Healthcare sector Update : Q2FY26 Quarterly Results Preview by Choice Broking Ltd

Sustained growth ahead led by expansions, specialties and strong leverage

Strong Q2FY26 results expected: Healthcare companies under our coverage are poised to sustain strong momentum through the year, with revenue expected to grow in high teens YoY. Growth will be driven by favourable industry tailwinds, including an increasing mix of high-end specialties, expansion in operational bed capacity and a steady recovery in international patient inflows.

ARPOB (Average Revenue Per Occupied Bed) growth is expected to remain moderate YoY. However, EBITDA is projected to outpace revenue growth across our coverage universe, underscoring continued improvement in operating leverage. Occupancy levels are likely to remain healthy in the 60–66% range for most players, except for RAINBOW (~42%) and MAXHEALT (~75%).

Factors diving long-term growth:

Aggressive capacity expansion to capture rising healthcare demand: Hospitals under our coverage are undertaking aggressive capacity expansion to capture rising healthcare demand through a mix of organic growth and strategic acquisitions. Over the next 2–3 years, APHS plans to add over 4,100 beds, FORH ~3,200 beds, MEDANTA ~1,400 beds, YATHARTH 700+ beds, MAXHEALT ~3,400 beds and RAINBOW ~930 beds. These additions span both, metro and Tier-2 locations, enhancing ARPOB potential in premium markets while strengthening reach in emerging regions.

Oncology emerges as key revenue driver, contributing up to 31% for top hospital chains: Rising demand for specialised treatment, such as oncology and high-end surgeries is driving higher ARPOB, improved operational efficiency through shorter ALOS and sustained revenue growth. While ongoing capacity expansion may temper near-term ARPOB gains, the structural mix shift towards high-end specialties remains evident. Oncology now contributes ~31% of revenues for MAXHEALT, 16% for NARH, 15.1% for FORH, 14.4% for MEDANTA and ~10% for YATHARTH. This trend towards higher-value specialties is expected to persist across most players under coverage, supporting long-term margin expansion.

International patient inflows to strengthen healthcare sector amid rising global demand: Medical tourism, at present accounting for ~5–7% of revenues, is expected to grow at nearly twice the industry average over the medium term. Growth will be supported by favourable tailwinds, including easing geopolitical conditions, the upcoming Noida International Airport, competitive treatment cost and the availability of world-class clinical expertise. These factors are likely to drive sustained inflows of international patients, particularly from Southeast Asia and the Middle East, further strengthening the sector’s growth trajectory.

We expect the healthcare sector to sustain its growth momentum, driven by high single-digit annual ARPOB expansion and steady improvement in occupancy levels. Further tailwinds include a more favourable payer mix, rising surgical volumes and increasing insurance penetration, all of which are set to reinforce the sector’s long-term growth trajectory.

High-conviction investment ideas

We continue to remain positive on JSLL and YATHARTH hospitals which are expected to deliver strong growth in Q2FY26.

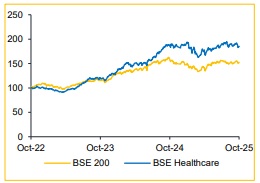

Rebased Price Chart

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131