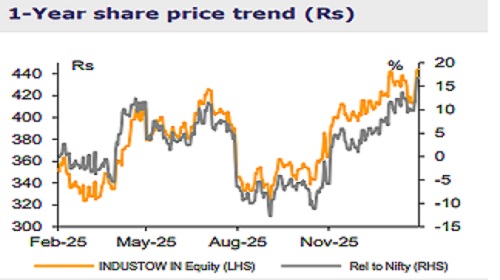

Buy Indus Towers Ltd for the Target Rs.540 by Emkay Global Financial Services Ltd

Indus Towers (Indus)’s Q3 results were broadly in line with street expectations, with key parameters moving in the right direction. Tenancy addition increased QoQ (6.1k vs 4.5k in Q2FY26), EBITDA margins improved with improvement in energy margins, and capex declined QoQ. We believe the government’s decision to allow Vodafone Idea (VI)—to repay its AGR dues in a long-term staggered manner and their reassessment—bodes well for VI’s long-term sustainability. VI has further announced ambitious plan for expanding its network, earmarking Rs450bn toward capex over the next 3 years. This would help Indus achieve 5.4% revenue CAGR and 6.4% EBITDA CAGR over FY26-28E. Considering longterm sustainability of its key customer and greater certainty of tenancy growth, we increase our target EV/EBITDA to 8x from 7x earlier, and increasing our TP by ~17% to Rs540 from Rs460

In-line revenue and beat on margins driven by healthy tenancy growth Indus reported revenue of Rs81.5bn (7.9% YoY) vs Street estimates of Rs83.1bn, driven by 2.6% QoQ decline in energy revenue. Revenue growth was driven by healthy tenancy additions of 6,105 (vs 4,505 in Q2FY26), while RPT was flat YoY and tenancy ratio was stable at 1.62x. The company added 3,548 towers during the quarter (vs 4,301 in Q2FY26), taking the total base to 259,622 towers. Improved weather supported a 190bps QoQ improvement in energy margins to -2.9%. EBITDA margin, adjusted for reversal of provision for doubtful debts, expanded by 140bps QoQ to 54.8%. Capex declined to Rs19.8bn (Rs25.6bn in Q2FY26), in line with lower tower additions, lifting FCF to Rs7.9bn (Rs3.0bn in Q2FY26). PAT, adjusted for one-offs, grew 14.2% YoY to Rs17.8bn.

Africa foray to be gradual; dividend commitment reiterated Indus is moving closer to execution in Nigeria, Uganda, and Zambia, with holding structures in place. Licensing, regulatory approvals, and operating model finalization are underway. Given the organic nature of tower rollouts, near-term financial impact is expected to be limited. While we remain constructive on the long-term potential of Africa’s tower market, we will keep a look out for dividend upstreaming and currency depreciation risks. Separately, the management highlighted that the financial leverage of the company is low and that the Board will deliberate dividends/buy-back in Q4FY26

Outlook and valuations: VI AGR moratorium improves valuation comfort We believe Indus’s valuations at 6.8x/6.5x FY27/FY28 EV/EBITDA remain at a discount to global peers’, due to concerns around the long-term sustainability of VI. We believe government decision regarding AGR dues signals its commitment toward maintaining a four-player telecom market structure (three private and one public network operator), which underpins the continuity of Indus’s tenancy base. In light of this, we increase our target multiple to 8.0x (from 7.0x) and roll forward to Q3FY28E EBITDA, resulting in our TP being revised up by 17.4% to Rs540 from Rs460

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354