Accumulate Mangalore Refinery and Petrochmcls Ltd for the Target Rs. 159 By Prabhudas Liladhar Capital Ltd

Strong results on all parameters, beating estimates

Quick Pointers:

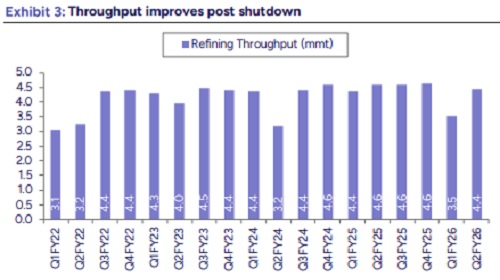

* Throughput improved to 4.43mmt, EBITDA/PAT of Rs14.9bn/6.4bn beat estimates.

Mangalore Refinery & Petrochemicals (MRPL) reported better-than-estimated results with an EBITDA of Rs14.9bn in Q2FY26 up from a loss of Rs.4.7bn in Q2FY25 and Rs.1.8bn in Q1FY26 (PLe:Rs14.5bn, cons est EBITDA: Rs13.6bn). PAT came in at Rs6.4bn, up from a loss of Rs.6.8bn/2.7bn in Q2FY25/Q1FY26 (PLe:Rs6.1bn, cons est:Rs5.4bn). The company has stopped reporting refining margins. MRPL expects GRM to be strong going forward, provided crude prices do not fluctuate. Throughput fell 3.3% YoY to 4.43mmt while it improved by 26.0% QoQ (Ple: 4.38mmt). We build in a GRM of USD7.6/7.5/bbl for Q3/Q4FY26 and 6.9/7.5/bbl for FY26/27E. The stock is currently trading at 16.8/12.8x FY26/27 EPS and 7.8/6.4x FY26/27E EV/EBITDA. We reiterate our rating of ‘ACCUMULATE’ on stock with a TP of Rs159 (5.5x FY27/28 EV/EBITDA) including the option value of Rs45 for its chemicals foray. The company is expected to operate at full capacity, with no major turnarounds expected in the near term leading to a continued strength in the coming quarters in GRM.

* Core GRM improves significantly: Company has stopped reporting GRM, although reported GRM was more than double that from Q1FY26. Core GRM stood at USD3.5/bbl in Q2FY25 and USD/5.9bbl in Q1FY26.

* Throughput improved QoQ: MRPL completed its major turnarounds in Q1FY26 and is currently operating at full capacity. Although throughput fell YoY from 4.58mmt to 4.43mmt this quarter, it improved QoQ from 3.52mmt in Q1FY26. Implied opex stood at USD2.6/bbl vs USD2.6/3.6/bbl in Q2FY25/Q1FY26.

Conference Call Highlights:

* No major planned turnarounds are expected for rest of FY26 and FY27. GRM was double QoQ as per MRPLand is expected to be strong going forward.

* MRPL reported fuel & loss of 10.4%, slightly higher due to initial pickups after the turnarounds. Expected to be in the range of 10% for FY26.

* Domestic diesel/gasoline/ATF demand grew 3%/7%/1% YoY, continues to be resilient going forward.

* On sourcing crude from Russia - No slowdown expected and continues to be business as usual. 35-40% crude, is being sourced from Russia, with discount range of USD0.5-4/bbl.

* As per govt mandate of 1% SAF, MRPL has already started the SAF project in Mangalore, with expected production capacity of 20KLPD, to be ready by Q4FY27 (Jan’27).

* MRPL has ~185 retail outlets operational currently and aims to open 100-130 outlets, ending the year with more than 250 outlets. Outlets have a gestation period of 75-90 days.

* Capex expected to be Rs.10bn-15bn in FY26.

* Light/Middle Distillate yields stood at 30%/52.6% in Q2FY26 vs 31.4%/49.6% in Q1FY26.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271