Neutral Bata India Ltd for the Target Rs.945 by Motilal Oswal Financial Services Ltd

Operational discipline visible, structural upside limited

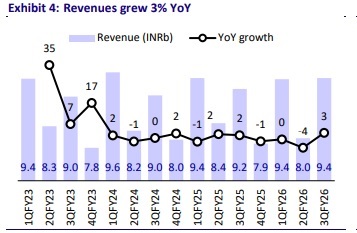

* Bata India reported a modest 3% revenue growth in 3QFY26 and its EBITDA margin expanded 73bp YoY to 22.4%, supported by tighter cost control and accounting changes.

* Management highlighted early signs of recovery in demand, aided by GST passthrough and improved value propositioning. The premium portfolio, led by Hush Puppies, remained resilient.

* Strategic focus areas include scaling up ZBM, improving sell-through, brand strengthening, and leaner inventory to enhance availability and turns. It is also increasing digital marketing spends (double-digit growth over two years) to strengthen engagement with younger cohorts. We believe these are the steps in the right direction.

* Nevertheless, these initiatives are yet to translate into meaningful growth acceleration or margin recovery, with profitability likely to remain below preCovid levels even by FY28E.

* We tweak our FY26-28 estimates and build in revenue/EBITDA/adj. PAT CAGR of 4%/8%/7% over FY26-28E. Reiterate Neutral with a revised TP of INR945.

Modest revenue growth; higher other income drives profitability

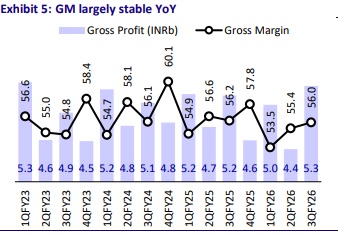

* Revenue grew 3% YoY to INR9.5b (in line), hit by GST-related disruptions (vs. Metro: +15% | Campus: +14% | Relaxo: flat). ? Gross margin contracted 20bp YoY to 56%, likely due to channel mix changes.

* Consequently, gross profit grew 2% YoY (in line).

* Employee costs rose 8% YoY, while other expenses were down by 4% YoY, aided by cost controls and partly due to an accounting change.

* EBITDA grew 6% YoY (in line), led by tighter cost controls.

* EBITDA margins stood at 22.4%, up 75bp YoY.

* BATA booked one-time exceptional items: 1) VRS – INR13m on top of the INR83m booked in 2Q; overall INR143m booked in 9MFY26; and 2) the labor code impact of INR67m.

* Depreciation grew 15% YoY, as the royalty amount was moved from other expenses to amortization. Finance costs rose 4% YoY.

* Other income more than doubled YoY to INR227m, boosting profitability.

* Reported PAT at INR660m grew 12% YoY. Adj PAT at INR740m rose 11% YoY (14% ahead).

* For 9MFY26, revenue was flat, gross margin compressed 90bp to 54.9%, and EBITDA dipped 1% with margin at 20.7%. Reported PAT at INR1.32b declined 54% YoY and adj PAT at INR1.5b dipped 25% YoY.

Key takeaways from the management commentary

* Demand: Early demand recovery is visible, supported by GST-led formalization and stronger internal execution—scaling up ZBM, improving sell-through, sharper brand focus, and leaner inventory driving better availability and turns. Growth is broad-based across price points, including lower ASPs, indicating that value proposition recalibration is working, while product funnel reengineering remains the key medium-term accelerator.

* Marketing spends have grown in double digits for two consecutive quarters and are expected to remain elevated, increasingly skewed to digital and influencerled campaigns. Focused product campaigns (Festive, Victoria Ballerina, Power Easy Slide) indicate sharper ROI orientation rather than diffuse brand advertising.

* Inventory quality has materially improved with a 25% reduction over two years and record-low aged stock, driven by SKU rationalization and data-led forecasting under ‘Project Customer First’. Freshness and tighter line architecture should help to sustain working capital gains and reduce markdown risk structurally.

Valuation and view

* Bata India is accelerating distribution expansion (~30% store growth via franchise), sharpening brand and product mix through youth-focused concepts (Floatz, Power, Sneaker Studios), and driving premiumization. Parallel execution on ZBM scale-up, sell-through improvement, leaner inventory, and higher digital spends support better availability, faster turns, and stronger engagement. We view these steps as directionally appropriate.

* Nevertheless, these initiatives are yet to translate into meaningful growth acceleration or margin recovery, with profitability likely to remain below preCovid levels even by FY28E.

* We tweak our FY26-28E estimates and build in revenue/EBITDA/adj. PAT CAGR of 4%/8%/7% over FY26-28E.

* Despite sharp underperformance, the stock trades at ~48x 1-year forward P/E, above its long-term average; however, the expected demand recovery after GST cuts in the organized value segment should benefit Bata, preventing a downgrade to Sell. Reiterate Neutral with a revised TP of INR945.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412