Daily Derivatives Report By Axis Securities Ltd

The Day That Was:

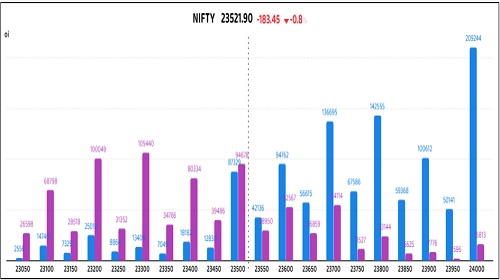

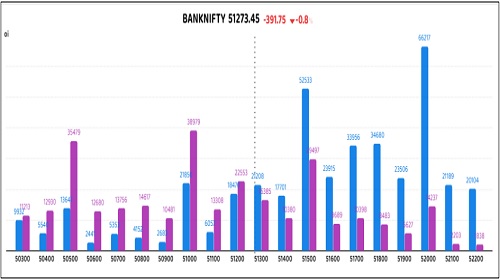

Nifty Futures: 23,521.9 (-0.8%), Bank Nifty Futures: 51,273.45 (-0.8%).

Nifty futures fell 183 points yesterday, extending losses for the second consecutive session and ending a seven-day rally, as declines in banking and energy stocks pushed the markets downward. This drop is tied to broader market consolidation prompted by domestic selling and profit-booking, ahead of key economic events and March-end closing pressures. Encouraging factors include a weaker dollar index and rupee appreciation, alongside slowing foreign institutional investor (FII) outflows. Investors remained cautious due to tariff concerns, although these are not expected to disrupt India’s economic or market stability significantly. Globally, worries about upcoming U.S. tariffs, effective April 2, have intensified market uncertainty, primarily due to the unclear details regarding which countries and sectors may receive exemptions. The rupee traded between 85.68 and 85.98 before closing at 85.69, gaining three paise from the previous day. Bank Nifty futures also closed in red, down 392 points in tandem with broader indices. The Nifty futures premium decreased to 35 points from 37, and the Bank Nifty premium increased from 57 to 64 points.

Global Movers:

US stocks finished down as trade war-related fears made headlines again, with President Trump announcing 25% tariffs on the auto industry for both parts and finished goods - these will be effective April 2nd. The S&P 500 and the Nasdaq 100 finished 1.1% and 1.8% lower, respectively. Chipmakers, led by Nvidia also ended in the red as concerns grew that AI-led spends were set to slow. In data, durable goods orders surprisingly rose, reducing growth concerns for now. Coming to markets, the VIX rose for the first time in six, the dollar and the 10-year treasury yield inched up, bitcoin fell slightly, Gold finished flat while oil continued its journey toward $70 as US supplies tightened to the highest since December.

Stock Futures:

In the previous session, there was increased trading activity and price volatility for stocks such as Siemens Ltd., Samvardhana Motherson International, BSE Ltd., and Max Healthcare Institute. This surge indicates strong momentum and heightened investor interest.

Siemens Ltd. witnessed a significant 5.7% price appreciation, culminating in a monthly peak and registering the most substantial single-day price and volume surge since mid-May 2024. This rally was catalysed by the National Company Law Tribunal's (NCLT) approval for the demerger of Siemens Energy India Ltd. The demerger's equity allotment ratio, set at 1:1, entitles Siemens’ shareholders to one share of Siemens Energy India for each share held, with a record date fixed for April 7, 2025. Despite the pronounced price ascent, open interest exhibited a marginal 0.7% expansion, adding only 0.23 lakh shares, indicating a restrained build-up of long positions. Concurrently, a three-month high in both call and put option open interest indicates a strongly hedged derivatives position, suggesting that market participants are strategically mitigating potential volatility surrounding the demerger event.

Samvardhana Motherson International experienced a 2.69% price surge, achieving a five-week peak, driven by Goldman Sachs' ?87 crore open market acquisition at ?132.7 per share on March 25th. This price action was accompanied by a modest 0.4% increase in open interest, representing a long build-up of 5.6 lakh shares. Despite a substantial 14% price rally from monthly lows, the overall open interest expanded by a restrained 2.7%, or 38.2 lakh shares, indicating a tepid long accumulation. The confluence of strong price momentum, inducing accelerated short covering and selective long position initiation, underscores a prevailing bullish bias. While further near-term price appreciation is plausible, market participants are likely to exhibit caution, awaiting more decisive commitment before significantly expanding long exposures.

BSE Ltd. continued its downward trajectory for a third consecutive session, registering a 3.6% price decline alongside a 4.5% increase in open interest, representing 2.4 lakh shares, indicating a short build-up. However, the announcement of a board meeting scheduled for March 30th to consider a potential bonus share issue, following market closure, introduces a countervailing factor. This development could trigger short covering in the subsequent session. Notably, the stock has witnessed a 6% increase in open interest, equivalent to 3.1 lakh shares, alongside a 6% price depreciation over the preceding four sessions, confirming the establishment of new short positions. The potential for a second bonus issue within three years may introduce an element of uncertainty, likely to induce short covering and increase volatility.

Max Healthcare Institute shares experienced a sharp 3.8% price contraction, representing the most significant single-day decline of the current trading series. This price depreciation coincided with a marginal 0.5% increase in open interest, equating to 0.4 lakh shares, indicative of a short build-up. This downturn occurred despite the company's prior announcement of receiving approval for the amalgamation of its two wholly-owned subsidiaries on March 21, 2025. The limited expansion in open interest, relative to the substantial price decline, suggests a degree of caution among short sellers. However, a continuation of the price decline, coupled with a more pronounced increase in open interest, would solidify the prevailing bearish sentiment and likely precipitate further downward price momentum.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) declined to 0.92 points from 1.04, while the Bank Nifty PCR fell from 1.03 to 0.88 points.

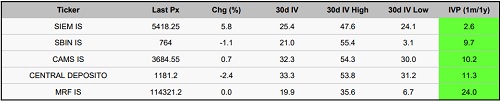

Implied Volatility:

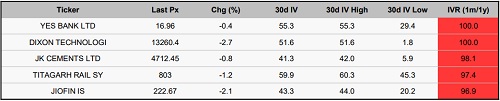

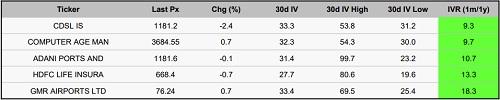

Dixon Technologies (India) and Yes Bank have experienced considerable shifts in their stock prices, evidenced by their high implied volatility ratings of 100 each. Currently, their implied volatilities stand at 52% and 55%. This uptick in implied volatility suggests that options for these stocks are becoming more expensive. As a result, traders may want to adopt hedging strategies to reduce risks linked to price fluctuations. Conversely, CDSL and Computer Age Management Services have shown the lowest implied volatility ratings of 9 and 10, respectively, with implied volatilities of 33% and 32%, respectively. This decline in volatility suggests that their options are relatively more attractive, creating a favorable opportunity for traders seeking to establish long positions.

Options volume and Open Interest highlights:

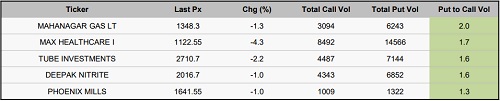

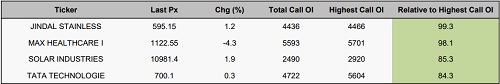

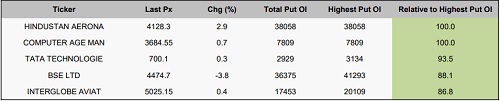

Macrotech Developers and IREDA have garnered significant attention from traders, evidenced by their remarkable call-to-put volume ratios of 3:1 each. This pattern indicates a broadly positive market sentiment, although these ratios may also reflect a variety of differing opinions among investors. In contrast, Mahanagar Gas and Max Health are experiencing an increase in put option volumes compared to call options, suggesting growing concern about possible market declines. In terms of positioning, Jindal Stainless Ltd and Max Health exhibit the highest open interest in call options. At the same time, Hindustan Aeronautics and Computer Age Management Services ranks highest for put options, indicating a greater likelihood of future price volatility. (This data considers only those stock options that saw a minimum of 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

Yesterday specifically, clients exhibited a notable expansion of long positions, augmenting their holdings by 2,846 contracts within a total shift of 11,571 contracts, indicating a bullish inclination. Conversely, foreign institutional investors (FIIs) aggressively amplified their long positions by a substantial 6,871 contracts, reinforcing a robust positive market outlook. However, this optimistic sentiment was starkly juxtaposed by proprietary traders, who drastically liquidated their positions, reducing their holdings by the entire 11,571 contract change, signalling a profoundly bearish perspective. Shifting to stock futures, a contrasting narrative unfolds; clients aggressively divested, curtailing their positions by 6,195 contracts within a total change of 11,314 contracts, suggesting a cautious or pessimistic bias. In parallel, FIIs demonstrated a strong appetite for stock futures, augmenting their positions by a significant 10,274 contracts, substantiating a bullish sentiment in individual equities. Concurrently, proprietary traders moderately increased their positions by 1,040 contracts, indicating a marginally positive, albeit less decisive, stance.

Securities in Ban for Trade Date 27-March-2025:

1) HINDCOPPER

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

Stocks With High Call Volume To Put Volume

Stocks With High Put Volume To Call Volume

Call Open Interest Relative to Record High

Put Open Interest Relative to Record High

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633