Daily Derivatives Report 20 June 2025 by Axis Securities Ltd

The Day That Was:

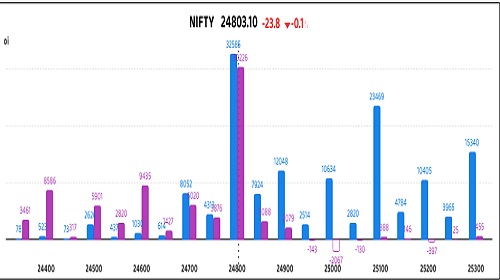

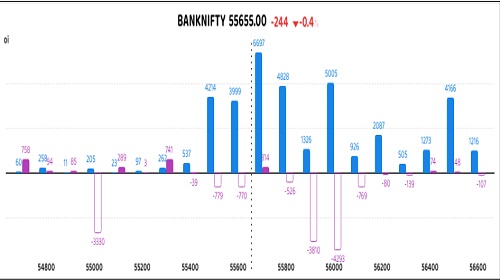

Nifty Futures: 24,803.1 (-0.1%), Bank Nifty Futures: 55,655.0 (-0.4%).

Nifty and Bank Nifty futures both experienced decline on Thursday, dropping by 24 and 244 points respectively, stemming from the escalating tensions between Israel and Iran. The Nifty's weekly expiry was uncharacteristically subdued, confined to a narrow trading band, signalling market indecision and probably a widespread reluctance among investors to take any significant directional bets. This cautious sentiment was exacerbated by the U.S. Federal Reserve's decision to hold interest rates, coupled with projections of elevated inflation and slower economic growth. Sectorally, nearly all NSE indices registered declines, with PSU banks, realty, and media sectors experiencing the most significant setbacks, while Nifty Auto showed resilience. Nifty futures premium narrowed to 10 points from 15, contrasting with a slight expansion in Bank Nifty premium from 70 to 78 points. The India VIX, indicating market volatility, remained stable at 14.26. Concurrently, the Indian Rupee depreciated for the third straight session, losing 30 paise to close at an over two-month low of 86.73 against the U.S. dollar.

Global Movers:

US markets were shut yesterday due to Juneteenth. Meanwhile, the VIX jumped over 10% to 22.2 and gold barely budged.

Stock Futures:

Yesterday's market session was marked by strong activity for Tata Consumer Products, Eicher Motors, Cyient Ltd, and Varun Beverages, as evidenced by their sharp price movements and increased trading volumes. This surge suggests growing investor confidence and could point to changing sectoral momentum.

Tata Consumer Products reaffirmed its strategic thrust towards inorganic expansion to supplement its organic growth trajectory, as it pivots to align with evolving consumer preferences for health-centric and convenient offerings. Amid external headwinds such as US tariffs impacting international revenue, the stock registered a short covering-led up move of 2.2%, accompanied by a marginal 1.5% decline in futures open interest, shedding 567 contracts—equivalent to 2.6 Lc shares—signalling profit booking and partial unwinding. On the options front, positioning activity intensified with total open interest in call options rising to 13,148 contracts and puts increasing to 4,826 contracts, driven by fresh additions of 837 call and 847 put contracts, respectively. The build-up in both call and put sides alongside futures unwinding indicates a tactical recalibration by market participants, suggesting a near-term reassessment of directional bias amid evolving fundamentals and valuation resets.

Eicher Motors extended its rally for a second straight session, propelled by heightened volumes and pronounced short covering, as evidenced by a 1.6% price gain alongside a 3.2% contraction in futures open interest. The shedding of 703 contracts—translating to 1.2 Lc shares—indicates aggressive unwinding by short participants. Derivatives data showed a sharp rise in investor activity, with total call open interest at 12,048 contracts and puts at 6,674 contracts. Notably, there was an incremental addition of 1,606 call and 2,038 put contracts. The put-call ratio advanced to 0.55 from 0.44, reflecting a calibrated shift in positioning and rising demand for downside hedges. This simultaneous build-up on both sides, paired with declining futures OI, suggests a phase of volatility repricing as traders recalibrate risk-reward expectations while the underlying sentiment remains cautiously bullish.

Cyient Ltd. witnessed intensified bearish sentiment in the wake of mounting global geopolitical tensions and a hawkish signal from the US Federal Reserve, contributing to a broader downturn in the information technology sector. The stock fell 5.1%, accompanied by a 2.6% rise in futures open interest to 10,257 contracts—reflecting a Short Addition pattern, with 259 fresh contracts introduced, indicating aggressive short build-up. Derivatives activity reinforced this cautionary tone as the Put-Call Ratio declined to 0.57 from 0.71, driven by a disproportionate spike in call OI—up by 3,002 contracts—nearly triple the 1,151 additions in put OI. With total call and put OIs standing at 6,931 and 3,926 contracts, respectively, the skewed build-up in call positions points to elevated hedging against further downside. The simultaneous price dip and rise in OI underscore a deteriorating risk outlook, with traders positioning defensively amid heightened macro uncertainty.

Varun Beverages (VBL) has experienced a three-day decline, with its stock price falling by 4.8%. This downturn is primarily attributed to heightened competitive pressure from players like Reliance's Spinner and Hindustan Coca-Cola Beverages (HCCB), which threaten to compress VBL's margins and impact profitability, thereby dampening investor sentiment. The company has witnessed significant long unwinding, indicated by a 2.8% decrease in open interest, shedding 1,570 contracts (equating to 13.7 lakh shares) – the highest single-day unwinding in the current series, bringing the current futures open interest to 53,740 contracts. In the options market, despite the price decline, call options still hold a substantial lead with 25,823 contracts compared to 9,985 put options, and both call (2,142 added) and put (1,165 added) contracts saw incremental additions, suggesting a complex interplay of bearish sentiment from unwinding and potentially some speculative bullish bets or hedging.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) rose to 1.03 from 0.8 points, while the Bank Nifty PCR fell from 0.79 to 0.72 points.

Implied Volatility:

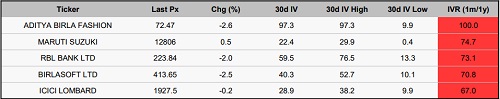

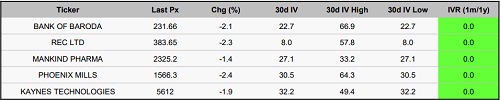

Bank of Baroda and REC Ltd have proven to be stable performers in a volatile market, earning the lowest implied volatility (IV) rankings among their peers. With Bank of Baroda's IV at 23% and REC Ltd's at 8%, both stocks show steady price movements, making them appealing for short-term traders looking for consistent returns in a turbulent market. Meanwhile, Maruti Suzuki India and RBL Bank have seen increased price fluctuations, reflected in their high IV rankings of 75 and 73, respectively. Interestingly, although Maruti Suzuki has a lower absolute IV of 22%, its higher ranking suggests a significant divergence from its historical average. RBL Bank, with a current IV of 60%, has experienced a surge in option premiums, highlighting the market's anticipation of future uncertainty. This increased volatility has pushed traders to adjust their risk management strategies to deal with the evolving landscape.

Options volume and Open Interest highlights:

Eicher Motors and United Spirits are currently displaying strong bullish sentiment, as reflected in their elevated call-to-put volume ratios of 4:1 and 3:1, respectively. This significant skew toward call options suggests that market participants are optimistic about near-term price appreciation. However, such imbalances can also imply potential overvaluation in the options market, warranting a cautious approach for those considering fresh long positions. Conversely, a more defensive tone is evident in the positioning of SBI Cards and NCC, where elevated put-to-call volume ratios and increased put activity signal rising investor concern over potential downside risks. While this may reflect genuine bearish sentiment, the sharp uptick in put volumes could also point to oversold conditions, possibly setting the stage for contrarian opportunities for traders anticipating a reversal. From a positional standpoint, Bharat Dynamics stands out due to its substantial open interest on both the call and put sides, indicating heightened expectations of price swings. Similar dynamics are observed in CAMS and Blue Star Ltd., where concentrated open interest on the call and put sides, respectively, could serve as key resistance or support zones. These positions suggest the potential for sharp moves, supporting volatility-based strategies in the near term. (This data considers only those stock options that saw a minimum of 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

Yesterday, the positioning in index futures showed a notable shift due to institutional adjustments. Clients reduced exposure by 4,808 contracts, indicating a de-risking or neutral stance among retail and high-net-worth traders. In contrast, Foreign Institutional Investors (FIIs) increased long positions by 2,171 contracts, showing a bullish bias on the broader market indices. Proprietary trading desks also added 2,943 contracts, reinforcing institutional confidence in an upward trend. This institutional buying suggests a belief in market resilience or positive catalysts. In Stock Futures, a different trend emerged, marked by a broad unwinding across participant categories. Clients decreased holdings by 13,410 contracts, indicating a reduction in speculative bets, possibly due to profit-taking or caution. Corresponding with this sentiment, FIIs cut stock futures positions by 5,610 contracts, reflecting reduced exposure to individual stocks. Proprietary traders also scaled back by 5,305 contracts, aligning with lower engagement in stock-specific derivatives. This decrease in open interest across all segments in stock futures indicates a cautious bias towards individual stock movements, likely due to volatility concerns or capital rotation towards index instruments.

NIFTY

Bank Nifty

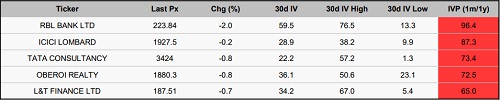

Stocks with High IVR:

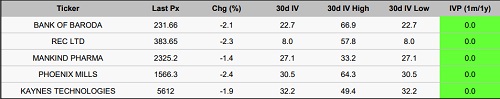

Stocks with Low IVR:

Stocks With High IVP

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)

.jpg)