CPI Inflation : Food deflation-led low; Oct to see sub-1% CPI by Emkay Global Financial Services

Food deflation-led low; Oct to see sub-1% CPI

Persisting food price deflation continues to dominate disinflationary trends, with September headline inflation at a 98-month low of 1.54%. However, core CPI rose to 4.7% (led by gold); also, core ex-gold saw a mild uptick. October inflation is currently tracking below 1% (0.4-0.5%), largely due to the GST rejig impact (and continued food price easing). Assuming >70% of the GST cuts will be passed-through, we see FY26E headline CPI at 2-2.2% (RBI: 2.6%), with core (ex-intoxicants) at 4%. With further downside to the RBI’s FY26E CPI forecast, this could burnish the case for a December rate cut (and beyond). Amid consistent inflation undershoots vs estimates, we reassert that RBI’s focus on the 1-year-ahead inflation seems misplaced. Macro resets in the form of consistent inflation undershoots and down-trending core inflation, followed by weaker sequential 2H demand and sub-8% nominal GDP growth in FY26E call for front-loaded rather than back-loaded policy support.

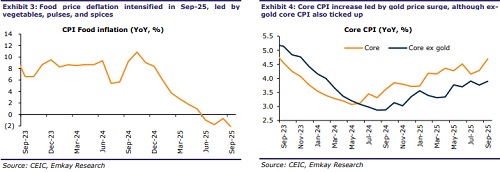

Headline inflation declines to multi-year low, as food price deflation intensifies

Headline CPI inflation declined to a 98-month low of 1.54% in Sep-25, in line with estimates (Emkay: 1.55%, prior: 2.07%). A favorable base effect and sequential easing in food prices (-0.5% MoM; -2.3% YoY) were the key drivers. Headline CPI rose 0.1% MoM (0.5% prior) – the lowest in six months. Within food, vegetable prices declined sequentially (-3% MoM; -21% YoY) for the first time since April, led by tomatoes (-22% MoM), while fruit prices also fell (-2% MoM; 10% YoY). Other significant movers include eggs (1% MoM) and meat & fish (1% MoM).

Core inflation moves higher as gold surges; ex-gold core also ticks up

However, core inflation (ex-intoxicants) rose to 4.7% (vs 4.3% prior), with monthly momentum rising to 0.7% MoM (vs 0.4% prior). Higher gold prices (8% MoM; 47% YoY) were once again the primary driver of this increase, with the Personal Care category resultantly seeing 3.5% MoM growth (vs 1% prior). Nevertheless, Core CPI ex-gold also saw a mild uptick, to 3.9% (vs 3.8% earlier), while monthly momentum stayed benign (0.2%). Housing (0.8% MoM) was the largest contributor here.

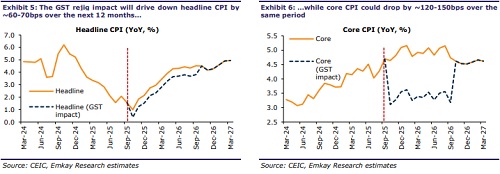

October CPI to be <1%, led by GST rejig; FY26E at 2-2.2%

Currently, October headline CPI is tracking at 0.4-0.5%, mainly due to the GST rejig impact, along with continued easing in most food categories (albeit there may be some upside risk here due to crop damage-led food price spikes). While actual 2Q CPI at 1.74% was only marginally lower than the RBI’s forecast (1.8%), we envisage further downside risk of ~30-40bps to RBI’s FY26 headline CPI forecast of 2.6% – after having been revised down for the fourth successive meeting in the October MPC. We estimate the impact of GST rationalization on headline CPI to be as high as 80-100bps on an annualized basis, depending on the price elasticity of demand of various products and pass-through to endconsumers. Nearly 85-90% of the net disinflation may come from core CPI, followed by F&B. Assuming ~70% of GST cuts would be passed on, we estimate FY26E headline CPI at 2-2.2%, with core CPI at 4%. FY27E could see headline CPI rising to ~4% (as the base effect turns unfavorable), while core CPI could remain below 4.5%.

Heavy disinflationary bias and slowing growth to restart the easing cycle

We note that the FY26E headline CPI ex-GST rejig is ~2.3%, thus implying downside for RBI’s forecasts even before accounting for the GST impact. The RBI’s FY26 headline CPI forecast of 2.6% hence carrying further downside risk could burnish the case for a December rate-cut (and beyond, depending on how tariff effects evolve). Given the repeated undershoots vs forecasts in FY26, we believe RBI focus on one-year-ahead expected inflation looks increasingly misplaced in a fast-changing environment. The macro resets in the form of consistent inflation undershoots and down-trending core inflation, followed by weaker sequential demand in 2HFY26 and <8% nominal GDP growth in FY26E call for frontloaded rather than back-loaded policy support. The timing and magnitude of rate cuts ahead will therefore be crucial.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354