Hold Eicher Motors Ltd For the Target Rs. 5,375 by Choice Broking Ltd

EIM posts in line Revenue driven by a strong volume growth; EBITDA Miss

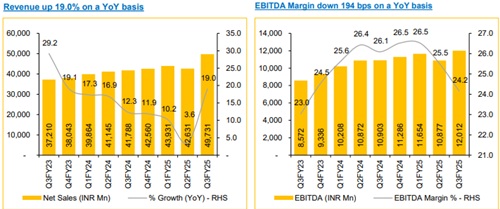

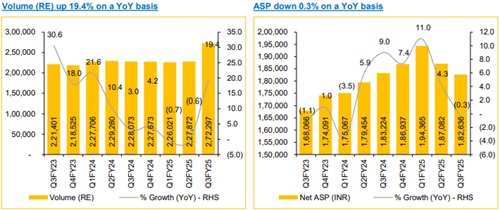

* Revenue for Q3FY25 was at INR 49,731 Mn up 19.0% YoY and up 16.7% QoQ (vs CEBPL est. at INR 50,942 Mn) led by 19.4% YoY growth in volume and 0.3% YoY de-growth in ASP.

* EBITDA for Q3FY25 was at INR 12,012 Mn, up 10.2% YoY and up 10.4% QoQ (vs CEBPL est. at INR 13,194 Mn). EBITDA margin was down 194 bps YoY and down 136 bps QoQ to 24.2% (vs CEBPL est. at 25.9%).

* PAT for Q3FY25 was at INR 11,705 Mn, up 17.5% YoY and up 6.4% QoQ (vs CEBPL est. at INR 11,898 Mn).

Royal Enfield to continue strong growth led by new product launches:

Royal Enfield posted a strong volume growth of 19.4% during the quarter driven by good domestic as well as export demand. The company had 5 major launches in Q3, including Bear 650, New Classic 350, Bullet Battalion Black, Classic 650, and Goan Classic, compared to 1 major launch in the same quarter last year. Royal Enfield took its first steps into electric mobility with the debut of its EV brand ‘Flying Flea‘, expected to hit the market around the first quarter of 2026.

VECV achieves Record Sales and Market Share Gains in Q3:

VECV delivered a strong performance, recording its highest ever quarterly sales, with 21,012 units in the quarter. VECV revenues for the quarter rose to INR 58,010 Mn, up 5.8% on a YoY basis and EBITDA rose to INR 5,090 Mn, up 16.2% on a YoY basis. The company performed strongly in the LMD truck market, with a 36% market share in Q3. VECV's bus business performed very well, posting its highest ever Q3 sales with a 20.7% market share. We believe the commercial vehicle industry will benefit from better consumer spending due to better taxation policies, leading to more consumption and movement of goods and services

View and Valuation:

We revise our FY26/27 EPS estimates by (2.0)%/1.0% and roll over our forecasts forward to come up with a revised target price of INR 5,375; valuing the company at 24x (unchanged) on FY27E EPS while maintaining our ‘HOLD' rating. We remain positive on the growth of the company driven by new product launches in the motorcycle segment and the revival of CV segment

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131