Union Budget 2025 -ANALYSIS by Geojit Financial Services Limited

Agenda is to Raise the Disposable Income

The precursor expectations on the 2025 budget were muted. It was stemmed from the fact of moderation in government spending in 2024, a rise in geopolitical risk with high volatility in INR, the need to attain a prudent fiscal policy, and a slowing global economy. The domestic and international economy & financial environment demanded a balanced budget.

The budget has successfully delivered a well-balanced approach, combining growth with fiscal prudence. It exceeds expectations by offering substantial direct and indirect tax benefits to the middle class and the manufacturing sector, aiming to boost disposable income and drive consumption. A taxpayer with an annual income of Rs 12 lakh is expected to benefit by Rs 83,200 per year, supporting increased consumer spending. The budget also drives growth across key sectors, boosting the rural economy through increased government spending and expanded Kisan Credit for agriculture.

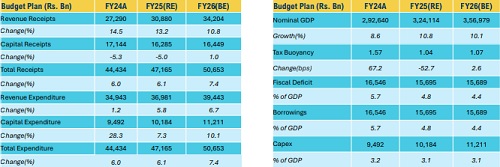

Additionally, it strengthens MSMEs - the economy’s second growth engine - by doubling loan guarantees and streamlining business operations. The overarching theme is to promote domestic manufacturing by reducing basic customs duties on inputs and advancing deregulation. The market has taken the government drive with a mixed view because of a modest capex of 10% YoY in FY26, much below the 17% forecast for FY25. The expenditure plan for key areas like railway, defence, and infrastructure is muted to manage the reduction in total income led by direct and indirect tax benefits offered. However, the overall benefit to the economy and corporates is likely to be led by a rise in economic growth. India's nominal GDP is projected to grow by 10% in FY26

Key Focus Areas

Multiply Disposable Income to Boost Consumption

Engine 1 – Agriculture: Improve Rural Economy

Engine 2 – MSME: To Enhance India’s Manufacturing Back-End

Engine 3 – Investment: To Develop a Skilled Economy (Education, Healthcare, AI)

Engine 4 – Exports : Cut Custom Duty to Prosper Manufacturing in India

De-Regulation: Tax Reforms & Ease of Business

Fiscal Prudence and Moderation in Public Borrowings

FY26 fiscal management is stable despite a more than average cut in tax revenue, managed by a moderate increase in capex and a more than average cut in non-capex expenditure. The low growth in total income did not affect fiscal discipline, as deficit was reduced to more than expected at 4.4% for FY26, down from 4.8% in FY25RE.

Above views are of the author and not of the website kindly read disclaimer