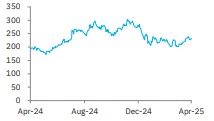

Accumulate Eternal Ltd For Target Rs. 300 By Elara Capital

Turf defended

Eternal’s (ETERNAL IN) Q4 show was in-line on the growth front, as Zomato delivered steady ~16% YoY GOV growth in food delivery led by continued sluggish demand and a 7.5% QoQ dip in delivery partner supply. Guidance of 5% adjusted EBITDA (percentage of GOV) now remains a low-hanging fruit (4.4% in Q4). Despite competition, Blinkit protected its contribution margin (up 11bps QoQ to 3.1%). High fixed cost-led adjusted EBITDA losses (percentage of GOV) slipped to 1.9%. User growth was healthy led by 294 dark stores in Q4, and due to seasonality, the average order value declined 5.9% QoQ. With elevated competition, we model in a mild elevation in Blinkit’s FY26E losses, though long-term prospects remain strong given its competitive edge versus peers. So, we cut our FY26E/27E overall EBITDA estimates. As we introduce FY28E and roll over to June 2027E (from March 2027E), we maintain BUY with an unchanged SoTP-TP of INR 300.

Zomato – Stable growth; profitability maintained: Sluggish demand environment and summer season led to a supply crunch in delivery partners (down 7.5% QoQ), which capped GOV growth (up ~16% YoY; in-line). In Q4, Zomato delisted ~19,000 food chains from its platform owing to non-compliance with standards, adjusted for which, GOV growth would have been at ~18%. On network, users rose 2.0% QoQ and restaurant additions were at 2.6% QoQ. ETERNAL maintained its 20% GOV growth guidance in the near term – Expect a 19% CAGR in FY25-28E. Zomato continues to march towards 5% adjusted EBITDA (percentage of GOV), as contribution and adjusted EBITDA margin rose 11bps QoQ each to 8.6% and 4.4% respectively. Quick food delivery closed given the absence of profitability without compromising on experience. Zomato aims to shorten existing delivery time to <30 minutes.

Blinkit – Good show on margin despite expansion: Despite a seasonality-led slip in AOV (down 5.9% QoQ), GOV grew 133.9%, led by healthy dark store additions (+294 in Q4), on user growth (up 114.1% YoY) with order frequency largely maintained. We expect a GOV CAGR of 65% in FY25-28E. In an elevated competitive landscape, Blinkit’s grip over contribution margin (percentage of GOV) was commendable, up +11bps QoQ to 3.1%. However, higher customer acquisition cost was reflected in fixed cost (5% of GOV, up 70bps QoQ), which pushed adjusted EBITDA loss (percentage of GOV) to 1.9%. Quick commerce, being a convenience-led model, has profitability levers in scale (in ad revenue), right assortment, and better consumer experience. Due to traction in GMA, shifting to an inventory-led model should aid margins, but ETERNAL continues to better evaluate the trade-off.

Maintain BUY, TP unchanged at INR 300: Slower GOV growth for Zomato and losses at Blinkit dragged Q4 earnings. Expect Blinkit to maintain industry-leading show on user growth and GOV. But higher fixed costs may continue to drag adjusted EBITDA. Thus, we model in a mild rise in losses (FY26E), resulting in 25%/15% cut in FY26E/27E EBITDA estimates. We expect a long haul for new quick-commerce entrants. Expect ETERNAL to maintain its market leadership in both the segments. We maintain BUY with TP unchanged at INR 300, as we introduce FY28E and roll over to June 2027E from March 2027E, valuing Zomato at 55x EV/EBITDA, Blinkit at 4x EV/sales and Hyperpure/Going Out at 3x/3x EV/sales, respectively

Please refer disclaimer at Report

SEBI Registration number is INH000000933