-

Aatmnirbhar Bharat

Union Budget 2026: Atmanirbhar Bharat Gains New Momentum — Key Turning Points Unveiled

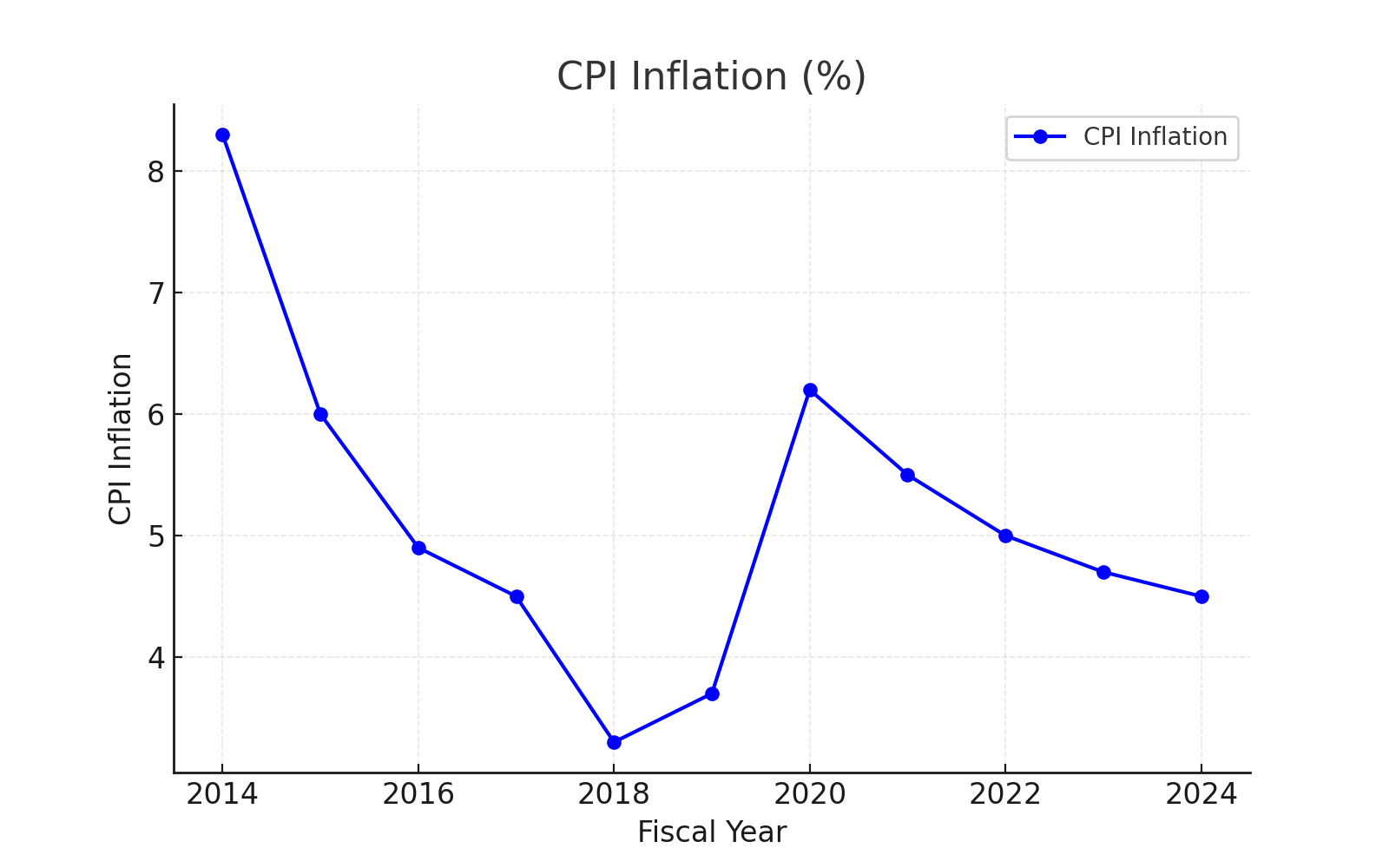

India’s Union Budget 2026–27, presented by Finance Minister Nirmala Sitharaman on 1 February 2026, marks a strategic inflection point for the government’s Atmanirbhar Bharat (self-reliant India) agenda. As the economy navigates global uncertainty, inflationary pressures and competitive geopolitical shifts, policymakers have focused on deepening self-reliance across critical sectors — from manufacturing and technology to energy and exports — signalling a broader shift from piecemeal incentives to systemic transformation...

-

Startup

Union Budget 2026: Startups at a Critical Juncture — Key Turning Points for Growth and Innovation

The Indian startup ecosystem has evolved significantly over the past decade, becoming one of the most vibrant and fast-growing entrepreneurial hubs globally. As we approach the pre-budget discussions for 2025, the focus is once again on how the government can continue to nurture and bolster this dynamic sector, which plays a pivotal role in driving innovation, job creation, and economic growth...

-

Taxation

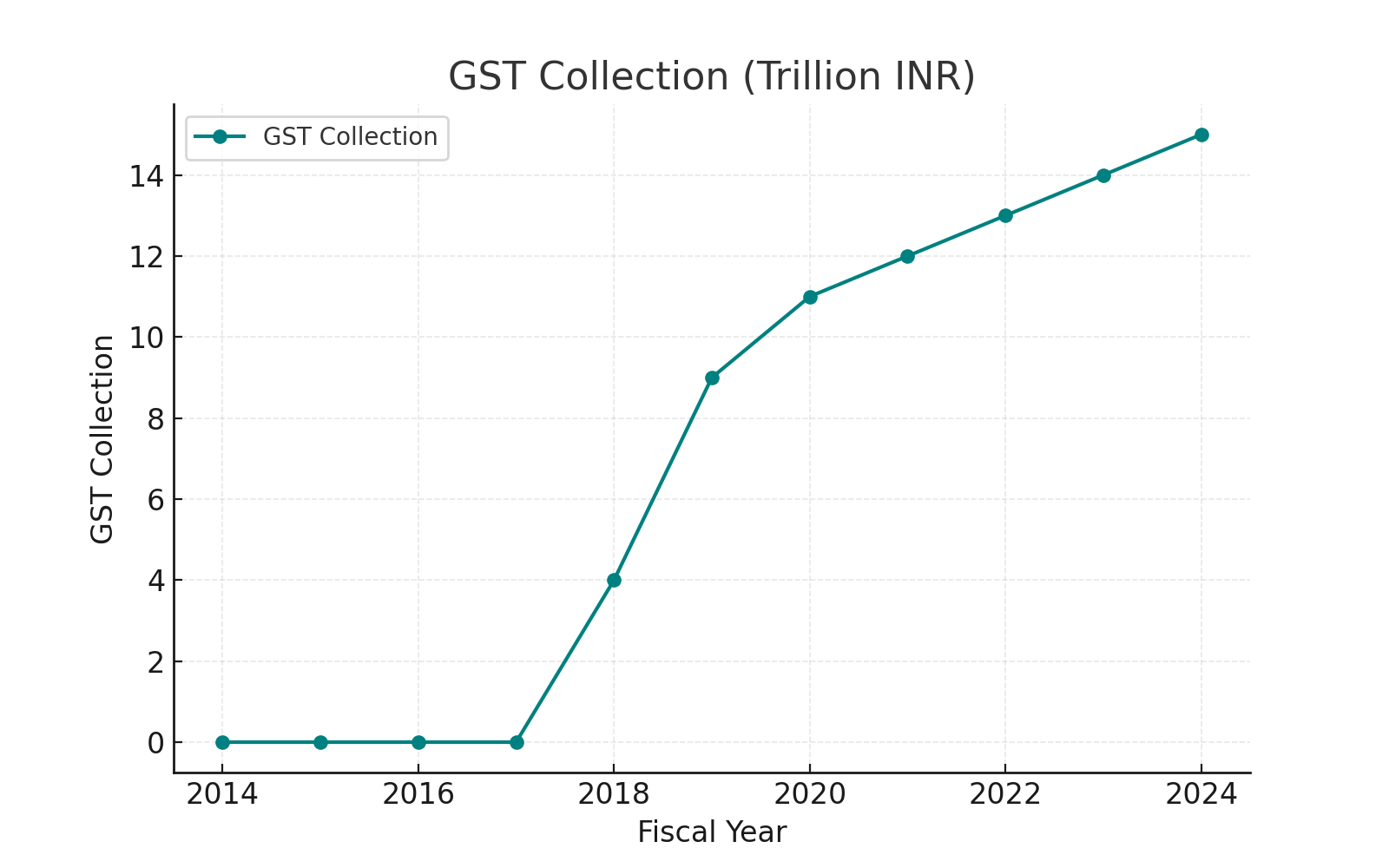

Union Budget 2026: Taxation Reforms Signal Strategic Turning Points for Growth and Fairness

India’s Union Budget 2026–27, presented by Finance Minister Nirmala Sitharaman on 1 February 2026, is shaping up to be a milestone for the country’s tax regime, with several reforms expected to introduce structural clarity, boost taxpayer relief and enhance economic competitiveness. The changes, both in direct and indirect taxes, are being widely discussed as key turning points in how the nation approaches taxation in an increasingly complex global and domestic environment...

-

Agriculture

Union Budget 2026: Agriculture Sector at Crossroads — Key Turning Points Unveiled

India’s Union Budget 2026–27, presented by Finance Minister Nirmala Sitharaman on 1 February 2026, is emerging as a critical inflection point for the agriculture sector. At a time when farmers’ incomes, climate risks and global market pressures are central concerns, policymakers appear poised to frame the Budget as a strategic pivot from welfare support to growth-led, resilient agriculture. Analysts say these changes could reshape how farming contributes to India’s economic and food security objectives...

-

Infrastructure

Union Budget 2026: Infrastructure Gets Strategic Reboot, Paving Way for Growth and Competitiveness

India’s Union Budget 2026–27, presented by Finance Minister Nirmala Sitharaman on February 1, 2026, underscores infrastructure as a pivotal engine of national growth. Analysts describe the budget’s approach as an inflection point—not merely increasing outlays but reshaping how infrastructure is planned, financed and delivered to better support economic expansion, sustainability and private capital mobilisation....

-

Manufacturing

Union Budget 2026: A Strategic Inflection Point for India’s Manufacturing Sector

The Union Budget 2026–27, presented by Finance Minister Nirmala Sitharaman on February 1, 2026, marks a significant turning point for India’s manufacturing landscape. With policymakers placing a renewed emphasis on competitiveness, technology adoption and global integration, the Budget signals a shift from incremental support to deep structural reforms that could redefine India as a global manufacturing hub....

-

Social Welfare

Union Budget 2026 Signals Major Shift in Social Welfare Strategy

The Union Budget 2026–27, presented by Finance Minister Nirmala Sitharaman on 1 February 2026, signals a strategic inflection point in India’s social welfare agenda. Beyond routine allocations, the Budget emphasises long-term empowerment, inclusive development and targeted support for vulnerable communities — marking a shift from traditional welfare outlays toward outcome-oriented social policy....

-

Defence

Union Budget 2026: Defence Sector at a Strategic Crossroads

With the presentation of the Union Budget 2026–27 by Finance Minister Nirmala Sitharaman on 1 February 2026, India’s defence sector finds itself at a pivotal moment. Analysts, defence experts and industry stakeholders say the upcoming budgetary decisions are likely to shape the trajectory of India’s military strength, technological capabilities and defence industrial ecosystem for years to come — especially in the face of evolving geopolitical challenges and shifting security priorities...

- Budget 2026

- News

- Hindi

-

Screeners

- Stock

- IPO

- Commodity

- Currency

- Mutual Fund

- Crypto

- Widgets

- Wealth

- World

- Tips

- Podcast

- Videos

- calculators

- More

- research center

.jpg)

Agriculture

Agriculture Aviation

Aviation Defence

Defence Education

Education Energy

Energy Insurance

Insurance IT

IT Healthcare

Healthcare Banking

Banking Income Tax

Income Tax Manufacturing

Manufacturing Infrastructure

Infrastructure MSME

MSME Tourism

Tourism Shipping

Shipping