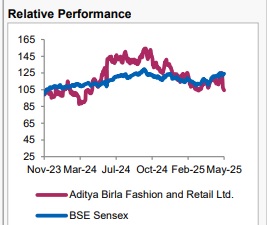

Hold Aditya Birla Fashion and Retail Ltd For Target Rs. 85 By Axis Securities Ltd

Est. vs. Actual for Q4FY25 : Revenue – NA; EBITDA – NA; PAT – NA

(NA-stands for “Not Comparable” as the two fashion entities demerged)

Recommendation Rationale

Resilient growth amid headwinds: Despite a challenging environment, the company’s consolidated revenue grew by 9% YoY, driven by strong performances in Ethnic (up 19% YoY), TMRW (up 27% YoY), and an 11% YoY increase in Luxury retail. Profitability improved notably across segments, with gross margins expanding 848 bps YoY to 63.2%. EBITDA rose to Rs 205 Cr in Q4 with EBITDA margins at 11.9%, up 970 bps YoY, driven by sharp margin expansion in Pantaloons and Ethnic segments. As per the presentation, comparable EBITDA doubled YoY to Rs 199 Cr, while reported EBITDA stood at Rs 295 Cr, including Rs 97 Cr gain from inter-division elimination post de-merger.

Demerger Update: The demerger became effective from May 1, 2025, with ABLBL’s listing anticipated by the end of June. This strategic move sets the stage for two independently run fashion platforms, each charting its own focused growth and value creation trajectory in the Indian fashion landscape.

Growth Guidance: Post-demerger, the management has outlined an aggressive roadmap, aiming to triple ABFRL’s revenue and double EBITDA margins over the next five years, signaling a strong focus on scale, efficiency, and long-term value creation.

Sector Outlook: Cautious

Company Outlook & Guidance: Short-term challenges remain, and with the demerger now in play, near-term execution will be key to unlocking value. We maintain a cautious stance and reiterate our HOLD rating.

Current Valuation: 13xMar’27 EV/EBITDA; ( Earlier Valuation: NA )

Current TP: Rs 85/share(NA)

Recommendation: With a 2% downside from the CMP, we maintain our HOLD rating.

Financial Performance: The company’s consolidated revenue stood at Rs 1,719 Cr, up \~9% YoY, driven by growth across segments. EBITDA came in at Rs 205 Cr, with EBITDA margins at 11.9%, expanding by 970bps YoY, driven by sharp margin expansion in Pantaloons and Ethnic segments. The company reported a negative PAT of Rs 161 Cr, impacted by investments in newer businesses and higher interest on borrowings during the year.

.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633