Union Budget 2025-26: Focus shifts from capex to consumption and savings by Motilal Oswal Financial Services Ltd

Focus shifts from capex to consumption and savings

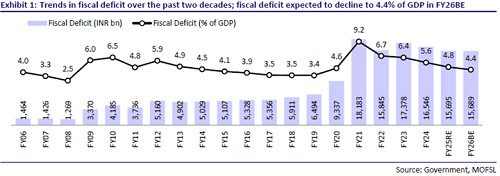

The new government after the 2024 general elections presented its first full Union Budget on 1st Feb’25. The anticipation was high for some consumption-boosting initiatives, tax cuts for the middle-income class, and continued focus on the capex, with some relaxed fiscal deficit targets. The Budget, for the first time in many years, chose to stimulate consumption and savings instead of focusing on capex. It, however, stayed focused on the fiscal deficit consolidation.

Comparison of FY25RE vs. FY25BE

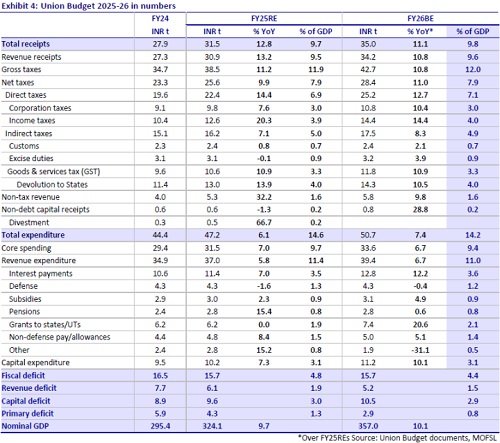

Total receipts have been revised down by INR0.6t and total expenditure has been cut by INR1.04t, leading to a reduction in the fiscal deficit by INR0.44t. Accordingly, the Government of India (GoI) has lowered its fiscal deficit target to 4.8% of GDP in FY25RE, from the budget estimate (BE) 4.98% of GDP.

Within receipts, corporate income taxes, union excise duties, non-tax revenue receipts and non-debt capital receipts have been revised down, while personal income taxes are revised higher. Further, while gross taxes are revised up by INR130b, higher devolution to states (by INR400b) has reduced net tax receipts of the central government. Total receipts are expected to grow 12.8% YoY in FY25RE.

Within spending, revenue spending has been kept largely unchanged, so almost the entire reduction in expenditure is led by a cut in capital spending, which is lowered to INR10.2t from INR 11.1t. Total spending is expected to grow 6.1%, with revenue spending growth of 5.8% and capital spending growth of 7.3%. Within capex, roads and railways are kept unchanged, while defense capex is reduced by INR125b, the equity infusion into BSNL is cut by INR100b, and capex under New Scheme is lowered to INR91b from INR626b budgeted earlier.

Total liabilities of the GoI are likely to ease to 57.1% of GDP in FY25RE from 58.3% of GDP in FY24.

Key highlights from FY26BE fiscal math

The GoI has budgeted a fiscal deficit of 4.4% of GDP for next year, better than the broad expectation of 4.5%. This is budgeted with receipt growth of 11.1% (with nominal GDP growth of 10.1%) and spending growth of 7.4%.

For the first time in many years, the Center’s receipt forecasts look aggressive. There are two reasons: 1) with higher tax rebates, budgeted growth of 14.4% YoY in personal income taxes looks optimistic, and 2) a growth of 12.3% in dividends may be a challenge even if the RBI transfers dividends worth INR2t. Overall, we believe there could be a shortfall of INR600-800b in total receipts.

At the same time, the GoI has budgeted 6.7% YoY growth in revenue spending and 10.1% growth in capital spending. Total spending is budgeted to fall to 14.2% of GDP next year vs. 14.6% in FY25RE and 15% in FY24. If, however, there is a shortfall in total receipts, there could be a corresponding fall in total expenditure (with lower capex) next year, as the deficit target could be sacrosanct.

IEBR capex expected to grow 12.9% YoY in FY26BE

Notably, as highlighted in our recent report, a large portion of the GoI’s higher capex is re-allocated from the internal and extra-budgetary resources (IEBR) of central public sector enterprises (CPSEs). After declining at an average of 10% between FY21 and FY23, IEBR capex grew 2.9% YoY in FY24, and is expected to grow 4.4%/12.9% YoY in FY25RE/FY26BE. If so, the combined capex of the Center (excluding loans & advances and equity infusion into BSNL) and CPSEs (excluding FCI) is budgeted to grow 13.4% YoY in FY26, following 4.7% growth in FY25RE. It also implies that the combined capex is budgeted at 3.7% of GDP in FY26BE, slightly better than 3.6% of GDP in FY25RE and lower than 3.8% of GDP in FY24.

Conclusion: Consumption/savings take center stage at the cost of fiscal spending

Overall, there were two big changes in the Union Budget 2025-26. For the first time in almost a decade, the GoI focused more on consumption and savings, rather than capex. We need to keep a keen eye on whether this change is a one-off or if it suggests a change in the paradigm. Secondly, after many years, the receipt projections look aggressive.

Although there has been a large downward revision in the Center’s capex in FY25, the adverse economic impact will be limited because a majority of the revision is due to lower spending under the ‘New Scheme’, which was never defined. This year also, the GoI has allocated INR417b for ‘New Schemes’ under the Department of Economic Affairs.

The GoI has also announced a shift to target the debt-to-GDP ratio from next year, rather than the fiscal deficit. Assuming 10.5% growth over the next five years (FY27-FY31), the fiscal deficit will have to consolidate by 0.2ppp of GDP every year to achieve a debt-to-GDP ratio of 49.7%. It means that if nominal GDP growth is weaker, more consolidation will be required to meet debt targets.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412