Neutral Alkyl Amines Chemicals Ltd for the Target Rs.1,730 by Motilal Oswal Financial Services Ltd

Muted performance amid demand and cost pressures

Earnings in line

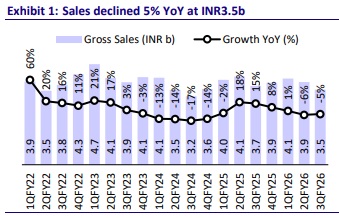

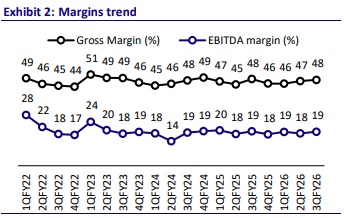

* Alkyl Amines Chemicals (AACL) reported a muted operating performance in 3QFY26 as EBITDA declined 6% YoY. Further, higher raw material costs (gross margin contracted 50bp YoY) resulted in a marginal 20bp YoY contraction in EBITDA margins to 19%.

* The momentum is expected to remain muted in the near term due to prevailing demand softness across key end-user industries and heightened competitive intensity from Chinese manufacturers.

* We broadly maintain our earnings estimates and value the stock at 38x FY28E EPS to arrive at a TP of INR1,730. Reiterate Neutral.

Muted operating performance

* In 3QFY26, revenue came in at INR3.5b (est. of INR3.7b), down 5%/9% YoY/QoQ, while gross margin stood at 48%, down 50bpsYoY and up 60bp QoQ.

* In 3QFY26, EBITDA margin stood at 19%, contracting 20bp YoY but expanding 90bp QoQ.

* EBITDA stood at INR672m (est. in line), declining 6% YoY and 4% QoQ.

* Adjusted PAT stood at INR423m (est. in line), declining 3% YoY and 2% QoQ.

* In 9MFY26, Revenue/EBITDA/Adj. PAT declined 3%/4%/4% YoY at INR11.5b/INR2.1b/INR1.3b.

Valuation and view

* We expect short-term headwinds to persist, with volumes likely to be affected by global demand softness and weakness across key end-user industries, along with continued pricing pressure due to heightened competition from Chinese manufacturers.

* However, the long-term outlook remains positive, supported by AACL’s strengthening global presence through the development of efficient, costeffective processes for high-grade and ultra-pure specialty products. The planned commercialization of a new product at the Kurkumbh facility, along with additional products in the R&D pipeline, should drive the next phase of growth.

* We estimate a CAGR of 5%/7%/8% in revenue/EBITDA/PAT over FY25-28 and maintain our earnings estimates. We value the stock at 38x FY28E EPS to arrive at a TP of INR1,730. Reiterate Neutral.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412