trade developments that enhance export opportunities. Margins are expected to expand from 17.8% in FY26E to 19.9% in FY28E as mix normalises from current unfavourable mix and Bharuch ramp-up costs taper off, and operating leverage improves with rising domestic and export volumes. Resultantly, earnings are projected to grow at a strong 22% CAGR over FY26–28E, reflecting both topline momentum and margin recovery. Hence, We value the stock at 44X on FY28 EPS and upgrade the stock from Sell to Accumulate rating with a Target price of Rs.3,665/Share

Key Highlights

* Timken's new Bharuch plant now makes SRB and CRB bearings and is fully ready for production. The team is speeding up PPAP approvals from customers so they can start selling more quickly from this big new facility.

* The company plans to expand rail bearing capacity at Jamshedpur, starting operations in Q3 of FY27. This will steadily meet growing demand from India's railway infrastructure projects.

* GGB's FRC line for plain bearings is right on schedule, with equipment setup planned for end of Q1 or start of Q2 FY27. It targets replacing costly imports in key markets.

* Recent India-US and EU trade deals lower tariffs and open doors for more exports. Timken sees these as big tailwinds for supply chain shifts favoring Indian manufacturing.

* Commercial vehicle demand is picking up fast due to OEMs building stocks ahead of year-end. Rail stays steady, supported by ongoing government budget spending on infrastructure.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH20000034