India Strategy Weekly IdeaMetrics: Macro update – Currency markets flashing amber by Emkay Global Financial Services Ltd

Negative signals from financial markets could be a spoiler for Indian equities if they persist beyond the next 2-3 months. The currency has been under pressure, probably because of US tariffs and the post-GST cut import surge. Consequently, M0 growth has been anemic at 1.8% and driven system liquidity to <0.5%. On the other hand, bonds remain under pressure as GST cuts hurt revenue and welfare spending threatens to widen the deficit – the RBI faces constraints in managing this as it defends the rupee. We see this as a temporary spell, but the lack of liquidity could hurt growth as we enter the seasonally intense 4QFY26. Policymakers have enough tools to manage this, but we will continue to monitor this. The good news is that growth momentum is strong, and we see the GST cut supporting consumption into CY26. We remain constructive on the market and retain our Sep-26E Nifty target of 28,000, with Discretionary being our top OW. If domestic liquidity remains stressed, banks and NBFCs will be the most vulnerable to a sell-off.

RBI meeting – rate decision irrelevant Consensus expectations of a rate cut in the upcoming RBI MPC meeting (decision on 5- Dec) may be optimistic. The low inflation in H2CY25 matters less to the RBI than the outlook for 1HCY26. The RBI’s last estimate of 4QFY26 CPI at 4.0% may be revised down, but we are not sure that it will be enough to warrant a rate cut. In any case, we think that transmission is more important for the broader economy, earnings, and the equity markets than further rate cuts. In that context, the RBI’s liquidity management will take centerstage, with the surplus slipping to <0.5% of NDTL as of 27-Nov-25.

RBI’s key challenges – rupee and bonds The RBI’s liquidity management is made more complex by pressure on the currency and bonds. The GST cut and welfare schemes from states have combined to put fiscal deficit under pressure, driving upward pressure on long bonds and a steepening of the domestic yield curve. The RBI could have easily managed this through OMOs but is challenged by sustained pressure on the rupee. We think that trade balances are under pressure from the US tariffs on the one hand and import pressure on the other, led by the sharp recovery in consumption. The overall challenge will persist until the pressure on the rupee eases. The conclusion of the India-US trade deal is, therefore, crucial. Read this note (link) by our Chief Economist. Madhavi Arora

Loan growth – smart recovery Loan growth has smartly recovered from 11.4% YoY vs the 30-May-25 low of 9%, led by improved demand. Deposit growth lags slightly at 9.3% and there are some concerns that this may slow the nascent recovery. We do not see a major challenge – the absolute CD ratio at 81% and 12M trailing incremental CD ratio at 91% are both manageable, given the CRR cuts and significant SLR cushion of 26-28% for most banks. However, banks will be watchful if liquidity remains <0.5% and M0 growth continues to be sluggish. We see no risks to our estimates of 11% credit growth for FY26 and 13.3% for FY27.

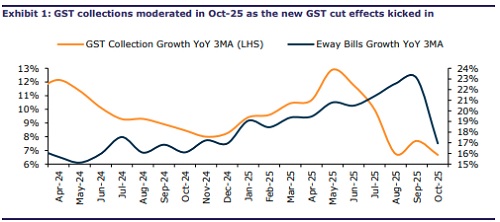

Constructive growth outlook We see a strong consumption-led growth recovery from 2HFY26. Auto sales data for the festive period have remained strong, and our channel checks suggest demand sustaining beyond the initial pop. The significant improvement in affordability should continue to drive demand, especially in entry-level 2Ws and PVs. The overall scatter of high frequency data (Exhibit 2) indicates strong positive momentum and should intensify into early-CY26 as the lagged impact of credit growth and the GST cuts start to filter through. The strong Q2FY26 GDP print was impacted by a low deflator, but the earnings reports for the same period indicated a nascent growth recovery anyway.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354