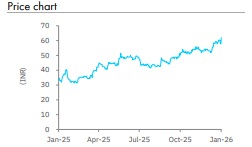

Buy Ujjivan Small Finance Bank Ltd for Target Rs.72 by Elara Capitals

Improving performance, durability key

Ujjivan Small Finance Bank ( UJJIVANS IN) posted a strong Q3FY26, driven by robust revenue momentum and controlled credit costs . Key highlights in Q3 were :

a) better NIM outcome (lower funding costs),

b) healthy loan growth which with better NIM resulted in improved NII growth (up 8.5% QoQ),

c) higher core other income (up ~24 % QoQ ) partially offset by elevated opex , which resulted in higher core PPoP and

d) better asset quality outcomes, aided by improvement in MFI collections.

We believe Q3 results reflect healthy business and operating performance , and sustained momentum will be key to further re -rating. We see some turnaround at play and anticipate better growth and improved performance . Hence , we raise our TP to INR 72 (from INR 60) , as we roll forward to December ’27 E and maintain BUY.

Healthy business momentum, with improved margins:

NIMs improved 30bps QoQ to 8.2%, given sharp reduction in funding cost, CRR cut benefits and steady yields on lower reversals. The bank has undertaken deposit rate actions, the full impact of which is yet to flow through , which may support margins in the near term . That said, we continue to monitor margin durability , as a higher mix of secured assets could impact NIMs over time. Loan growth outcomes were healthy, with unsecured segments beginning to see traction, which is already visible in QoQ growth . Going forward, management expects growth momentum to continue, with strategic focus on the secured portfolio and increasing its share to 50% by FY26 . Opex growth was faster (up ~9% QoQ), due to the new labor code and higher disbursement momentum . T his would remain elevated in the near term and we would continue to monit or the same. Overall, UJJIVANS reported RoA (annualized) of 1.5% in Q3FY26, and reiterated its FY26 RoA guidance of 1.2 -1.4%, led by further reduction in cost of funds .

Better asset quality outcomes:

Slippages were curtailed at INR 2.2bn, at ~2.6% ( versus 3.3% QoQ), led by lower slippage trends in the m icro -banking segment. Management remained confident of sustaining momentum, aided by better collection efficiency in the unsecured book . Credit cost for the quarter was 2.3%, including accelerated provisions of INR 90mn. Management guided that credit cost would remain within 2.3-2.4% for FY26 , with likely improvement in H2FY27. While Q3 marked a meaningful improvement, we remain watchful of evolving trends but expect gradual stabilization in asset quality.

Maintain BUY with a raised TP of INR 72:

Q3FY26 was better quarter with improvement in core performance. Considering better industry tailwinds and improving growth momentum and profitability trajectory , we raise our TP to INR 72 (from INR 60) as we roll forward to Dec ’27E . We believe sustained funding cost benefits , moderation in credit costs and improving return ratios could support a valuation re -rating in the medium term. Progress on the universal bank licence application remains a key monitorable, with any adverse outcome posing a downside risk.

Please refer disclaimer at Report

SEBI Registration number is INH000000933.