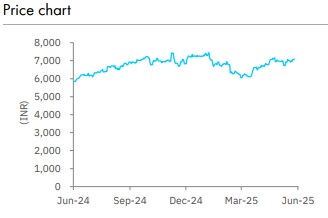

Accumulate Apollo Hospitals Enterprise Ltd for Target Rs. 7,479 by Elara Capitals

Q4 weak; FY26 guidance in line

Apollo Hospitals Enterprise’s (APHS IN) Q4FY25 revenue was in line, but EBITDA came in 8% below our expectations due to lower margin. PAT was 2% above our estimate, helped by higher other income and lower tax rate. The margin was sub-par, mainly due to 80bps QoQ decline in EBITDA margin (adjusted for 24/7 expense) for the Pharmacy business (Health Co). Lower growth in the higher-margin Hospitals (HSG) business also contributed to the margin miss. Health & Lifestyle (AHLL) businesses came in broadly in line with our expectations. We continue to expect steady performance, as >1,000 new beds will get added in FY26. FY26 guidance for the three businesses was broadly in line with our expectations. We lower our FY26E core EPS estimate by 5% as we build in higher impact from new beds, but raise our FY27E core EPS by 3%. We retain Accumulate rating and raise TP to INR 7,479 from INR 6,979

Hospitals segment – Mixed performance: Revenue for the Hospitals segment grew 10% YoY, marginally below our estimate. Growth was below par in Tamil Nadu, and East and North India, but remained strong in Karnataka, West India and Andhra Pradesh/Telangana. Going ahead, we expect volume growth to moderate and growth to be more balanced between volume and ARPOB. We project ~10% revenue growth from existing beds. New bed additions could add up to 200bps to growth in FY26E, but could hit margins.

Health Co – Margin down QoQ: EBITDA margin for the Pharmacy business (excluding ‘Apollo 24/7 expense) was down 110bps YoY and 80bps QoQ – we were expecting an improvement. Including ‘Apollo 24/7’ expense, EBITDA margin was down 90bps from Q3 level. We continue to project steady margin improvement in this business. Together with lower expenses for Apollo 24/7, this should help improve the overall margin of Health Co. The impending closure of the deal with Advent PE and Keimed will be key monitorable in this business.

AHLL – Increased focus on profitability: AHLL delivered a good Q4, with 11% topline growth and 190bps YoY expansion in EBITDA margin. APHS has been focusing on the profitability of the business for the past few quarters – the total number of centers has declined in FY25 as loss-making centers were closed down. Now with improving profitability, the company has started adding more centers.

Retain Accumulate; TP raised to INR 7,479: We lower our FY26E core EPS estimates by 5% as we build in higher impact from new beds, but raise our FY27E core EPS estimates by 3%. Despite ongoing expansion, the management is confident of maintaining an EBITDA margin of ~24% in FY26 for the hospital business. APHS trades at 59.7x FY26E core P/E and 31.9x FY26E EV/EBITDA. We raise our TP from INR 6,979 to INR 7,479, which is 56x FY27E core EPS plus cash per share (27.3x FY27E EV/EBITDA). We retain Accumulate. Increased competition in the Hospitals business and slower ramp-up in profitability of the Pharmacy business (Health Co) are key risks.

Please refer disclaimer at Report

SEBI Registration number is INH000000933