Sugar Sector Update : Signs of improvement by Elara Capiatal

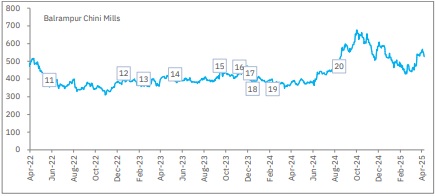

Domestic volume of the sugar industry has been flat YoY in Q4FY25 to INR 6.8mn tonne, driven by demand normalization. In the base quarter, high demand prevailed because of the General Elections. The government also has allowed export of 1.0mn tonne of sugar, which should drive growth for the industry in H1CY25. Post the announcement of sugar exports, the industry witnessed ~10% increase in ex-mill price and the current price stands at INR 40-41 ex-mill in North India. Prices are likely to stay firm as production is down 18% to ~25.0mn tonne (post diversion) until 31 March 2025 (Source: National Federation of Cooperative Sugar Factories). While Balrampur Chini Mills (BRCM IN) quota volume is up 12.7% YoY to 0.18 mn tonne, in Q4FY24 sales was more than quota volume at 0.22mn tonne. Hence, we expect a 20% decline in BRCM sugar volume in Q4FY25E

Sugar production expected to be down 19% this season: The National Federation of Cooperative Sugar Factories (NFCSF) expects pan-India sugar production to reduce 19% to 25.9mn tonne (post diversion), led by a 25% decline in sugar production from Maharashtra and a 10% drop from Uttar Pradesh (UP). Cane crushing is down 19% in Maharashtra, 9% in Karnataka and 2% in UP, leading to an 11% decline in pan-India cane crushing volume to 265.3mn tonne until 31 March 2025. Karnataka has witnessed the sharpest contraction in sugar recovery at 125bps at 8.5%, followed by 85bp in UP at 9.7%, and 75bp in Maharashtra at 9.5%, leading to a 78bp contraction in pan-India recovery at 9.4%. Cane crushing is largely complete in Maharashtra and Karnataka.

Ethanol blending at ~20% for January and February: Ethanol blending volume grew 66% YoY to 1.6bn liters for January & February cumulatively, and the current blending rate is in the range of 19.5-20.0%. A large part of incremental growth in ethanol volume has come in from grain-based ethanol

Volume growth and better realization to drive profitability: We expect profitability to improve for the industry, driven by improvement in sugar realization, resumption of volume growth for the sugar business, and operating leverage benefits for the distillery segments, led by resumption of full-scale ethanol blending. The Government of India is also evaluating whether to increase the blending rate from the current target of 20% to 25% or more. BRCM is our top pick in the sector

Please refer disclaimer at Report

SEBI Registration number is INH000000933

.jpg)

More News

Insurance Sector Update: A better quarter by Kotak Institutional Equities