Daily Derivatives Report By Axis Securities Ltd

The Day That Was:

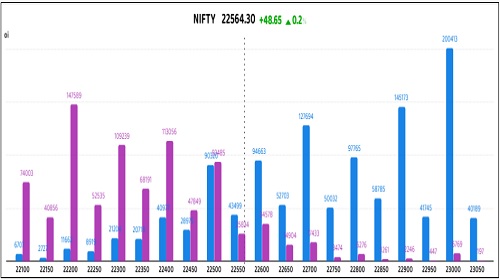

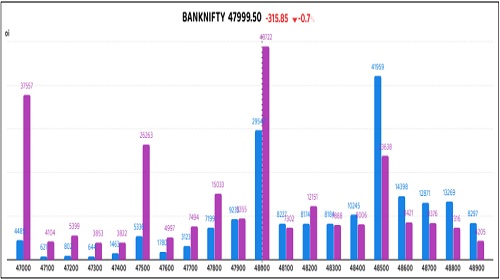

Nifty Futures: 22,564 (0.2%), Bank Nifty Futures: 48,000 (-0.7%).

Indian markets opened lower following a weak global outlook but staged a recovery, with Nifty Futures closing 44 points higher. In contrast, Bank Nifty declined by 316 points, weighed down by IndusInd Bank’s sharp sell-off that saw the stock drop by a record 27%. Despite the divergence, sectors like real estate, telecom, and oil & gas saw strong buying interest, cushioning the broader market. Open interest in the Bank Nifty rose 6%, indicating short positioning. Meanwhile, the premium on Nifty futures widened from 55 to 66 points, while that on the Bank nifty surged from 99 to 146 points, signalling heightened market expectations and volatility.

Global Movers:

US equities fell for a second day, on continuing uncertainty about US tariffs. The S&P dropped 0.8% after earlier falling into correction territory - defined as a 10% fall from an important high - while the Nasdaq 100 and the Dow finished 0.2% and 1.1% respectively. President Trump's announcements on tariffs on Canada created plenty of volatility, which saw the VIX approach 30 for a second straight day, its highest level since August. In markets, the dollar rose a little while the 10-year trsy yield fell, bitcoin rebounded, Gold remained stuck in a tight range around $2900/ounce and oil rose slightly as forecasts for global oversupply were cut.

Stock Futures:

In Tuesday’s session, Tata Comm, Lodha, IndusInd Bank, and Ashok Leyland experienced marked market activity, high trading volumes and notable price changes, signifying increased momentum and stronger investor engagement.

Tata Communication (TataComm) surged 8.8%, extending its highest single day rally since July 2022, with a 9.2% rise in open interest signalling sustained bullish sentiment. This upward movement aligns with a domestic broker's recent upgrade of the stock to a 'Buy' rating, citing strong upside potential and a compelling risk-reward profile. The price momentum and rising OI reinforce a positive near-term outlook for the stock.

Macrotech Developers Limited (Lodha) surged 5.2%, accompanied by a slight rise in open interest, following its ?279 crore acquisition of a 3.4-acre land parcel in Mumbai’s Jogeshwari West from Unichem Laboratories. The deal includes an 82,000 sq ft office building. Broader real estate momentum, driven by gains in Godrej Properties and DLF, further supported the market. Investor confidence in Lodha’s growth and strategic direction remained strong.

IndusInd Bank plunged 27%, witnessing its largest such drop on record and sending the stock to a four-year low. The decline came with a 61.8% surge in open interest that reached a two-month high, as 4.2 million shares changed hands. The selloff followed the bank’s disclosure of forex accounting discrepancies, potentially impacting earnings by ?1,500-2,000 crore. Brokerages downgraded the stock, citing corporate governance concerns, while the rising open interest signals strong short build-up and bearish sentiment.

Ashokleyland dropped 3.2%, extending its downtrend and marking a near 21% decline from its recent peak over the year. This drop was accompanied by a 11% rise in open interest, attributed to the Maharashtra government's recent decision to increase motor taxes on select vehicles. The simultaneous price decline and OI surge indicate a strong short build-up, reflecting bearish sentiment and expectations of further downside.

Put-Call Ratio Snapshot:

Nifty's put-call ratio (PCR) increased to 1.09 from 0.91, whereas that of the Bank Nifty's remained flat around 0.94.

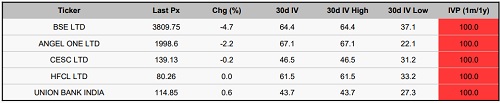

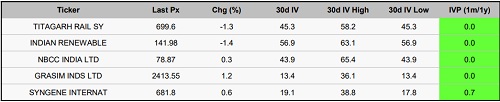

Implied Volatility:

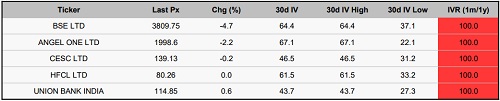

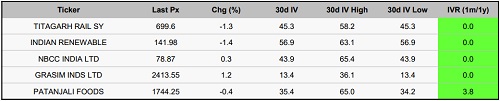

BSE India and Angel One Ltd are experiencing significant price volatility, both reflected in their high implied volatility rankings of 100. The latter's implied volatility was at 67%, while that of BSE was at 64%. This rise in implied volatility means underlying options on these stocks are expensive, which may prompt traders to implement hedging strategies to manage the risks associated with potential price fluctuations. In contrast, IREDA (Indian Renewable) and Titagarh Railway System were exhibiting the lowest implied volatility rankings, with implied volatilities of 57% and 45%, respectively. This means their options are relatively inexpensive, creating an advantageous opportunity for investors looking to create long exposures.

Options volume and Open Interest highlights:

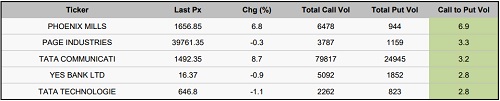

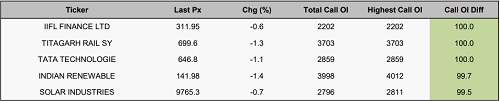

Phoenix Mills and Page Industries are drawing significant interest from traders, as shown by their call-to-put volume ratios of 7:1 and 3:1, indicating a bullish market perspective. However, these elevated ratios may also reveal contrasting opinions. At the same time, the growing ratio of put options to call options for IIFL Financial LTD and L&T Technology indicates heightened investor caution, underscoring worries about possible downside risks. Indusind Bank and Titagarh exhibit significant open interest in both call and put options, exceeding their 20-day averages. TataCommunication follows suit on the put side, indicating a likelihood of heightened price volatility. However, investors should remain cautious given the current market conditions risk. (This data considers only those stock options that saw a minimum of 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

For today's session, sentiment on index futures was bullish among participants, as FIIs and clients collectively increased their positions. FIIs added 508 contracts, while clients expanded their holdings by 1,204 contracts. In contrast, proprietary traders adopted a contrarian stance, reducing their positions by 6,396 contracts, indicating a potential bearish outlook.

Meanwhile, in stock futures, FIIs and clients collectively reduced their positions, signaling a bearish market sentiment. FIIs led the sell-off by offloading 3,005 contracts, followed by clients trimming 10,809 contracts. On the other hand, proprietary traders increased their holdings by 25,149 contracts. This broad-based selling reflects a cautious to negative outlook in the stock futures segment.

Securities in Ban for Trade Date 12-March-2025:

1) BSE

2) HINDCOPPER

3) INDUSIND BANK

4) MANAPPURAM

5) SAIL

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

Stocks With High Call Volume To Put Volume

Stocks With High Put Volume To Call Volume

Call Open Interest Relative to Record High

Put Open Interest Relative to Record High

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Pre-market comment for Monday December 1 by Amruta Shinde, Technical & Derivative analyst, C...