Sell Deepak Nitrite Ltd for the Target Rs.1,470 by Motilal Oswal Financial Services Ltd

Steady operating performance amid macro challenges Operating performance misses estimate

? Deepak Nitrite (DN) reported a healthy operating performance, with EBITDA growing 25% YoY (on a low base) to INR2b amid persistent macroeconomic challenges.

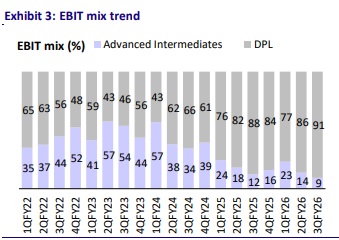

? Phenolic segment EBIT grew 20% YoY, driven by higher plant utilization and process optimization, while Advanced Intermediate EBIT declined 11% YoY due to continued pricing pressure from aggressive Chinese dumping, global oversupply, residual inventory restocking, and import competition.

? We expect DN’s performance to remain under pressure in the short term amid persistent industry-wide challenges. Continued oversupply from China, coupled with rapidly evolving geopolitical developments, is likely to sustain pricing pressure and weigh on overall operational performance.

? We reduce our FY26/FY27 earnings estimates by 17%/7% while maintaining our FY28 estimates, and project a CAGR of 5%/9%/7% in revenue/EBITDA/PAT over FY25-28. We value the stock at 24x FY28E EPS to arrive at our TP of INR1,470. Reiterate Sell.

Intermediate segment continues to face margin headwinds

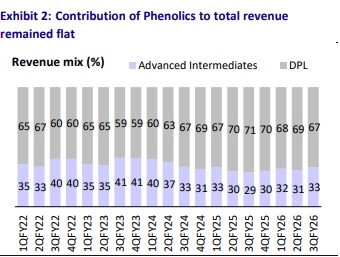

? 3Q revenue grew 4% YoY to INR19.8b (est. in line), primarily led by an 18% YoY growth in Advanced Intermediates to INR6.5b, while Phenolic revenue declined 2% YoY to INR13.4b.

? Gross margin came in at 27.8% (up 100bp YoY), while EBITDAM stood at 10.7% (up 180bp YoY). Employee costs as a % of sales stood at 5.4% (vs. 5.2% in 3QFY25), while other expenses stood at 11.8% (vs. 12.8% in QFY25).

? EBITDA grew 25% YoY to INR2b (our est. INR2.5b), while EBIT for Phenolics grew 20% YoY, and EBIT for Advanced Intermediates declined 11%.

? EBIT margins for Advanced Intermediates contracted 80bp, while EBIT margins for Phenolic expanded 200bp YoY to 11%.

? Adjusted PAT stood at INR1b (est. of INR1.5b), rising 11% YoY (Adjusted for the one-time impact of labor code).

? In 9MFY26, its revenue/EBITDA/Adj. PAT declined 5%/22%/31% to INR57.7b/INR6b/INR3.4b.

Highlights from the management commentary

? Guidance and outlook: While the global environment remains characterized by persistent pricing pressures and heightened competitive intensity, management expects a favorable performance in 4QFY26, driven by strategic priorities, including product innovation, geographical expansion, and leveraging in-house nitric acid production.

? Polycarbonate: The company is systematically building an integrated ecosystem from raw material security to the final polycarbonate product, supported by strategic tie-ups with key vendors and suppliers. The financial arrangements and funding structures are in the final stages to ensure capital and balance sheet readiness. This is expected to come online over the next 2- 2.5 years in an integrated fashion with propylene, phenol, BPA, and then polycarbonates.

? Product development: The company has a pipeline of ~15 products across R&D and pilot stages, with key opportunities in mining chemicals, personal care, flavors & fragrances, and polymer applications. The Methyl Isobutyl Ketone (MIBK)/Methyl Isobutyl Carbinol (MIBC) project is progressing well and is targeted for commissioning in 4QFY26.

Valuation and view

? The global chemical industry continues to face a challenging operating environment, with sustained pricing pressure, intense competition, and uneven demand trends driven by shifting trade flows and aggressive pricing by Chinese producers. While the favorable shift in US tariffs offers a constructive long-term outlook, the near- to medium-term impact on the company is expected to remain moderate, given its limited exposure.

? We reduce our FY26/FY27 earnings estimates by 17%/7% while maintaining our FY28 estimates. We project a CAGR of 5%/9%/7% in revenue/EBITDA/PAT over FY25-28E. We value the stock at 24x FY28E EPS to arrive at our TP of INR1,470. Reiterate Sell.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412