Union Budget 2025-2026 - Religare Broking Ltd

A Growth-Oriented Blueprint with Fiscal Discipline

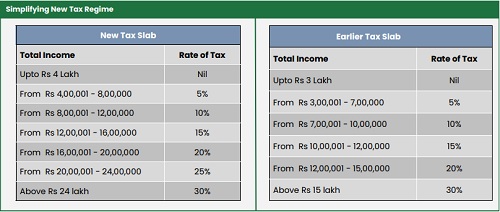

The Union Budget 2025-26 presents a strategic roadmap for India's economic growth, focusing on fiscal prudence, infrastructure development, and middle-class empowerment. With a total estimated expenditure of ?50.65 lakh crore, the budget aims to balance economic expansion and financial discipline while ensuring inclusive progress. One of the most significant announcements is the revision of income tax slabs, with the tax-free income limit raised to Rs.12 lakh and the highest tax rate of 30% now applicable to incomes above Rs.24 lakh. These changes are expected to enhance disposable income, thereby stimulating consumer spending, particularly in sectors like FMCG, automotive, and real estate.

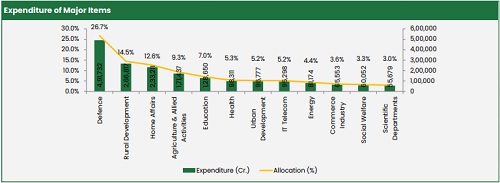

A key highlight of the budget is its continued emphasis on capital expenditure, with an allocation of Rs.11.21 lakh crore, up from the revised Rs.10.18 lakh crore last year. The effective capital expenditure, which includes grants for asset creation, stands at Rs.15.48 lakh crore. This increased investment is expected to drive growth in infrastructure-related industries such as cement, steel, and construction, while also generating employment. The government has also taken a prudent approach to fiscal management, targeting a fiscal deficit of 4.4% of GDP, down from 4.8% in the previous year, and reducing the primary deficit to 0.8% of GDP. These measures indicate a concerted effort to maintain economic stability while fueling growth.

Manufacturing and the 'Make in India' initiative have also received a boost, with policy measures aimed at strengthening India's role in global supply chains. Tariff rationalization and regulatory reforms are expected to improve the ease of doing business, while increased capital allocations for defense, electronics, and pharmaceuticals will further support domestic production. Rural development and welfare schemes continue to be a major focus, with total resource transfers to states and union territories reaching Rs.25.01 lakh crore. Flagship programs such as PM-KISAN, MGNREGA, and the Jal Jeevan Mission have received strong financial backing to drive socio-economic progress.

Stock Market Perspective

From a stock market standpoint, the 2025-26 Union Budget is largely pro-growth, with tax relief measures expected to benefit consumption-driven sectors. The rationalization of personal income tax is likely to boost discretionary spending, which bodes well for FMCG, white goods, and automotive stocks. Consumer finance companies may also witness increased demand as higher disposable incomes encourage retail borrowing. Infrastructure and construction-related industries, including cement, capital goods, and real estate, stand to gain significantly from the government's continued focus on capital expenditure.

Moving forward, the budget's impact on stock performance will depend on implementation efficiency and broader economic factors, including global market trends and corporate earnings.

Overall, the 2025-26 Budget lays a solid foundation for sustainable economic growth while maintaining fiscal discipline. With an emphasis on boosting consumption, strengthening infrastructure, and supporting manufacturing, it sets a forward-looking tone for India's long-term development. Market participants should align their investment strategies accordingly, focusing on sectors poised to benefit the most from the government's policy direction.

1. Agriculture

* Dhan Dhanya Krishi Yojana: The government introduced this scheme to develop agricultural districts in collaboration with state governments, benefiting 1.7 crore farmers across 100 districts with low productivity. The initiative focuses on enhancing agricultural productivity through crop diversification and improved irrigation facilities.

* Increased Budget Allocation: The Ministry of Agriculture and Farmers Welfare received a substantial allocation of Rs.1.52 lakh crore, aimed at transforming the agricultural landscape and supporting various initiatives to boost farmer incomes and productivity.

* Kisan Credit Card Enhancement: The loan limit for Kisan Credit Cards has been raised to Rs.5 lakh, providing farmers with greater access to credit and financial support for their agricultural activities.

* Focus on Pulses Self-Reliance: A mission was outlined to achieve self-reliance in pulse production over the next six years, emphasizing the cultivation of tur, urad, and masur, along with initiatives to improve post-harvest storage and marketing support for farmers.

2. MSME’s

* Increased Credit Guarantee Cover: The credit guarantee cover for micro enterprises has been raised from Rs.5 crore to Rs.10 crore, facilitating an additional Rs.1.5 lakh crore in credit over the next five years, enhancing access to finance for small businesses.

* Enhanced Investment and Turnover Limits: The government has increased the investment limit for MSME classification by 2.5 times and the turnover limit by 2 times, allowing more enterprises to qualify as MSMEs and improving their access to capital and technology.

* Customized Credit Cards: A new initiative introduces customized credit cards with a limit of Rs.5 lakh specifically for micro enterprises registered on the Udyam portal, aimed at addressing their unique financial needs.

* Support for Exporting MSMEs: An export promotion mission will be launched to assist MSMEs in overcoming non-tariff barriers in exports, further strengthening their contribution to India's export economy.

3. Infrastructure

* Capex Outlay: The capital expenditure outlay for FY26 has been increased to Rs.11.21 lakh crore, while the target for FY25 is set at Rs.10.18 lakh crore. This underscores the government's commitment to infrastructure-driven growth, building on the previous year's allocation of Rs.11.11 lakh crore.

* Supporting States for Infrastructure Projects: An allocation of Rs.1.5 lakh crore in interest-free loans will be provided to states for infrastructure projects, aimed at enhancing local development and improving public services.

* Urban Challenge Fund to Transform Cities: A total of Rs.1 lakh crore is designated for the Urban Challenge Fund to transform cities, complemented by an increased outlay for the Jal Jeevan Mission to achieve 100% potable water supply coverage. Furthermore, a new asset monetization plan worth Rs.10 lakh crore is introduced to finance infrastructure projects and foster sustainable economic development.

This infrastructure investment will benefit sectors like Cement, Infrastructure developers, and Capital Goods. Stocks such as Ultratech Cement, Dalmia Bharat, and NCC will gain from this spending.

4. Investment in Human Capital

* Nutritional Support Initiatives: The Saksham Anganwadi and Poshan 2.0 program will enhance nutritional support for over 8 crore children, pregnant women, and lactating mothers, aiming to improve health outcomes across the country.

* Atal Tinkering Labs: The establishment of 50,000 Atal Tinkering Labs in government schools over the next five years is designed to foster creativity and innovation among students, encouraging a scientific mindset.

* National Centres of Excellence for Skilling: Five National Centres of Excellence will be set up to provide global expertise and training, equipping youth with essential skills for the "Make for India, Make for the World" initiative.

* Expansion of IIT Capacity: The budget allocates resources to expand infrastructure in IITs, increasing student capacity by 6,500 to support higher education and research in technology and innovation.

5. Promoting Export

* Export Promotion Mission: An Export Promotion Mission will be established with specific sectoral and ministerial targets to facilitate easier access to export credit, cross-border factoring support, and assistance for MSMEs in addressing non-tariff barriers in international markets.

* BharatTradeNet Initiative: The government will launch BharatTradeNet (BTN), a digital public infrastructure designed as a unified platform for trade documentation and financing solutions, aligning with global best practices to streamline international trade processes.

* National Framework for Global Capability Centres: A national framework will be developed to guide states in promoting Global Capability Centres (GCCs) in emerging Tier-II cities, focusing on enhancing talent availability and infrastructure.

* Air Cargo Infrastructure Enhancement: Plans are in place to upgrade infrastructure and warehousing facilities for air cargo, particularly for high-value perishable horticultural products, ensuring efficient logistics and improved export capabilities.

6. Reforms

* Financial Sector Reform: The budget introduces a new Investment Friendliness Index for states to foster competitive federalism and enhance the investment climate, alongside a Financial Sector Development Council (FSDC) mechanism to evaluate and improve financial regulations.

* Simplification of Tax Compliance: The government aims to ease the compliance burden by rationalizing TDS and TCS regulations, increasing thresholds for various deductions, and extending the registration period for small charitable trusts from 5 to 10 years.

* Other Key reforms: The government has raised the Foreign Direct Investment (FDI) limit in the insurance sector from 74% to 100%, allowing full foreign investment provided that all collected premiums are invested in India, aiming to attract significant capital and enhance competition. Additionally, the establishment of NABFID will facilitate the resolution of stressed banking assets, while KYC norms will be simplified to improve access to financial services, and a commitment to develop the digital payment ecosystem will further promote cashless transactions and financial inclusion.

The rationalization of personal income tax is expected to benefit consumer-oriented sectors such as FMCG, automotive, and white goods, while also indirectly aiding consumer finance companies. Stocks like ITC, Bajaj Finance, Hindustan Unilever, and Maruti Suzuki are likely to be key beneficiaries of the new tax adjustments.

7. Economy

* The total receipts, excluding borrowings, are projected at Rs.34.96 lakh crore, while the total expenditure is estimated at ?50.65 lakh crore.

* Net tax receipts are anticipated to reach Rs.28.37 lakh crore.

* The fiscal deficit for FY26 is targeted at 4.4% of GDP, reduced from 4.8% in FY25.

8. Tinkering in Direct Tax

* The increase in the tax exemption limit to Rs.12 lakh enhances disposable income, fostering higher household consumption, increased savings, and improved financial planning.

* Additionally, the Section 87A rebate has been raised from Rs.25,000 to Rs.60,000

* Taxpayers to be allowed to claim tax benefits for two self-occupied houses, a major change from the previous rule that allowed relief for only one property.

* Extension of time-limit to file updated returns, from the current limit of two years, to four years.

* Specific benefits to ship-leasing units, insurance offices and treasury centres of global companies which are set up in IFSC.

* Rationalization of TDS/TCS for easing difficulties:

* Tax deduction limit on interest income for senior citizens doubled from Rs. 50,000 to Rs. 1 lakh.

* The annual limit of Rs.2.40 lakh for TDS on rent increased to Rs. 6 lakh.

Please refer disclaimer at https://www.religareonline.com/disclaimer

SEBI Registration number is INZ000174330