Reduce Gabriel India Ltd For Target Rs. 1,125 By Choice Broking Ltd

Multi-product Strategy to Drive Growth

Strengthening Core with Strategic Diversification into Mobility Solutions:

GABR is strategically transitioning from a suspension-centric company to a diversified and innovation-driven mobility solutions-provider. This is evidenced from GABR’s ongoing restructuring to significantly strengthen its financial position through the integration of high-margin, growth-oriented businesses with its core operations. The inclusion of Anchemco, along with strategic stakes in Dana Anand, Henkel Anand and ACYM, is expected to drive meaningful revenue expansion by adding both, scale and product diversity, with an estimated revenue CAGR of 20.0% from FY25–28E. GABR has also entered into a new joint venture (JV) with SK Enmove, a leading Korean corporation. The company has a 49% stake in this JV, business scope of which includes engineering, manufacturing and marketing of automotive and industrial lubricants. We believe GABR is wellpositioned to benefit from the continued strong performance of its core business along with these new segments, allowing diversification and reducing single product dependency.

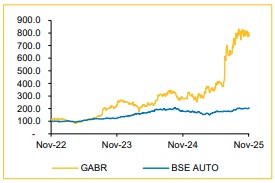

View and Valuation: We revise our FY26/27E EPS estimate downwards by 5.5%/1.6% and arrive at our target price of INR 1,125. We value the company at 30x (maintained) on the average of FY27/28E EPS. We maintain our ‘REDUCE' rating on the stock, given the recent run-up in the stock price, presenting limited upside potential from the present level.

Q2FY26 Results are Lower than our Estimate

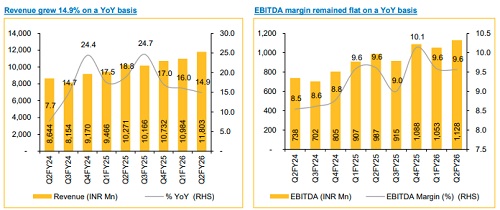

* Revenue was up 14.9% YoY and up 7.5% QoQ to INR 11,803 Mn (vs CIE est. at INR 11,966 Mn).

* EBITDA was up 14.3% YoY and up 7.2% QoQ to INR 1,128 Mn (vs CIE est. at INR 1,197 Mn). EBITDA margin was flat YoY and flat QoQ at 9.6% (vs CIE est. at 10.0%).

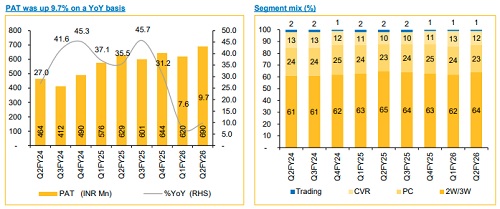

* PAT was up 9.7% YoY and up 11.4% QoQ to INR 690 Mn (vs CIE est. at INR 735 Mn).

Securing Market Share Growth: GABR is actively securing business for longterm market share growth in its core suspension segments. In the PV segment, the company recently secured three new platforms from Maruti. This pipeline is expected to result in a 4% to 5% increase in market share starting next year. In the E-2W segment, GABR continues to enjoy a healthy market share owing to a first-mover advantage. The company has not lost any platform and recent order wins in the E-2W segment include the River model (Yamaha), Ultraviolet and TVS Orbiter.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131c