India Equity Strategy : TRUMPíS VOLTE-FACE: India first among equals within EMs but not out of woods by Choice Broking Ltd

We evaluate Trump Tariffs announced on April 02 and subsequent volte face on April 09 to assess India investment case. Our base case is eventual settling of tariff rates for all countries excluding China in the range of 10-25% . There is now increasing likelihood of US-China negotiating tariff terms; thus, not putting 80% of global goods trade (as per WTO) at risk. With Trump’s spanner in the investing wheel not out of the way but getting more pointed on China, we believe it is long-term Advantage India amongst the EMs; provided we drive well

What has happened?

Owing to rising global tensions, frantic US bond yield movement and market volatility, US President Donald Trump announced a 90-day pause on new tariffs above 10% for most countries (includes India). This followed a series of tariff hikes in late 2024 and early 2025, including steep duties on imports from Canada, Mexico, and over 100 nations. While the pause aimed to calm markets and open negotiations, tariffs on Chinese goods were simultaneously raised to 125%, deepening US - China trade tensions. Markets have rallied on the news, but uncertainty remains as selective tariff enforcement continues to pose risks to global trade and economic stability.

India macro data is improving and RBI actions are encouraging

India’s manufacturing PMI rose to 58.1 in March 2025, the highest in eight months, driven by strong new orders and production momentum. GST collections also remained robust at INR 1.96 lakh crore, marking a 9.9% year-on-year rise and the second-highest monthly tally since April 2024. On the monetary front, the RBI has infused INR 2.4 lakh crore through OMOs and USD 15 Bn via forex swaps since January to ease liquidity. It also conducted an INR 50,000 crore VRR auction to ease the short-term liquidity strain. These steps aim to maintain a surplus of INR 2 Trn for effective policy transmission.

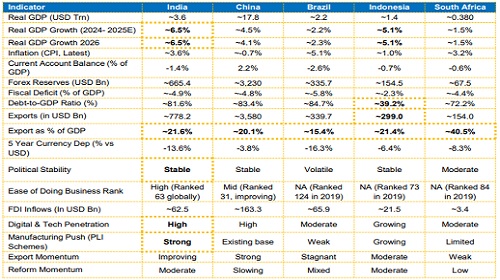

On April 9, the central bank cut the repo rate by 25 bps to 6%, lowered the FY26 GDP forecast from 6.7% to 6.5% and shifted its policy stance to "accommodative," indicating a readiness to further support economic growth amid rising global uncertainties. Amongst this swift market developments, and despite stubborn volatility expected during Trump’s Presidency, we believe that India enjoys strong investment metrics amongst the EMs and should attract strong flows in near future. India government proactiveness can catalyze Trump-induced domestic reforms for greater geo-economic prominence.

We believe that with Trigger Event of April 2 Tariff announcement and subsequent TRUMP VOLTE-FACE, the India markets are at lower end of market bottom and despite the PAUSE and associated negotiations; markets should stabilize and start looking UP. Weakening global macro, substantial miss on impending earnings, hardened China stance and associated dumping and Trump tantrums are the monitorable risks; which have been already put under microscope in the last 1 week.

Post global trigger event; subsequent returns can be chunky

Among the EMs, India enjoys the best investment metrics

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)