Neutral NTPC Ltd for the Target Rs. 372 by Motilal Oswal Financial Services Ltd

Weak power demand weighs on 2Q performance

Adjusted PAT in 2QFY26 was 4% above our estimate, mainly supported by higher-thanestimated other income. EBITDA missed our estimate as weak power demand led to soft generation trends. Management highlighted its vision to take group capacity to 244GW by 2037. Medium-term capacity addition targets were guided at 9.8/9.6/10.5 GW in FY26/27/28. We maintain a cautious view on execution, especially at NGEL. Further, we believe valuations for NGEL (15% of our SOTP) have little room for rerating and may continue to face pressure. We reiterate our Neutral stance on NTPC with a TP of INR372.

Decline in power generation weighs on earnings performance

2QFY26 performance:

NTPC reported standalone revenue of INR392b in 2QFY26, 13% below our estimate of INR453b (-3% YoY), owing to subdued demand.

* EBITDA came in 15% below our est. at INR100b (+4% YoY, -3% QoQ).

* Reported PAT of INR46.5b (flat YoY, -3% QoQ) beat our estimates by 7%, mainly on account of higher-than-expected other income. Adj. PAT came in at INR45b (+8% YoY, +2% QoQ).

* NTPC Green reported consolidated revenue of INR6.1b (up 22% YoY) and EBITDA of INR5.3b (up 26% YoY) in 2QFY26. APAT rose 131% YoY to INR0.9b.

Operational and other highlights:

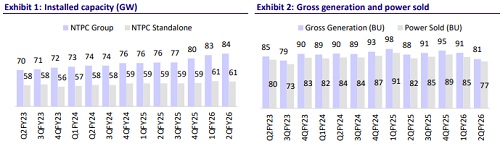

* NTPC Group’s total installed capacity now stands at 83.9GW (Standalone: 60.7GW).

* The company's gross power generation fell 6% YoY to 83Bus in 2Q.

* NTPC group added a capacity of 4,403MW in 1HFY26. Of this, 1,732MW was added on a standalone basis, 1,506MW through NGEL and its JVs and balance 1,165MW through other JVs and subsidiaries. An additional 956 MW was commissioned in Oct’25.

* Plant availability for coal plants stood at 84.4% in 2QFY26 (2QFY25: 84.93%).

* Coal plant PLF declined 627bp YoY to 66.01% in 2QFY26, primarily due to grid restrictions impacting generation.

* Hydro plant PLF improved to 104.6% (vs. 97.4% in 2QFY25), while gas plant PLF remained flat YoY at 6.8%.

* Average tariff was INR4.90/unit in 1HFY26 vs. INR4.67 in 1HFY25.

* Total electricity generation stood at 214BUs, down 6BUs YoY due to subdued demand.

* Pumped Storage Project: Commissioned first two units (250 MW each); two additional units expected within FY26.

* Coal Stock: Maintained 13.4 MMT (15 days’ requirement) with 85% station availability.

* Financial Highlights

* Cost of borrowing fell to 6.11% from 6.63% last year through refinancing and loan restructuring.

* Receivables improved to 28 days from 33 days in 1HFY25.

* Capex: Group capex stood at INR232b (+32% YoY); standalone capex was INR141b (flat YoY), and NGEL incurred INR66b.

* Regulated equity: Standalone regulated equity at INR945b (+6% YoY); consolidated at INR1,160b (+10% YoY).

* Corporate Developments

* Executed business transfer agreements for hiving off the coal mining business to NTPC Mining (NML) at an estimated value of INR105b; Chatti and Badam mines already transferred, and the remaining mines expected to be transferred in FY26.

* Dividend

* Declared an interim dividend of INR2.75/share for FY26.

Valuation and view

Our TP of INR372 for NTPC is based on:

* Value of INR207 for the standalone, coal, and other businesses at Dec’27E P/B of 2x.

* Value of INR19 for other subsidiaries and INR59 for JV/associates at Dec’27E P/B of 2.0x.

* The stake in NGEL is valued at a 25% discount to the current market price.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412