Trade Deficit :Welcome improvement in exports signals resilience by Emkay Global Financial Services Ltd

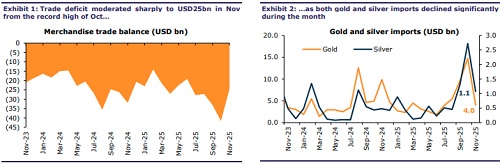

The goods trade deficit dropped to a 4-month low of USD24.5bn in Nov (Oct: USD42bn), primarily as gold (-73% MoM) and silver (-60% MoM) imports collapsed. However, there was also a broad-based improvement in exports (USD38bn; 11% MoM), with exports to both the US and RoW rising as well, to 11% MoM. Tariff-hit sectors have performed better-than-expected so far, with Gems & Jewelry and Textiles seeing flat growth for FY26TD, and Marine Products delivering strong improvement on the back of higher shipments to China. Services surplus rose to USD18bn in Nov, albeit considerably revising down in Oct. With trade data being volatile over the past few months, we watch for signs of a structural diversification in India’s export destinations that would offset the US tariff hit. We maintain FY26E CAD/GDP at 1.4%, but a continuation of the current trends would create a downside potential.

Record-high gold and silver imports cause a surge in deficit The goods trade deficit dropped to a four-month low of USD24.5bn (vs the record USD41.7bn in Oct), below estimates (Emkay: USD32.2bn). While both gold (USD4bn; - 73% MoM) and silver (USD1.1bn; -60% MoM) imports expectedly declined sharply, total exports saw an improvement (USD38.1bn; 11% MoM, 19% YoY), which drove the deficit lower. Total imports fell sharply to USD62.7bn (-18% MoM, -2% YoY), largely due to decline in precious metal imports. Oil imports were down 5% MoM at USD14.1bn, while growth in oil exports was flat sequentially (USD3.9bn). For FY26TD, total goods exports are at USD292bn (~3% YoY), while total imports have risen ~6% to USD515bn, even as oil imports remain lower (USD121bn; -5% YoY). As a result, the 8MFY26 deficit stands at USD223bn (vs USD203bn for the same period last year).

Core deficit rises; mixed trends for tariff-hit sectors Core (non-oil, non-precious metals) deficit also fell, to USD11.9bn, with core exports (USD31.6bn, 12% MoM) improving sharply and core imports (USD43.5bn, -1% MoM) declining. 8MFY26 has seen core exports at USD234bn (5% YoY), while core imports stand at USD342bn (9% YoY). Notably, trends for tariff-affected sectors are mixed – while both Gems & Jewelry and Textiles exports have seen flat growth so far in FY26, Marine Products exports continue to see strong growth (16% YoY FYTD). Among major export categories, Electronics (39% YoY for 8MFY26) continues as a strong growth performer, followed by Drugs and Pharma (6% YoY) and Engineering Goods (4% YoY).

US exports recover partially; ex-China RoW exports decline The improvement in exports was broad-based, as exports to both US (USD7bn; 11% MoM) and rest of world (USD31.1bn; 11% MoM) rose. Exports to the US are thus now up ~11% to USD59bn for FY26TD, despite the 50% headline tariff rate, while RoW exports are up ~1% (USD233bn), having been 2% lower till Aug. This improvement has been led by sharp growth in exports to Spain (122%), China (56%), Vietnam (26%), Hong Kong (18%), and Brazil (10%), among others, in the last three months after the US tariff imposition. This indicates that while Indian exporters may have found new destinations, some transshipments are also taking place.

Services surplus grows modestly, but Oct sees a heavy downward revision Services surplus rose to USD17.9bn in Nov, but Oct was heavily revised down to USD17.4bn from USD20bn earlier. As a result, provisional services surplus for 8MFY26 is USD134bn, up 15%, with gross services exports (USD270bn) having grown 9%. For Nov, exports (USD36bn) rose 2% MoM while imports (USD18bn) rose 1% MoM. Services exports, especially software services, are facing headwinds in FY26 from tariff-led global uncertainty, though growth has remained healthy so far.

FY26E CAD/GDP maintained at 1.4%, albeit amid extreme volatility Recent trade data has also caught the volatility bug, with large swings every month – especially exports, which have held up far better than expected, given the punitive US tariffs. While sustainability of such early trends is still questionable, India has so far managed to evade the worst-assumed tariff outcomes and seems to have diversified its export destinations. We maintain FY26E CAD/GDP at 1.4%; however, a continuation of such trends would create significant downside to our estimates, especially if export growth and diversification continue.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354