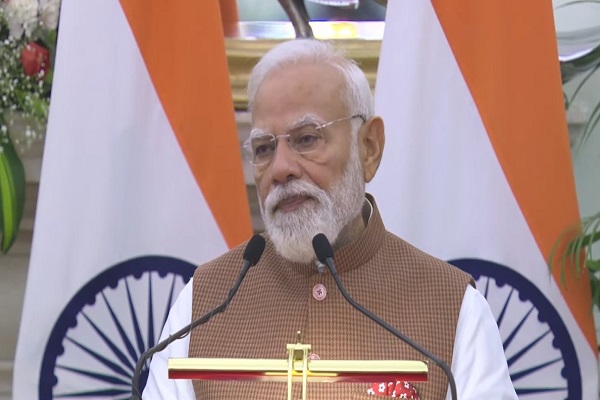

Navigating the Pre-Budget 2025 Landscape: Key Expectations for India`s Startup Ecosystem

The Indian startup ecosystem has evolved significantly over the past decade, becoming one of the most vibrant and fast-growing entrepreneurial hubs globally. As we approach the pre-budget discussions for 2025, the focus is once again on how the government can continue to nurture and bolster this dynamic sector, which plays a pivotal role in driving innovation, job creation, and economic growth.

The Current Landscape of Indian Startups

India's startup scene has witnessed unprecedented growth, with thousands of new ventures sprouting up across sectors such as technology, fintech, e-commerce, healthtech, and edtech. In recent years, the country has produced numerous unicorns, and the government has shown strong support through various initiatives aimed at promoting entrepreneurship and innovation.

The Startup India initiative, launched in 2016, has been one of the major drivers of this growth. It provides a range of benefits, including tax exemptions, easier compliance, and access to government-backed funding, among others. The result has been a surge in entrepreneurial activity, with more people choosing to start their own ventures rather than opt for traditional job paths.

Despite the success, challenges remain. Regulatory hurdles, funding difficulties, and the ever-changing market dynamics are some of the factors that hinder the full potential of the sector. As the startup ecosystem matures, there is a growing need for more comprehensive policies that address these issues and create an environment conducive to sustainable growth.

Key Expectations from the Pre-Budget 2025 for Startups

As we prepare for Budget 2025, Indian startups are looking forward to several key reforms that could enhance their ability to scale, innovate, and create jobs. Here are some of the major expectations:

Simplification of Taxation

One of the top priorities for Indian startups is a simplified and more predictable taxation system. The current tax regime, while offering some relief through initiatives like the 3-year tax holiday for new startups, still poses challenges in terms of compliance and documentation. Entrepreneurs are hopeful that Budget 2025 will introduce more streamlined procedures and tax incentives for early-stage startups, allowing them to focus on innovation rather than navigating complex tax structures.

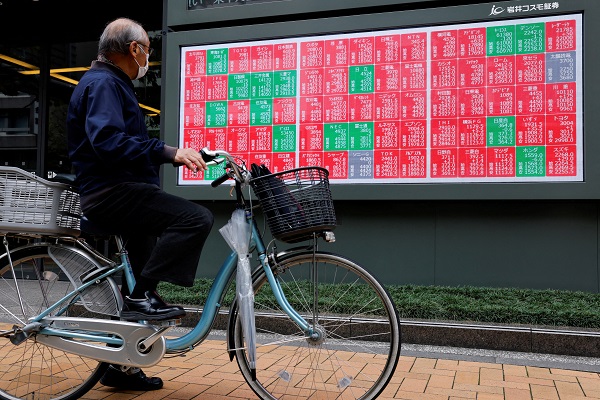

Increased Access to Funding

Funding is often cited as one of the biggest challenges for startups in India. While venture capital and private equity investments are growing, many startups still face difficulties in accessing funds, especially in the early stages. The budget could look at expanding avenues for alternative financing, including increasing government-backed funding schemes and improving the availability of angel investments. Startups are also expecting more encouragement for corporate venture capital, which has been instrumental in the growth of numerous successful startups globally.

Regulatory Reform for Ease of Doing Business

While India has made strides in improving its ease of doing business ranking, there is still room for improvement, particularly when it comes to compliance with labor laws, intellectual property rights, and registration processes. Entrepreneurs are calling for more regulatory reform that would reduce the administrative burden on startups, particularly in their formative years. This includes easing regulations around hiring, employee benefits, and intellectual property protection to encourage innovation.

Focus on Skill Development and Talent Pool

Startups often struggle to find the right talent, particularly in technical fields like AI, machine learning, and data science. Budget 2025 could focus on enhancing skill development programs that align with the needs of emerging industries. Additionally, measures that encourage universities and educational institutions to partner with startups to create a talent pipeline could also be beneficial.

Incentives for Green and Sustainable Startups

With a global focus on sustainability, Indian startups are also looking to align themselves with green technologies and sustainable business practices. There is hope that the budget will introduce tax incentives and funding schemes for startups that are committed to environmentally sustainable business practices, including those in the renewable energy, electric mobility, and waste management sectors.

Global Expansion Support

As Indian startups continue to gain global recognition, many are looking to expand their operations internationally. The budget could introduce measures that help ease the process of internationalization, such as tax benefits for startups that invest in foreign markets, support for cross-border mergers and acquisitions, and policies that facilitate global market entry.

Conclusion

India's startup ecosystem has a bright future, but it needs continued support and strategic policy reforms to reach its full potential. The pre-budget discussions for 2025 are a crucial moment for shaping the direction of this vibrant sector. If the right measures are introduced—particularly around taxation, funding, talent development, and regulatory reform—the Indian startup ecosystem can continue its trajectory as a key engine of economic growth and innovation in the years to come.