Reduce Central Depository Services Ltd For Target Rs. 1,150 By JM Financial Services

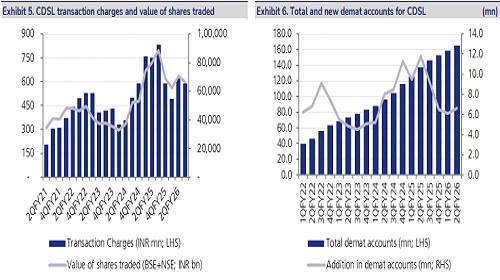

CDSL reported consol. PAT of INR1.4bn, higher than JMfe of INR1.25bn driven by lower eff. tax rate and higher sales. The company delivered a 23% QoQ revenue growth driven by a) ~195% QoQ growth in IPO / corporate action charges and b) ~48% QoQ growth in online data charges partially offset by lower transaction charges (-5% QoQ). Annual issuer charges, accounting for 36% of total revenue remained flat QoQ at INR1,150mn. Consol EBITDA came in at INR1.8bn, up 36% QoQ led lower jump in employee costs and technology costs vis-à-vis sales. Key takeaways from the call – a) income from annual issuer charges was flat QoQ given 1Q is a seasonally strong quarter (charges levied in 1Q for the companies which were admitted till 31st March of previous financial year) - incremental revenue accrues from the newly admitted companies which stood at 3,593 in 2Q b) LIC integration for the Insurance repository expected to be completed by Nov’25 – company witnessed 30% YoY growth in number of policies issued against a decline in industry numbers and c) income from unlisted issuer charges stood at INR35.3mn while processing charges (unlisted) stood at INR53.9mn leading to total unlisted income of INR89.2mn. Other income for the quarter stood at ~INR590mn consisting of INR120mn from e-CAS, INR200mn from e-voting and INR214.6mn from investment income. With its dominant position in depository business, CDSL is poised for growth, capitalizing on rising capital market activity. However, continued reduction in turnover volumes (combined ADTO across BSE and NSE down 18% YoY in 2QFY26) might weigh on the company’s earnings going ahead. Given its dominant market share in demat accounts, we peg P/E multiple to longterm average of ~40x. However, we believe the name trades at expensive valuations and in line with our new rating system, we downgrade the stock from HOLD to REDUCE with an unchanged TP of INR1,500/sh.

* Net Sales grow driven by higher IPO / corporate action charges:

CDSL's consolidated revenue increased ~23% QoQ, reaching INR3.2bn. This was primarily driven by a 195% sequential increase in IPO / corporate action charges. Annual issuer charges, accounting for 36% of total revenue remained flat QoQ at INR1,150mn. Transaction charges, which comprises ~19% of the total revenue, decreased sequentially by ~5% to INR590mn. CDSL added 6.6mn demat accounts during the quarter, taking its total demat accounts to 165.7mn (+4% QoQ). Employee costs and technology costs witnessed growth in 2QFY26 to the tune of ~6% QoQ and ~9% QoQ respectively. Consol EBITDA came in at INR1.8bn, up 36% QoQ led lower jump in employee costs and technology costs vis-à-vis sales. Consequently, EBITDA margin increased by ~530bps QoQ to 55.7% in 2Q. Consol Adj PAT for 2Q stood at INR1.4bn, higher than JMfe of INR1.25bn driven by lower eff. tax rate and higher sales.

* Insurance remains a key business opportunity:

Annually, India churns out ~300mn policies and with a significant portion of market share being untapped – company plans to target this going forward. Integration with LIC remains on track and is expected be completed in Nov’25 – to lead to higher market share. Company witnessed 30% YoY growth in number of policies issued against an overall decline as evident from the IRDAI numbers. Company opened a direct portal for the end policyholders 6 months ago which is expected to aid to these increasing volumes.

* Revenue growth driven by buoyant market; annual issuer charges remain flat:

CDSL’s demat account additions continues to increase (+6.6mn accounts in 2Q). income from annual issuer charges was flat QoQ given 1Q is a seasonally strong quarter (charged in 1Q for the companies which were admitted till 31st March of previous financial year) - incremental revenue accrues from the newly admitted companies which stood at 3,593 in 2Q.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361